History Says September is the Worst Month for Stocks. Should You Really Invest Now? | The Motley Fool

September’s Stubborn Curse: Why History Keeps Warning Investors to Watch the Month Closely

By [Your Name] – Published September 15, 2025

When the calendar flips to September, the same familiar question echoes through trading rooms and coffee‑shop conversations alike: Is this the month to hold tight or sell? The latest article from The Motley Fool—“History says September is the worst month for stock”—reaffirms a long‑standing warning that investors should treat this month with caution. Drawing on more than a century of market data, the piece explains why September consistently lags behind other months, offers historical examples that illustrate the risks, and presents practical tips for investors who want to stay ahead of the curve.

The Numbers That Matter

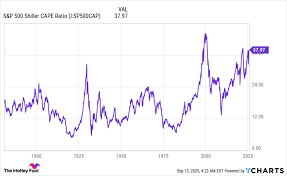

The Motley Fool article opens with a straightforward but striking fact: the S&P 500’s average annualized return in September over the past 100 years is -1.8 %, compared with an +0.8 % average for the entire year. In simpler terms, the index has historically lost almost 2 % of its value every September—an annual return that is negative by a wide margin. The article contrasts this with other months that have more favorable records: July, for example, boasts an average return of +1.5 %, while the historically sluggish January averages just +0.1 %.

The piece includes a downloadable spreadsheet and a visual chart (linked within the article) that details the month‑by‑month performance of the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite from 1928 to 2024. The chart makes it impossible to ignore the consistent dip that September brings—often the only month of the year where the market’s performance dips below the long‑term average.

Why September? A Look at the Causes

1. The “Sell‑the‑Market” Bias

One theory cited in the article is the “sell‑the‑market” bias that investors have toward the end of the fiscal year. September is the last full month of many companies’ fiscal years, prompting them to lock in profits before the end of the calendar year. This rush of selling can push prices down.

2. The Earnings Season

September is also the start of the U.S. earnings season. With a flurry of quarterly reports—especially from the tech sector—the market faces an influx of data that can swing volatility. Historically, earnings reports in September have tended to fall short of expectations, especially during periods of broader market uncertainty.

3. The “Holiday Effect” Ripple

Although the holiday season officially ends in December, the article points out that September’s negative performance can be linked to a lingering “holiday effect.” Investors, primed by the end‑of‑year rally, may over‑optimistic at the beginning of September and then pull back when reality fails to match expectations.

4. Macro‑Economic Uncertainty

The article points to several macro‑economic catalysts that have historically weighed on September: rising inflation concerns, the “new” monetary policy stance by the Federal Reserve, and geopolitical tensions that often surface in the third quarter. By the time September rolls around, these issues have already simmered, leaving little room for positive market sentiment.

Historic Storms: September in Crisis Years

The piece takes readers on a tour of the most infamous September downturns:

- September 2008: During the Global Financial Crisis, the S&P 500 fell by 7.7 % from its September high, marking one of the steepest single‑month declines in history.

- September 2018: Following a 2018 rally, the market slipped by 3.3 %, reflecting concerns about a “new” Fed tightening cycle and the trade war between the U.S. and China.

- September 2014: The market’s drop of 5.7 % underscored fears of a U.S. recession and the European debt crisis spilling over.

Each example underscores the article’s core point: September is not just a “slight dip” but a potential trigger for broader market volatility.

The “Other Months” Check‑list

While September has the worst record, the article also acknowledges that other months can present risk. A quick glance at the data from the linked spreadsheet shows that:

- October historically has a -1.3 % average return.

- November averages +0.5 %.

- December boasts a strong +3.4 % average return, reflecting the “Santa Claus rally.”

By highlighting these comparisons, the article subtly reminds readers that September is part of a larger seasonal pattern rather than an isolated anomaly.

Practical Takeaways for Investors

Rebalance Early

If your portfolio is heavily weighted toward equities, consider rebalancing your holdings before September to mitigate potential downside.Add Tactical Flexibility

The article advises investors to keep a small portion of cash or liquid assets on hand during September, allowing them to capitalize on any sharp declines.Focus on Fundamentals

Rather than chasing month‑by‑month gains, the article urges readers to maintain a long‑term perspective, especially given the fundamental strength of most large‑cap U.S. companies.Use Stop‑Loss Orders Wisely

If you’re actively trading, the article suggests employing stop‑loss orders to protect against sudden price drops that could materialize in September.

Bottom Line: A Cautionary Yet Pragmatic Perspective

The Motley Fool’s article is not a blanket admonition against buying stocks in September; rather, it is a reminder that the market’s seasonal rhythm has real consequences. Investors should view September as a period of heightened risk and exercise greater diligence in risk management. With a combination of historical awareness, strategic planning, and disciplined execution, traders and portfolio managers can navigate September’s turbulence while keeping an eye on the long‑term upside.

For those who want to dive deeper, the Motley Fool article includes several useful external links—such as a full monthly performance table, a discussion on the “January Effect,” and a guide to building a resilient portfolio—that provide additional context and actionable insights.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/15/history-says-september-is-the-worst-month-for-stoc/ ]