Selling Puts & Covered Calls: A Synergistic Strategy

Forbes

ForbesLocale: UNITED STATES

The Mechanics: Put Selling and Covered Calls - A Synergistic Approach

The foundation of this strategy lies in selling put options. A put option gives the buyer the right, but not the obligation, to sell shares of an underlying asset (in this case, Gartner) to the seller (the investor) at a predetermined price (the strike price) on or before a specific date (the expiration date). By selling this put option, the investor receives a premium - an immediate influx of capital. Let's illustrate with a current example. If Gartner (IT) is trading at $150 per share, an investor might sell a put option with a strike price of $140, expiring in 30 days. The premium received represents the initial profit.

If Gartner's price remains above $140 by the expiration date, the put option expires worthless. The investor keeps the premium, achieving a positive return on investment without being obligated to purchase any shares. This is ideal. However, if the stock price dips below $140, the investor is obligated to buy the shares at the $140 strike price, even if the market price is lower. This obligation is mitigated by the premium already received. Essentially, the investor's effective purchase price is reduced by the amount of the premium.

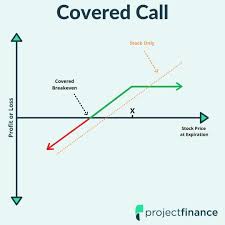

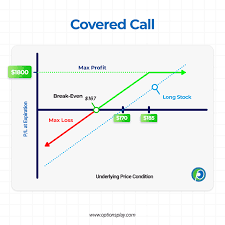

Covered calls complement this strategy. If the investor already owns Gartner shares, they can sell call options, giving the buyer the right to buy their shares at a predetermined price. This generates additional premium income. While limiting potential upside, it further enhances the income generated from the portfolio.

Why Gartner (IT) is a Suitable Candidate

Gartner's position as a global leader in research and advisory services makes it a relatively stable investment. However, even established companies are subject to market volatility. This volatility is precisely what makes Gartner a good fit for this strategy. The consistent demand for Gartner's services generally supports the stock price, while occasional market corrections or company-specific news can create opportunities to acquire shares at a discount through the put option strategy. The premiums earned from selling put options act as a buffer against potential downside risk, and the potential to buy at a lowered price is attractive to long-term investors.

Risk Management and Considerations

While this strategy offers appealing benefits, it's crucial to acknowledge the inherent risks. The most significant risk is the possibility of Gartner's stock price falling sharply below the strike price. In this scenario, the investor is obligated to purchase shares at $140 (in our example), regardless of the actual market price. This could lead to substantial losses if the price declines significantly. To mitigate this, careful selection of the strike price is paramount. A more conservative (lower) strike price reduces the premium received but also lowers the risk of being assigned the shares at an unfavorable price.

Furthermore, investors should consider their risk tolerance and financial goals. This strategy is best suited for investors who are comfortable owning Gartner shares at the strike price and are seeking to generate income while potentially acquiring them at a discount. It's not a suitable strategy for those who are highly risk-averse or have a short-term investment horizon.

Expanding on the Strategy: Rolling Options

An advanced technique to consider is "rolling" the options. If the stock price approaches the strike price as the expiration date nears, investors can close out their existing put option and open a new one with a later expiration date and potentially a different strike price. This allows them to adjust their position based on market conditions and further optimize their returns.

Important Disclaimer: I am not a financial advisor. This article provides educational information and should not be considered financial advice. Investing in the stock market carries inherent risks, including the potential loss of principal. Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor who can assess your individual circumstances and provide personalized guidance.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2026/01/09/how-to-get-paid-to-buy-gartner-stock-at-a-discount/ ]