Private Credit Boom: Filling the Funding Gap

Locales: New York, Connecticut, Maryland, California, UNITED STATES

The Private Credit Boom: Filling the Funding Gap

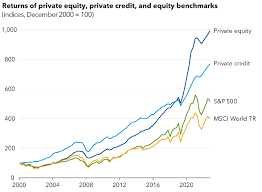

Private credit has emerged as the star performer within this alternative space. Defined as loans originated directly to companies outside of traditional public credit markets, it has experienced explosive growth. From $363 billion in 2017 to a staggering $1.6 trillion in 2023 (according to Preqin), the market's expansion is undeniable. This growth isn't merely opportunistic; it's filling a critical void. Banks, facing increased regulatory scrutiny and a desire to de-risk their balance sheets, have tightened their lending standards, particularly for mid-sized businesses. This has created a funding gap that private credit funds are actively - and profitably - bridging.

Matthew Wintress, co-founder and CEO of Fideres Capital, succinctly puts it: "Private credit has become a critical source of financing for businesses across all sectors, and the demand continues to grow." The higher yields offered by private credit compared to traditional bonds are a significant draw, especially in a rising (or persistently elevated) interest rate environment. However, the growth isn't without complexity. Private credit isn't a monolith. It encompasses various strategies, including direct lending, distressed debt, and special situations financing, each with its own risk-reward profile.

Who's Leading the Charge?

The influx of capital into alternative investments is attracting major players. Established private equity firms are expanding their private credit arms. KKR, a long-time player, is actively scaling its offerings. Blue Owl, having built its foundation on credit strategies, is solidifying its position as a leader in the space. Even traditional financial institutions are entering the fray, with Bank of America launching a dedicated private credit fund targeting institutional investors. This participation from established financial giants validates the asset class and signals a long-term commitment.

Infrastructure and Real Estate: Tangible Assets in a Tangible World

While private credit currently dominates headlines, infrastructure and real estate remain cornerstones of the alternative investment landscape. Infrastructure - encompassing assets like transportation networks, energy grids, and communication systems - offers stable, long-term cash flows, often backed by government contracts or regulated revenue streams. It's considered a relatively safe haven, particularly during periods of economic uncertainty.

Real estate, though more sensitive to economic cycles, continues to appeal as an inflation hedge and source of income. However, the landscape is evolving. Traditional commercial real estate is facing challenges due to the rise of remote work and changing consumer habits. This is shifting investment towards niche sectors like data centers, logistics facilities (driven by e-commerce), and specialized housing (senior living, student accommodation).

Navigating the Risks

Despite the potential benefits, alternative investments aren't without risks. Perhaps the most significant is illiquidity. Private credit, infrastructure, and real estate investments are inherently less liquid than publicly traded stocks and bonds. This means investors may face difficulties selling their holdings quickly, especially in times of market stress. Increased competition within the private credit space is also starting to compress yields, potentially eroding returns. Furthermore, a broad economic downturn could lead to higher default rates in private credit and decreased occupancy/valuations in real estate, impacting overall performance.

Investors must conduct thorough due diligence, understand the specific risks associated with each asset class, and carefully assess their own liquidity needs before allocating capital to alternatives. While the potential rewards are significant, a cautious and informed approach is paramount. The future of investing appears increasingly diversified, with alternatives playing a growing - and crucial - role in achieving long-term financial goals.

Read the Full Business Insider Article at:

[ https://www.businessinsider.com/alternative-investing-stocks-infrastructure-private-credit-kkr-blue-owl-bofa-2026-1 ]