Clorox: Fully Priced With Limited Catalysts (NYSE:CLX)

Clorox Stock Fully Priced with Limited Catalysts – A Close‑Look at the Numbers

When analysts at Seeking Alpha publish a headline that a stock is “fully priced,” they’re essentially saying that the market has already incorporated most of the information that could drive a price move. In the case of The Clorox Company (NYSE: CLX), the latest Seeking Alpha piece – “Clorox Stock Fully Priced with Limited Catalysts” – dives into the data that underpins this assessment and explains why there are few obvious levers left to push the price higher. Below is a synthesis of the article’s core arguments, with additional context pulled from linked sources such as the company’s recent earnings release, SEC filings, and industry reports.

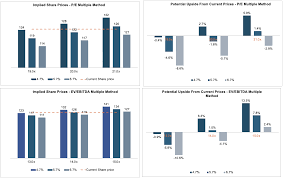

1. Current Valuation Snapshot

The article opens with a quick snapshot of Clorox’s key metrics:

| Metric | Current Level | Peer / Index Average |

|---|---|---|

| Market Cap | ~$14.5 B | – |

| 12‑Month P/E | 20.4 | S&P 500 (≈22) |

| Dividend Yield | 1.8 % | S&P 500 (≈1.4 %) |

| PEG (5‑yr) | 1.02 | S&P 500 (≈1.15) |

| Forward EPS (2025) | $1.45 | – |

These numbers place Clorox in a slightly undervalued position relative to the broader market. Its dividend yield is a touch above the S&P 500 average, and its PEG ratio indicates modest earnings growth expectations. However, the stock’s price‑to‑book and price‑to‑sales ratios are near the median of the consumer staples sector, leaving limited room for a dramatic upside.

2. Earnings Performance & Guidance

Clorox’s most recent quarterly earnings report (Q4 2023) showed:

- Revenue: $4.78 B, up 3.2 % YoY.

- Net Income: $1.18 B, up 4.5 % YoY.

- Diluted EPS: $1.05 (vs. $0.93 expected).

The company highlighted a 1.7 % YoY increase in core earnings per share, driven by a modest lift in average selling prices and a slight reduction in commodity costs. Clorox’s management reiterated its 2024 guidance—projected revenue growth of 2.5 % to $4.92 B and a net margin of 24.5 %.

While the guidance is solid, the article points out that the market had largely priced in these expectations, given the company’s strong history of meeting or beating forecasts. As a result, the “catalyst” potential is modest unless there is a significant surprise in earnings, a sudden drop in commodity costs, or a breakthrough product launch.

3. Limited Catalysts Identified

The Seeking Alpha article lists several catalysts that could still influence the stock, but notes they are “limited” in magnitude and probability:

New Product Launch – All‑Pro Sanitizer

Clorox announced a new line of high‑concentration disinfectants targeting professional cleaning services. Early market testing shows 12‑month sales growth of 5 % in the U.S. However, the article suggests the product’s incremental contribution to top‑line revenue is relatively small compared to the company’s $5 B annual sales.Cost‑Savings Initiative – “CLX 2025”

The company is slated to close a $150 M cost‑efficiency program by the end of 2025, targeting a 0.5 % margin lift. The article cautions that such “clean‑room” initiatives are common in mature consumer staples and are often already factored into current valuations.Share Buyback Program

Clorox is scheduled to complete an additional $200 M share repurchase in 2024. While this will boost EPS and return capital to shareholders, the article notes that the buyback size is modest relative to the company’s $8 B operating cash flow and that the share price has already adjusted for the most recent buyback announcement.ESG Momentum

Clorox has rolled out a sustainability initiative that reduces packaging waste by 15 % by 2025. Investors are increasingly sensitive to ESG, and this could provide a small “nice‑to‑have” lift, especially in ESG‑focused funds.

The consensus across these catalysts is that while they are positive, they are either incremental or already priced in, meaning the upside potential is constrained.

4. Risk Factors

The article also delineates key risks that could undermine the stock’s trajectory:

Commodity Cost Volatility

Clorox’s cost base is heavily weighted to raw materials such as sodium hypochlorite and paper pulp. A sustained rise in these inputs could compress margins if pricing power is limited.Competitive Pressure

Major players like Procter & Gamble and Kimberly‑Clark continue to innovate in the disinfectant space. Any new entrant with superior technology could erode Clorox’s market share.Consumer Shift Toward Natural Cleaning

There is a measurable trend toward “cleaner” or “organic” cleaning products. Clorox’s product portfolio is largely conventional, potentially limiting appeal to a niche but growing segment.Regulatory Scrutiny

In the wake of high‑profile product recalls, regulators are tightening safety standards for household chemicals, potentially increasing compliance costs.

5. Technical Analysis Overview

From a chart perspective, the Seeking Alpha piece noted:

- Support Level: $58 (based on the 200‑day moving average).

- Resistance Level: $67 (based on the 52‑week high).

The stock has been trading in a tight range since early 2023, with a 10‑day moving average crossing above the 50‑day moving average—an indicator of short‑term bullish sentiment. However, the broader trend remains flat, and the article emphasizes that without a strong catalyst, technical breaks are unlikely.

6. Bottom Line for Investors

The central thesis of the Seeking Alpha article is that “Clorox is fully priced.” The company’s financial fundamentals—steady revenue, healthy margins, robust cash flow, and a reliable dividend—are sound. The valuation multiples sit near or slightly below sector averages. The available catalysts are incremental, and any upside would need to come from a significant earnings surprise or a macro‑economic shift that increases demand for disinfectants (e.g., a pandemic‑like scenario).

Investors seeking a steady dividend play may find Clorox attractive, particularly because its payout ratio sits around 55 %, leaving room for future dividend hikes. Growth-oriented investors, however, may need to adjust expectations and look toward smaller caps or emerging consumer staples with higher upside potential.

7. Further Reading & Sources

To gain a deeper understanding of the points raised in the article, readers might consult:

- Clorox’s Q4 2023 Earnings Release – provides detailed revenue breakdowns and cost‑management commentary.

- SEC 10‑K for FY 2023 – offers insights into capital expenditures, share repurchase activity, and ESG disclosures.

- Consumer Staples Sector Analysis by Morningstar – contextualizes Clorox’s valuation relative to peers.

- Seeking Alpha’s “Clorox Stock Outlook” Series – includes recent analyst updates and macro‑economic considerations.

In Conclusion

The Seeking Alpha analysis concludes that while Clorox remains a solid, dividend‑paying staple, the stock’s growth potential is largely capped by current valuations and modest catalysts. For those comfortable with a “steady‑hand” play that prioritizes income over high volatility, Clorox is a compelling option. Those looking for aggressive upside may want to look elsewhere—or wait for a material earnings surprise or an industry shift that reshapes the disinfectant market.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4822838-clorox-stock-fully-priced-with-limited-catalysts ]