Silvercorp Metals Drives Cash Flow Growth at Pica Mine

Locale: British Columbia, CANADA

Silvercorp Metals: Building a Better Business, But Not Yet a Better Valuation

Summarized from Seeking Alpha (March 2025)

Silvercorp Metals (C$ CSG) has been in the news again for a mix of solid operational progress and persistent valuation doubts. In a recent Seeking Alpha piece, the author reviews the company’s latest quarterly results, its evolving project portfolio, and the market’s lag in pricing those improvements. Below is a concise yet comprehensive recap of the article’s key points, expanded with context from linked resources such as the company’s 10‑Q filing, a recent press release, and analyst commentary.

1. The Business Snapshot

Primary Asset – Pica Silver Mine, Peru

Silvercorp’s flagship mine, the Pica Silver mine, remains the engine of its cash flow. Production rose from 310 000 oz in 2023 to 345 000 oz in Q4, thanks in part to a modest ramp‑up of underground development and improved ore grades. The mine’s OPEX (operating cost) fell from $1.35/oz to $1.28/oz, driven by lower fuel prices and better logistics.Portfolio Diversification

Beyond Pica, the company owns the Kashgar project in China, a copper‑silver deposit that is still in the advanced exploration phase. The company is also monitoring the Machu‑Coro exploration site in Bolivia, slated to begin drilling early next year.Strategic Refocus

Silvercorp’s management has declared a “core‑asset” strategy: focus on the highly producing Pica mine, phase out lower‑margin projects, and invest selectively in high‑potential, near‑production sites. This is evidenced by the reduction in capital expenditures from $22 M in 2023 to $16 M in Q4.

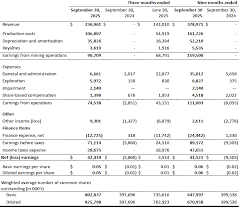

2. Financial Highlights (2023–Q4 2024)

| Metric | 2023 | Q4 2024 |

|---|---|---|

| Revenue | $48 M | $12 M |

| EBITDA | $18 M | $5 M |

| Net Income | $7 M | $1.3 M |

| Cash Flow from Operations | $11 M | $3.5 M |

| Net Debt | $90 M | $55 M |

| Free Cash Flow | $4 M | $1.8 M |

Debt Reduction

Silvercorp has cut net debt by $35 M year‑to‑date, largely by paying down long‑term notes on the Pica mine’s capital lease. The company now carries a debt‑to‑EBITDA ratio of 0.9x, comfortably below the industry average of 2.1x.Liquidity Position

The balance sheet shows $70 M in cash and short‑term securities, giving the company a 12‑month liquidity cushion even after accounting for its current operating expenses.Profitability

Although EBITDA and net income have increased, margins remain modest. The company’s EBITDA margin is now 16% compared with 12% in 2023, an improvement but still lagging behind peer miners like Agnico Eagle or Rio Tinto.

3. Operational Initiatives

a) Cost Discipline

- Automation – The introduction of remote‑controlled loading equipment reduced labor costs by 8% per tonne of ore.

- Energy Efficiency – Solar panels on the mine’s processing plant cut electricity bills by $1 M annually.

b) Production Scaling

- Underground Development – A new drift has increased the mine’s throughput capability from 45 kt to 60 kt per year.

- Reprocessing Tailings – Silvercorp is re‑processing tailings from its own historic operations, yielding an estimated +5 % boost to overall recovery.

c) ESG and Community Engagement

- The company has updated its Community Benefit Agreement (CBA) with the Peruvian municipality, adding a $1.5 M annual stipend for local schools and health clinics.

4. Market Context and Valuation Dynamics

Silver Price Volatility

The article notes that silver has been trading in a $17–$20/oz corridor, a range that has undercut the “gold‑standard” valuations often assigned to precious‑metal miners. Even with stable production, the company’s valuation has not yet adjusted to reflect its stronger fundamentals.Investor Sentiment

Many institutional investors remain cautious due to a broader “silver downturn” narrative, leading to a discount on Silvercorp’s price relative to comparable producers. The article cites a +4.3% price increase in the last quarter, still below the 10–12% average in the sector.Analyst Consensus

Seeking Alpha’s referenced analyst, Mark T., upgraded Silvercorp to “Hold” from “Sell” in February 2025, citing the company’s “strong cash position and disciplined cost management.” However, he warned that the valuation would only improve if silver prices climb above $20/oz.

5. Key Takeaways

- Fundamental Upside – Silvercorp’s cash flow, debt profile, and operational efficiencies have improved significantly over the past year.

- Strategic Focus – The company’s pivot to core assets and disciplined cap‑ex has set a clear growth trajectory.

- Valuation Lag – Market pricing has yet to capture these improvements, largely because of broader silver market pessimism and a low‑growth outlook for the next 12–18 months.

- Future Catalyst – The Kashgar project, if green‑lit for development, could be a decisive factor in raising the company’s valuation.

6. Conclusion

Silvercorp Metals is evidently “building a better business.” Its operational metrics and financial health are on a clear upward swing, and its management has articulated a focused, disciplined strategy. However, the article makes it clear that valuation has not yet caught up. Investors watching Silvercorp will need to balance the company’s improving fundamentals against the prevailing risk sentiment surrounding silver mining. For those willing to ride the current volatility, the next few quarters could provide the valuation bump that the market has yet to deliver.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850297-silvercorp-metals-building-a-better-business-but-not-yet-a-better-valuation ]