New Zealand Stock Market Outperforms Australia Amidst Global Uncertainty

rnz

rnzLocales: NEW ZEALAND, AUSTRALIA

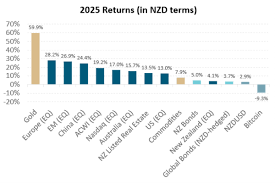

Auckland, New Zealand - February 7th, 2026 - While global markets continue to navigate a complex landscape of economic uncertainty, geopolitical instability, and fluctuating interest rates, New Zealand's stock market is demonstrating a surprising level of resilience, significantly outpacing its Australian counterpart. Investment advisors are attributing this performance to a fundamental difference in market composition and a greater weighting towards defensive sectors.

Shane Simpson, Managing Director at MyFiduciary Wealth, highlighted the divergence in a recent interview, noting that New Zealand's market has "largely shrugged off" the volatility impacting other global exchanges. This outperformance is occurring despite ongoing concerns regarding persistent inflation, escalating conflicts in Ukraine and the Middle East, and a noticeable slowdown in the Chinese economy - factors collectively contributing to a challenging global economic environment.

"We're seeing a clear distinction between the New Zealand and Australian markets. New Zealand has demonstrably held up better," Simpson explained. "The key lies in the makeup of each market. New Zealand's is heavily weighted towards sectors considered 'defensive' - think utilities like electricity and water providers, and essential healthcare. These sectors tend to maintain stability even during economic downturns because demand for their services remains constant. Australia, on the other hand, has greater exposure to cyclical sectors like materials (mining and resources) and discretionary consumer spending (retail, tourism, entertainment)."

The contrast is particularly stark when considering recent economic shifts. The Reserve Bank of Australia (RBA) recently implemented a record-low interest rate of 3.6% in an attempt to stimulate its economy, a move signaling concerns about potential recessionary pressures. This rate cut, while intended to boost economic activity, underlines the more significant challenges facing the Australian market. In comparison, New Zealand has not required such drastic measures, demonstrating a greater degree of internal economic stability.

Understanding Defensive vs. Cyclical Sectors

The difference between defensive and cyclical sectors is crucial to understanding this market dynamic. Cyclical sectors thrive during economic expansion but suffer significantly during contractions. Demand for luxury goods, for example, drops sharply when household incomes decline. Materials, while essential, are heavily influenced by global demand and prices, making them vulnerable to external shocks. Defensive sectors, however, provide goods and services that people need regardless of the economic climate. This stability translates into more predictable revenue streams and, therefore, more resilient stock performance.

Beyond Composition: A Broader Look at NZ's Resilience

While market composition is a primary driver, other factors likely contribute to New Zealand's relative stability. The nation's strong agricultural sector, a significant export earner, provides a consistent revenue stream. Furthermore, New Zealand's relatively small and well-regulated banking sector has avoided some of the stresses seen in larger, more complex financial systems. The country's strong tourism sector, though impacted by global events, has shown signs of recovery, bolstered by its reputation for safety and natural beauty.

Investor Implications: A Call for Prudence, Not Panic

Simpson advises against panic selling but urges investors to conduct thorough portfolio reviews. "Now is the time to ensure your investments are adequately diversified," he stated. "Diversification is the cornerstone of sound investment strategy, especially in turbulent times. Don't put all your eggs in one basket." This includes considering a mix of asset classes - stocks, bonds, property, and potentially alternative investments - and geographical diversification, spreading investments across different markets.

The outperformance of the New Zealand market doesn't guarantee future success. Global economic conditions remain fragile and unpredictable. However, its current trajectory suggests that a focus on defensive stocks and a well-diversified portfolio could offer a degree of protection against ongoing market volatility. Investors considering exposure to the region should consult with a qualified financial advisor to determine the suitability of New Zealand equities within their overall investment strategy. The situation warrants careful monitoring, as shifting global circumstances could quickly alter the landscape. The long-term outlook remains cautiously optimistic, but vigilance and informed decision-making are paramount.

Read the Full rnz Article at:

[ https://www.rnz.co.nz/news/business/586160/nz-stock-less-affected-by-global-market-than-australia-advisor-says ]