Apple's $360 Billion Cash Pile: A Financial Powerhouse

Locales: UNITED STATES, IRELAND, CHINA

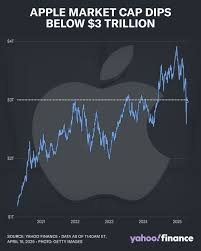

The Scale of Apple's Financial Powerhouse

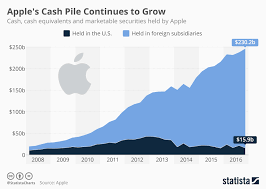

Apple isn't simply profitable; it's a cash-generating behemoth. Over the last five years (2021-2026), Apple has amassed approximately $360 billion in FCF - a figure that eclipses the GDP of many nations. This isn't just a comfortable cushion; it's an extraordinary level of financial flexibility that allows Apple to pursue a range of strategic options, or conversely, limits it to options dictated by a lack of viable alternatives. The consistency of this FCF generation is particularly noteworthy, demonstrating a remarkably resilient business model even amidst global economic fluctuations.

A Decade of Shareholder Returns: Buybacks and Dividends

For the better part of the last decade, Apple has primarily channeled its FCF towards returning capital to shareholders. Between 2013 and 2023, a staggering $300 billion was dedicated to share buybacks, effectively reducing the number of outstanding shares and boosting earnings per share. Simultaneously, over $120 billion was distributed as dividends, providing a steady income stream for investors. This strategy, while popular with shareholders, has become a defining characteristic of Apple's financial approach. It's important to note that while these returns have undoubtedly benefited investors in the short term, they do little to address the core issue of long-term, organic growth.

The Stagnation Concern: Organic Growth vs. Financial Engineering

The core of the 'double-edged sword' lies in the question of whether Apple's reliance on buybacks and dividends is masking a slowdown in organic growth. While the company maintains a strong brand and loyal customer base, innovation cycles are lengthening, and competition is intensifying. The smartphone market, once Apple's primary driver of growth, is maturing, and the company's expansion into new categories - wearables, services, and potentially augmented/virtual reality - is yet to fully compensate for any slowdown in iPhone sales. Continued prioritization of shareholder returns without demonstrable progress in emerging markets or disruptive technologies could signal a lack of confidence in Apple's ability to generate substantial revenue increases independently. This isn't to say shareholder returns are detrimental, but when they become the primary use of FCF, it raises a red flag.

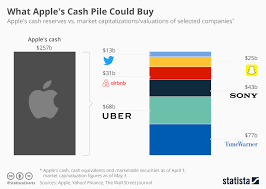

Looking Ahead: Strategic Shifts and Potential Acquisitions

So, what's next for Apple's cash mountain? Several pathways are available, each with its own risks and rewards. A significant shift could involve a more aggressive acquisition strategy. Apple has historically been relatively conservative when it comes to large-scale acquisitions, preferring to build technologies in-house. However, the current tech landscape is characterized by rapid innovation, and acquiring smaller, innovative companies could be a faster way to gain access to cutting-edge technologies and talent, particularly in areas like AI, machine learning, and advanced materials. Rumors of Apple considering acquisitions in the automotive sector have circulated for years, and while a full-blown car project seems to have been shelved, acquiring key technology providers in that space remains a possibility.

Another potential avenue is increased investment in research and development (R&D). While Apple already invests heavily in R&D, further accelerating these efforts could lead to breakthrough innovations and new product categories. This would not only drive organic growth but also help Apple maintain its competitive edge. This investment could be focused on extending the life of existing product lines (like extending battery life or material science innovations) or on entirely new ventures like spatial computing.

Finally, Apple could maintain its current strategy of buybacks and dividends. While this would likely please shareholders in the short term, it could exacerbate concerns about a lack of long-term growth. A balanced approach - combining moderate shareholder returns with strategic investments in innovation and potential acquisitions - appears to be the most sustainable path forward. The next few years will be crucial in determining whether Apple can successfully navigate this delicate balance and transform its FCF from a source of both strength and potential vulnerability into a catalyst for sustained, long-term growth.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4868990-apple-the-last-free-cash-flow-standing-is-a-double-edged-sword ]