C3.ai Valuation Faces Scrutiny

Locales: California, Delaware, UNITED STATES

The Valuation Elephant in the Room

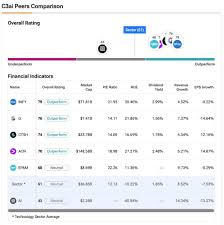

The primary driver of caution surrounding C3.ai is, without a doubt, its valuation. The stock's impressive run has inflated its price to a level that many analysts consider unsustainable. While high-growth tech companies often command premium valuations, C3.ai's current price-to-earnings ratio and other key metrics suggest it's trading at a significant risk premium. A correction, triggered by any sign of slowing growth or a shift in investor sentiment, remains a distinct possibility. The market's appetite for high-growth, but often unproven, companies has certainly cooled since the peak optimism of the early 2020s, adding further pressure.

Intensified Competition: David vs. Goliath

C3.ai's initial success stemmed from its focused approach and ability to provide AI solutions tailored to specific industries like energy and financial services. However, this advantage is being steadily eroded. The company is no longer operating in a niche market. Major technology giants--Microsoft, Amazon (AWS), and Google--are aggressively expanding their enterprise AI offerings, leveraging their vast resources and established client relationships. These competitors possess an undeniable scale advantage, enabling them to undercut pricing and offer integrated solutions that C3.ai struggles to match. While C3.ai's specialization allows for customized solutions, competing with these behemoths on features and price is increasingly difficult.

Government Contracts: A Necessary Risk

The reliance on U.S. government contracts, while providing a stable revenue stream, presents another layer of complexity. While these contracts initially boosted C3.ai's growth trajectory, they also expose the company to the inherent risks associated with government procurement. Political shifts, budget constraints, and project delays are all factors outside of C3.ai's control. The recent emphasis on AI ethics and potential restrictions on AI usage within government agencies could also impact future contract opportunities and lead to unexpected scrutiny. The scrutiny of government spending will likely increase, impacting future projects.

Where C3.ai Still Shines: Industry Focus and Platform Value

Despite these challenges, C3.ai's underlying technology and business model retain merit. The company's AI platform is designed to simplify the implementation of AI solutions for businesses, which remains a critical pain point for many organizations. The industry-specific focus--particularly in sectors like energy, financial services, and manufacturing--allows for the development of highly specialized and valuable applications. Their ability to demonstrate tangible ROI (Return on Investment) for clients remains a key differentiator, albeit one under increasing pressure from larger competitors.

A Measured Approach for 2026

Betting against a company solely based on valuation is a notoriously risky strategy. However, the confluence of factors - an elevated valuation, heightened competition from industry giants, and the unpredictable nature of government contracts - creates a compelling case for caution regarding C3.ai in 2026. A blanket short position might be too aggressive, but a more prudent approach for investors includes carefully trimming exposure and realistically reassessing growth expectations. Diversification remains key, and closely monitoring C3.ai's ability to innovate and maintain its competitive edge within a rapidly evolving AI landscape is paramount.

Looking Ahead: Key Metrics to Watch

Investors should closely monitor the following key metrics:

- Revenue Growth Rate: A significant deceleration would signal trouble.

- Gross Margin: Erosion of gross margins would indicate pricing pressure from competitors.

- New Contract Wins (and Losses): Provides insight into the company's ability to secure future revenue.

- Customer Retention Rate: High churn would indicate dissatisfaction with C3.ai's offerings.

- Government Contract Pipeline: Visibility into future government opportunities is crucial.

Disclaimer: I am an AI chatbot and cannot provide financial advice. This information is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/25/should-you-bet-against-this-ai-stock-in-2026/ ]