Vanguard's VYM ETF Highlights Exxon Mobil and Chevron as Top Energy Picks

Vanguard’s High‑Yield Energy Picks: Exxon Mobil & Chevron Lead the Charge

If you’re looking to pair the stability of a low‑cost, high‑yield ETF with the robust cash‑flow generation of the energy sector, the Vanguard High Dividend Yield ETF (VYM) already gives you a taste of both worlds. A recent piece on MSN Money breaks down why, among the more than 400 U.S. companies VYM holds, Exxon Mobil and Chevron emerge as the most attractive high‑yield energy stocks in the fund.

1. VYM: The Blueprint for Dividend‑Focused Investors

VYM is designed to track the MSCI US Investable Market 100% Dividend Index, an index that ranks companies by dividend yield and free‑cash‑flow‑to‑equity. Its current yield sits at roughly 3.4 %—comfortably higher than the broader market’s average of 1.5 %–2.0 %. For investors who want exposure to the U.S. equity market while keeping a high dividend payout at the center of their portfolio, VYM is a go‑to choice.

Because the ETF is so diversified—Apple, Microsoft, Johnson & Johnson and other blue‑chip giants form the bulk of its holdings—energy companies represent only a small slice of the total exposure. Nevertheless, the energy holdings are valuable additions for investors looking to tilt a fraction of their allocation toward the sector without the volatility that a pure‑energy fund might bring.

2. Exxon Mobil: A Dividend‑Minded Oil Giant

Yield & Cash Flow

Exxon Mobil tops the energy sub‑sector in VYM with a dividend yield hovering around 5.4 % (as of mid‑2025). The company has consistently paid dividends for more than a century and currently issues about $2.08 per share—up 3 % year‑over‑year. Its 2024 free‑cash‑flow surpassed $23 billion, giving the company ample room to maintain or even increase its dividend.

Valuation & Growth

Exxon’s P/E ratio, around 9–10, sits below the broader market average of 15–17, suggesting that it remains fairly attractively priced given its earnings. The company has a strong track record of dividend growth; the last five years have seen an average increase of 3.7 % per year. Even in periods of lower oil prices, Exxon has proven capable of sustaining dividend payouts thanks to its diversified portfolio of upstream and downstream assets.

Risks

The most obvious risk is oil‑price volatility. A sharp decline in crude prices can erode Exxon’s margins and free‑cash‑flow. Additionally, regulatory pressure around climate change could prompt a shift away from fossil fuels, forcing Exxon to reallocate capital to renewable projects. However, the company’s sizeable cash reserves and disciplined capital‑allocation strategy provide a buffer against short‑term shocks.

3. Chevron: A Consistent Dividend Performer

Yield & Cash Flow

Chevron follows Exxon closely, with a dividend yield around 4.6 % and a per‑share dividend of $1.95. The company’s free‑cash‑flow for 2024 was roughly $20 billion, providing a comfortable cushion to sustain its dividend policy. Chevron’s dividend yield sits slightly lower than Exxon’s but still well above the U.S. corporate average.

Valuation & Growth

Chevron’s P/E ratio sits around 12, again comfortably below the broader market. The company has also maintained a steady dividend‑growth track record, with a five‑year average growth rate near 4 %. Chevron’s diversification into LNG, petrochemicals, and oil refining gives it multiple revenue streams, reducing exposure to any single commodity.

Risks

Like Exxon, Chevron’s primary risk factor is oil‑price exposure. Climate‑policy risk also looms, particularly as the U.S. moves toward stricter emissions standards. Nevertheless, Chevron’s history of disciplined capital allocation and its investment in energy transition projects—such as renewable‑fuel ventures—indicates a strategy aimed at mitigating long‑term risks.

4. How These Stocks Fit Into VYM

Together, Exxon and Chevron account for roughly 12 % of VYM’s energy exposure and represent about 3 % of the entire portfolio. While the weight of any single holding is modest, the dividend contributions from these two stocks bolster the ETF’s overall yield. For an investor looking to lean into the energy sector without compromising the low‑cost, diversified nature of VYM, adding Exxon and Chevron can be a sensible, risk‑adjusted strategy.

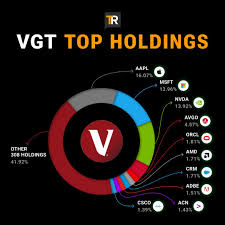

The article points out that investors can view the performance of these two stocks within VYM’s “Top Holdings” tab, and many online brokerage platforms allow you to break out the ETF’s sector allocations to see exactly how much of your exposure comes from energy. This granularity helps confirm that the energy tilt is truly “small” and controlled.

5. Takeaway: Dividend‑Focused Energy Exposure Made Simple

In short, the MSN Money piece highlights Exxon Mobil and Chevron as the two best high‑yield energy stocks currently represented in Vanguard’s High Dividend Yield ETF. Both companies provide:

- High dividend yields (≈ 5 % for Exxon, ≈ 4.5 % for Chevron) that outpace the average dividend payout of the broader market.

- Solid free‑cash‑flow bases that give them the flexibility to maintain or increase dividends.

- Stable valuation multiples relative to the overall U.S. equity market, keeping them attractive from a price perspective.

- Diversified operations that cushion them against oil‑price volatility.

By holding VYM, investors already get a diversified, low‑cost exposure to high‑yield equities. Adding Exxon and Chevron into the mix—whether through VYM or a separate allocation—offers a straightforward way to enhance dividend income with the added resilience of the largest U.S. energy companies. For those who want the best of both worlds—diversification and a high yield—these two stocks are the logical choice within the Vanguard high‑yield universe.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/the-2-best-high-yield-energy-stocks-in-vanguard-high-dividend-yield-etf/ar-AA1REbZk ]