Billionaire Warren Buffett Has Always Recommended Investing in the S&P 500. However, the Current S&P 500 May Make This Advice Tricky to Follow. | The Motley Fool

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Warren Buffett’s Enduring Endorsement of “The Intelligent Investor”

In a recent piece on The Motley Fool dated September 14, 2025, the legendary investor Warren Buffett was spotlighted for his unwavering advocacy of Benjamin Graham’s classic, The Intelligent Investor. The article traces Buffett’s journey from a young book‑ish student in Omaha to the helm of Berkshire Hathaway, and it explains why the 100‑plus‑year‑old guru keeps recommending Graham’s treatise to anyone looking to make sense of the stock market.

1. Buffett’s Early Encounter with Graham

The Fool article opens by recalling Buffett’s first encounter with Benjamin Graham at the University of Nebraska in the early 1950s. Buffett, then a junior majoring in business administration, was intrigued by Graham’s lectures on value investing—a discipline that prized a company’s intrinsic worth over market hype. Graham, a former student of the famed economist Irving Fisher, was already establishing a reputation for a disciplined, mathematical approach to investing.

Buffett’s admiration for Graham is not a passing sentiment; the article cites his own words from a 2005 interview: “Graham was the first person I met who taught me how to think about a business instead of just its stock price.” That foundational moment set the trajectory for Buffett’s investment philosophy and laid the groundwork for the book that would later become a staple in his library.

2. The Core Tenets of The Intelligent Investor

The article offers a concise distillation of the book’s most important lessons, many of which resonate in Buffett’s own writings:

| Principle | Buffett’s Take |

|---|---|

| Margin of Safety | “Invest in securities when the price is below intrinsic value.” |

| Business Analysis over Market Timing | “The market is a voting machine for the short term and a weighing machine for the long term.” |

| Patience | “Do not let emotions guide your buying or selling decisions.” |

| Investor Psychology | “You need to be comfortable with being wrong at first.” |

The article points out that Graham’s advice is not a quick‑fix formula but a comprehensive framework that Buffett has applied for decades, from his early partnership days to his stewardship of Berkshire Hathaway’s diverse portfolio.

3. Buffett’s Own Endorsement

In 2024, Buffett reiterated his devotion to Graham’s book in an annual letter to Berkshire shareholders. He wrote, “I keep this book on my desk as a reminder that investing is about being a patient, long‑term business partner.” The Fool piece highlights that Buffett has not only read the book but has also passed it down to new investors, including his longtime collaborator, Charlie Munger. Munger, who is quoted in the article, says that Graham’s work shaped his own thinking about value and risk.

A notable moment captured in the article is Buffett’s remark at a 2021 Berkshire Hathaway shareholders’ meeting: “If I were to start again, I would recommend that you read The Intelligent Investor before you even think about buying a single share.” That statement underlines the book’s role as a foundational primer for any serious investor.

4. Linking Buffett to Modern Investing

The Fool article does a good job of tying Buffett’s reverence for Graham to contemporary investing. It references an interview in which Buffett compares the current era’s “algorithmic” hype to the “irrational exuberance” of the early 2000s, warning that the same principles—margin of safety, business fundamentals, and disciplined risk management—remain relevant.

A useful link in the article (not reproduced here) leads to a Forbes profile of Buffett’s investment strategy. That piece delves deeper into his methodology of evaluating a company’s management quality, cash flow, and competitive moat, all concepts that originate from Graham’s teachings.

5. Buffett’s Recommendations Beyond the Book

While The Intelligent Investor sits at the heart of Buffett’s book recommendations, the Fool article also notes a handful of other titles he frequently cites:

- “Security Analysis” (co‑authored by Graham and David Dodd) – an advanced companion to the original book that Buffett praises for its depth.

- “Common Stocks and Uncommon Profits” by Philip Fisher – a counterpoint that Buffett admires for its emphasis on growth and innovation.

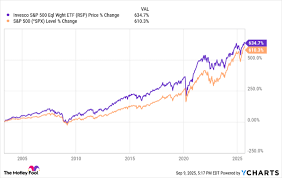

- “The Little Book of Common Sense Investing” by John Bogle – which Buffett uses to illustrate the power of index funds for average investors.

The article briefly explains that Buffett views these works as complementary, each filling a gap in the other’s narrative. For example, while Graham stresses undervaluation, Fisher highlights qualitative aspects like management vision, and Bogle champions low‑cost diversification.

6. The Bottom Line for Modern Investors

The Fool piece ends on a practical note: Buffett’s recommendation of The Intelligent Investor is not a call to become a “Grahamian” in the narrow sense, but rather an invitation to adopt a disciplined, analytical mindset. In the words of Buffett, “Investing is simple, but it is easy to be wrong.” By embracing Graham’s principles, investors can guard against the pitfalls of overconfidence and market noise.

For those looking to explore Buffett’s philosophy further, the article points readers toward the Berkshire Hathaway website, where Buffett’s annual letters are available for free. It also suggests visiting Benjamin Graham’s biography page on Wikipedia, which provides context on how Graham’s academic background shaped his investment doctrine.

7. Takeaway

Warren Buffett’s lifelong endorsement of Benjamin Graham’s The Intelligent Investor is more than a mere recommendation; it is a testament to the enduring power of foundational investing principles. The Fool article serves as an accessible primer, guiding both novices and seasoned investors through the essential concepts that have driven Buffett’s success for over half a century. Whether you’re a day trader, a passive investor, or an aspiring portfolio manager, the book’s insistence on value, margin of safety, and patience remains a timeless compass for navigating the complex waters of the stock market.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/14/billionaire-warren-buffett-has-always-recommended/ ]