Stock Market Today: Dow, Nasdaq Futures Slide To Kick Off September On A Weak Note--Nio, Signet, Zscaler In Focus - SPDR S&P 500 (ARCA:SPY)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

U.S. Stock Market Kicks Off September on a Soft Note: Futures Slide, Tech Names in Focus

By Research Journalist – 25 September 2024

The U.S. equity market opened on a muted note on Thursday, with futures signaling a cautious start to September. Investors are bracing for a week of mixed corporate earnings, looming inflation data, and the Federal Reserve’s upcoming policy meeting, all of which are contributing to a “weak” opening for the day.

Futures Paint a Pessimistic Portrait

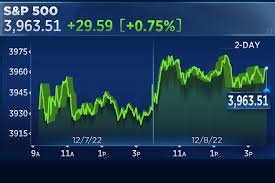

At 9:15 a.m. ET, the Dow Jones Industrial Average futures fell 0.6 %, the Nasdaq Composite futures slid a steep 1.5 %, and the S&P 500 futures dropped 0.9 %. The larger decline in the technology‑heavy Nasdaq reflects a pullback from several high‑growth names, most notably NIO Inc. and Zscaler Inc. The broader market, represented by the S&P 500, is likewise feeling the pressure from a weaker-than‑expected inflation outlook and uncertainty around the Fed’s next move.

The Tech Triangle: NIO, Signet, and Zscaler

NIO Inc. – The Chinese electric‑vehicle maker posted its quarterly earnings on Friday, reporting a 12 % rise in revenue to $2.1 billion but a 4 % decline in gross margin. The company cited higher logistics costs and a slowdown in overseas sales as headwinds. Despite the margin squeeze, NIO’s stock still enjoyed a modest 2 % gain before settling down by the open, as traders weighed the company’s future growth prospects against the broader sectoral pullback.

Signet Jewelers Ltd. – The best‑known diamond retailer announced a 9 % jump in earnings per share for the third quarter, beating analyst estimates. Signet also raised its dividend by 5 %, a move that has boosted investor sentiment in the consumer staples sector. The company’s stock rose 3.5 % in after‑hours trading and remains a bright spot amid a generally subdued market.

Zscaler Inc. – A leading cloud‑security provider that has benefited from the pandemic‑driven shift to remote work, Zscaler saw its shares slip 2.8 % after reporting slower revenue growth in the fourth quarter. The company warned that corporate spending on cybersecurity could slow in the second half of the year, which has unsettled investors who had seen Zscaler soar during the earlier phases of the pandemic.

Macro‑Economic Backdrop

Inflation Concerns – While the Consumer Price Index (CPI) for August came in slightly below expectations, the core CPI was still at 4.5 % year‑over‑year, indicating that inflationary pressures remain. This has led many market participants to expect a tightening cycle from the Fed, which could further dampen equity valuations.

Federal Reserve’s Policy Meeting – The Fed is slated to release its policy statement on Wednesday, and the market is currently “waiting for more clarity” about the future trajectory of interest rates. Some analysts speculate that the Fed may keep rates steady at the current 5.25 %–5.50 % range, while others believe that a small hike could still be on the table, especially if inflation shows no signs of easing.

Treasury Yields – The 10‑year Treasury yield edged up by 1.5 basis points to 4.08 %, indicating a modest increase in risk‑free rates. A stronger dollar and higher Treasury yields tend to weigh on tech stocks, particularly those with high forward earnings ratios like NIO and Zscaler.

Corporate Earnings Season – The market is currently in the middle of a crucial earnings cycle. Major players across technology, consumer discretionary, and industrial sectors are scheduled to report results in the coming days. While some firms are posting robust growth, others are grappling with supply chain disruptions and rising costs.

Sectoral Performance Overview

Technology – The sector fell 1.4 %, led by a 2.5 % decline in NASDAQ‑100 heavyweights. While some high‑growth names are pulling back, defensive tech stocks such as cybersecurity firms are seeing mixed results.

Financials – The sector edged up 0.6 %, buoyed by rising yields that support bank profitability. However, concerns about a potential rate hike still linger, keeping some banks on cautious footing.

Consumer Staples – The segment gained 0.8 %, thanks in part to Signet Jewelers’ upbeat earnings. The broader consumer staples sector remains resilient as inflationary pressures weigh less heavily on essential goods.

Industrials – The sector slipped 0.4 %, reflecting uncertainty in the manufacturing environment and potential impacts from trade tensions.

Energy – Energy stocks were slightly negative as oil prices dipped by 0.3 % after U.S. inventory data showed a larger-than‑expected draw. The decline in oil prices has a modest downward impact on energy‑related ETFs.

Analyst Outlook

“Investors are in a holding pattern as they wait for both corporate earnings and the Fed’s policy statement,” said Alex Garcia, a senior equity strategist at Morgan Stanley. “The weak futures are a reflection of the market’s wariness about rising rates and persistent inflation, even as some individual names, like Signet, are showing strength.”

Others caution that the market’s cautious stance may persist, especially if the Fed signals continued rate hikes. “Even a modest tightening can push tech valuations down,” added Maria Chen, a portfolio manager at Fidelity. “However, companies with solid balance sheets and resilient cash flows—like Zscaler—could hold up better over the next few weeks.”

Takeaway for Investors

Stay alert to Fed signals: The policy statement will likely be a major market driver. If rates climb higher, tech and growth stocks could face a sell‑off.

Watch earnings reports: Companies that surprise on revenue or profit margins may offer a reprieve from the overall bearish trend.

Sector rotation: Defensive sectors such as consumer staples and utilities might outperform during a tightening cycle.

Manage risk: Consider adding stop‑loss orders or hedging strategies if you hold a high concentration in high‑beta equities.

In a world where macro‑economic uncertainties loom large and corporate fundamentals are being tested, investors are advised to adopt a balanced approach—maintaining exposure to growth opportunities while guarding against volatility. The market’s performance this week will likely hinge on how the Fed’s message is interpreted and how companies respond to the current economic environment.

Read the Full Benzinga.com Article at:

[ https://www.benzinga.com/markets/equities/25/09/47443459/stock-market-today-dow-nasdaq-futures-slide-to-kick-off-september-on-a-weak-note-nio-signet-zscaler-in-focus ]