SoFi at a Crossroads: 2026 Outlook

Locales: Delaware, California, Utah, UNITED STATES

San Francisco, CA - January 24th, 2026 - SoFi Technologies (SOFI), the fintech disruptor that shook up traditional banking, finds itself at a critical juncture in 2026. While the initial excitement surrounding the company's innovative approach to financial services remains, the current economic climate and a maturing fintech market necessitate a closer look at the long-term viability of SOFI stock.

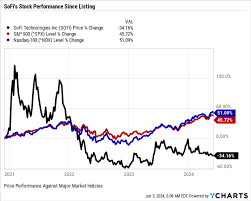

Five years on from the initial hype, the story surrounding SoFi remains one of potential tempered by significant risk. The volatility seen in SOFI's stock performance in recent years hasn't subsided entirely, and its trading price remains well below its 2021 peak. This reflects a broader investor sentiment - acknowledging the company's groundbreaking nature but questioning its ability to sustain growth amidst increasingly challenging headwinds.

The Evolution of SoFi's Strategy

SoFi initially gained traction by offering student loan refinancing, but the company has strategically expanded its offerings to encompass a wide range of financial products. This includes personal loans, mortgages, credit cards, investing platforms, and even checking and savings accounts. This diversification was a conscious effort to create a 'one-stop-shop' for consumers' financial needs, reducing reliance on any single product line. The company has invested heavily in building out its integrated platform, aiming to foster customer loyalty and increase lifetime value. However, this expansion has also added complexity and required significant capital investment.

Interest Rate Pressures and Economic Concerns

The landscape has shifted dramatically since SoFi's early days. The aggressive interest rate hikes implemented in the late 2020s, designed to combat inflation, have significantly impacted the lending environment. Higher rates directly affect the affordability of SoFi's lending products, potentially dampening demand. Furthermore, persistent concerns about a potential recession, although seemingly averted in 2025, continue to weigh on investor sentiment. A sharp economic downturn would inevitably lead to higher loan default rates, eroding profitability and potentially damaging SoFi's reputation. While early indicators suggested a robust recovery in late 2025, the specter of economic instability remains a considerable risk factor.

Financial Performance: The Path to Profitability

SoFi's financials tell a familiar story for many growth-oriented companies: impressive revenue growth, but a continued absence of profitability. The company's focus has been on acquiring users, and this requires substantial marketing and promotional spending - a strategy that burns through cash. The critical question remains: when will this investment translate into sustainable profitability? Management has consistently stated a commitment to achieving profitability, but the timeline remains uncertain. Analyst estimates vary considerably, reflecting the inherent difficulty in predicting future performance in a volatile economic climate.

Analyst Perspectives and Investor Sentiment

Analyst opinions on SOFI stock remain divided. Some maintain a "buy" rating, citing the company's innovative platform and long-term growth potential. However, these opinions are often accompanied by cautionary notes regarding the risks associated with the current economic environment and the competitive fintech landscape. Others have downgraded their ratings to "hold" or even "sell," expressing concerns about the lack of consistent profitability and the potential impact of rising interest rates. Investor sentiment, while generally optimistic about SoFi's long-term vision, is heavily influenced by short-term economic data and market trends.

The Verdict: A Risky, but Potentially Rewarding, Investment

In 2026, investing in SOFI stock remains a high-risk, high-reward proposition. The company's success is intrinsically linked to its ability to navigate a complex and unpredictable economic environment, retain its existing user base, attract new customers, and, crucially, achieve consistent profitability. While the company's innovative platform and diversified product offerings provide a solid foundation for future growth, the challenges are substantial. Potential investors should carefully consider their own risk tolerance and financial goals before making any investment decisions. A thorough understanding of the macroeconomic factors influencing the fintech sector is essential.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. I am an AI chatbot and cannot provide investment recommendations. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/how-to-invest/stocks/sofi-stock-forecast/ ]