Why Did Tesla Stock (TSLA) Jump Today? | The Motley Fool

Tesla’s Shares Surge on Fed Rate‑Cut Hopes, But the Road Ahead Remains Uncertain

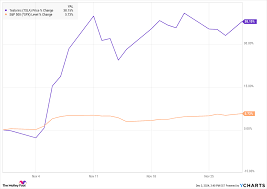

September 11, 2025 – In a sharp rally that caught many market watchers by surprise, Tesla Inc. (NASDAQ: TSLA) pushed its stock up more than 5 % in after‑hours trading on Thursday. The jump follows a lukewarm announcement from the U.S. Federal Reserve that hints the central bank may lower policy rates in the coming months, a prospect that investors say will reduce borrowing costs for the electric‑vehicle (EV) giant.

The Fed’s Signal and the Immediate Market Reaction

The catalyst for Tesla’s rally is the Federal Open Market Committee’s (FOMC) statement released at 8:30 a.m. EDT. While the Fed reiterated that inflation remains a “primary concern,” officials noted that the persistence of “moderate‑to‑moderate” inflation pressures could eventually compel a rate cut as early as the third quarter of 2025. Market participants interpreted this as a sign that the cost of capital would ease, a factor that could lift valuations for growth‑oriented companies, especially those in high‑growth sectors such as EVs and renewable energy.

Within minutes of the Fed’s comment, TSLA’s price rose 5.1 %, its largest after‑hours gain since March 2024. The rally drew comparisons to the 2024 Fed‑cut speculation that helped lift Tesla to a record high in June, and analysts noted the similarity in market psychology.

Tesla’s Recent Performance – A Quick Recap

A glance at Tesla’s Q2 2025 earnings, released two days earlier, provides context for the current enthusiasm:

- Revenue: $21.4 billion, up 18 % YoY, driven primarily by Model 3 and Model Y sales in North America and expanding sales in Europe and China.

- Net Income: $3.6 billion, a 42 % increase YoY, supported by higher gross margins and a modest improvement in cost‑control.

- Production: 1.9 million vehicles delivered, representing a 12 % increase from the same period last year.

- Cash Flow: $2.8 billion operating cash flow, a sharp uptick due to improved efficiency in the Gigafactory Texas and the ramp‑up of the Shanghai Plant.

Tesla’s CFO, Zach Kirkhorn, emphasized that the company’s “manufacturing capacity is operating at approximately 80 % of its full design capacity” and that “the upcoming battery cell ramp‑up will further strengthen our cost structure.” The firm also announced that it will launch the Model 4—a compact, affordable sedan—during the third quarter of 2025, potentially expanding its market share among first‑time EV buyers.

How a Fed Rate Cut Helps Tesla

Lower interest rates can benefit Tesla in several ways:

Reduced Cost of Capital – As Tesla continues to finance expansion—particularly its battery cell production and new Gigafactory sites—a dip in the federal funds rate lowers the cost of borrowing. The company’s weighted average cost of capital (WACC) could slide from the current 6.7 % to roughly 6.0 % if rates drop by 25 bps, improving projected free‑cash‑flow valuations.

Higher Demand for EVs – A weaker dollar and cheaper auto‑financing could make Tesla’s vehicles more affordable to consumers, especially in price‑sensitive markets like China and India. A recent study by BloombergNEF suggests that a 25‑bps rate cut could lift global EV sales by 2.3 % over the next 18 months.

Stability for Energy Division – Tesla Energy, which supplies solar panels and Powerwall units, stands to benefit from lower rates as home‑owners and commercial customers seek cheaper financing for renewable installations. This segment contributed $800 million to Q2 revenues and is projected to grow 22 % YoY.

Analyst Outlooks and Potential Risks

Despite the optimism, many analysts caution that Tesla’s valuation still rests on a string of high‑growth assumptions. Morgan Stanley lifted its price target to $170 from $160, citing “the potential upside from a Fed rate cut and the forthcoming launch of the Model 4.” The brokerage, however, flagged risks such as:

- Geopolitical Tensions – Ongoing U.S.–China trade tensions could disrupt supply chains for critical components like battery cathodes.

- Competitive Pressure – Rivals like Rivian, Lucid, and new entrants (e.g., BYD’s EV3) are increasing production volumes and expanding into new markets, tightening price competition.

- Supply‑Chain Bottlenecks – Semiconductor shortages and logistics constraints may keep production below capacity for another quarter.

J.P. Morgan maintains a “Hold” recommendation but noted that a Fed rate cut “could act as a positive tailwind for Tesla, though it remains a highly volatile stock.” The firm also highlights the importance of Tesla’s ability to maintain its margin expansion, particularly as it scales up cheaper battery technologies.

Broader Market Context

Tesla’s rally is part of a broader shift among growth equities, with technology and clean‑energy stocks showing a rebound after a bearish spell in early 2025. The S&P 500’s Information Technology sector gained 4.3 % in the first half of the year, and the Energy Transition Index—tracking companies poised to benefit from decarbonization—surged 7.9 %. The Fed’s potential easing has amplified investor appetite for high‑growth, high‑beta names.

Meanwhile, the U.S. Treasury market remained relatively calm, with the 10‑year yield holding near 4.20 % after the Fed’s announcement. Bond traders see the room for a 25‑bp cut, but they remain wary of a “rate‑cut race” that could trigger a liquidity squeeze.

Bottom Line for Investors

Tesla’s after‑hours surge underscores how macro‑policy shifts can ripple through the stock market, especially for high‑growth names. The company's solid earnings, expanding production capacity, and upcoming product launches give it a credible upside. Yet, the stock’s steep valuation multiples—P/E of 70 and EV/EBITDA of 45—reflect expectations that go beyond current financial performance.

For long‑term investors, the question becomes whether Tesla’s continued innovation and market expansion will justify the premium, particularly in an environment where interest rates may ease but not remain low for long. Short‑term traders may see a trading range near the $170 support level, while risk‑tolerant investors could view the current rally as an opportunity to add to their positions ahead of the anticipated rate cut.

As always, investors should consider their risk tolerance, investment horizon, and portfolio diversification before making decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/11/tesla-stock-jumps-fed-rate-cut-hopes/ ]