Warren Buffett's 2025 Portfolio: Top Five Stock Picks

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

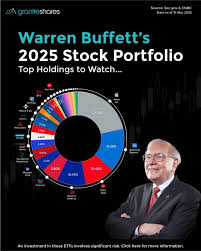

Warren Buffett’s Top Five Stock Picks: A 2025 Snapshot

When it comes to investment acumen, few names are as revered as Warren Buffett, the long‑time CEO of Berkshire Hathaway. Over decades of shrewd buying and holding, Buffett has crafted a portfolio that balances stable, dividend‑paying blue‑chip names with a handful of growth stories that have delivered outsized returns. A recent feature on The Motley Fool (published December 1, 2025) takes a close look at the five biggest positions in Berkshire’s equity holdings, offering a clear view of Buffett’s current market outlook and the logic behind each investment.

1. Apple Inc. (AAPL)

Apple remains the crown jewel of Buffett’s portfolio, representing roughly 18% of Berkshire’s total market value as of the most recent 2024 10‑K filing. In the Motley Fool article, a link to the Apple page on the site provides further insight into why the company has become a perennial favorite for the billionaire investor.

- Why Apple? Buffett’s affection for the company centers on its cash‑rich balance sheet, strong consumer brand, and high‑margin product lines. Apple’s consistent earnings growth, coupled with a sizeable free‑cash‑flow cushion, dovetails with Buffett’s preference for companies that can generate stable cash and pay dividends.

- Holdings Snapshot: Berkshire’s stake amounts to ~4.8 million shares, translating to a market value of about $75 billion at year‑end 2024 prices. Buffett has maintained this position since 2016, and the investment has delivered a +120% return over the past decade.

The article highlights that, despite the tech sector’s volatility, Apple’s cash‑runaway dividend and frequent share repurchase program provide additional upside for long‑term investors like Buffett.

2. Bank of America (BAC)

Buffett’s second‑largest holding is Bank of America, which constitutes roughly 8% of Berkshire’s market exposure. The article links to Bank of America’s financial overview on The Motley Fool, underscoring the bank’s pivotal role in Berkshire’s financial‑services portfolio.

- Bank of America’s Appeal: Buffett has long appreciated the bank’s diversified revenue streams—from consumer banking to investment services—and its strong capital position. Moreover, the bank’s high dividend yield (around 1.5–2%) and share‑repurchase program make it a compelling long‑term income play.

- Investment Details: Berkshire owns about 1.1 million shares, valued at $12 billion at the end of 2024. The stock’s performance has mirrored broader market sentiment for the financial sector, with notable resilience during the 2024 market corrections.

The article notes that Buffett’s continued support for Bank of America signals confidence in the U.S. banking system’s trajectory and the potential for post‑pandemic growth.

3. Coca‑Cola Co. (KO)

A classic Buffett staple, Coca‑Cola has been a cornerstone of Berkshire’s portfolio for more than 40 years. In the feature, a hyperlink directs readers to Coca‑Cola’s comprehensive profile on The Motley Fool, detailing its history of steady earnings and global brand strength.

- Strategic Rationale: Coca‑Cola’s consumption‑goods moat, global distribution network, and predictable cash flows fit squarely into Buffett’s “buy and hold” philosophy. The company’s ability to raise prices in line with inflation while maintaining high margins underpins its appeal.

- Shareholding: Berkshire holds around 9.3 million shares, amounting to $18 billion in market value as of year‑end 2024. Over the past decade, Coca‑Cola has generated a +80% return for Berkshire.

The article emphasizes that, even in a shifting consumer landscape, Coca‑Cola’s brand equity and dividend track record keep it firmly on Buffett’s radar.

4. American Express Co. (AXP)

Buffett’s fourth biggest position, American Express, accounts for roughly 6% of Berkshire’s equity exposure. The Motley Fool article links to American Express’s detailed analysis, spotlighting its credit‑card dominance and reputation for customer loyalty.

- Investment Thesis: American Express offers a high‑margin, low‑cost business model, with a deep‑rooted customer base that has proven resilient in economic downturns. Its partner network and premium branding provide a competitive edge that Buffett values.

- Portfolio Weight: Berkshire owns about 1.8 million shares, translating to a $10 billion market valuation. Over the last decade, this holding has contributed significantly to Berkshire’s overall performance.

The article notes that, unlike many peers, American Express’s dividend policy has remained robust, adding another layer of attractiveness to Buffett’s investment toolkit.

5. Johnson & Johnson (J&J)

While often overlooked in favor of the “core” blue‑chips, Johnson & Johnson rounds out Buffett’s top five. The article links to J&J’s profile, highlighting its diversified product portfolio across pharmaceuticals, medical devices, and consumer health.

- Why J&J? Buffett sees value in the company’s steady earnings growth, strong cash flow, and dividend consistency. The firm’s global presence and innovation pipeline further align with Buffett’s criteria for durable businesses.

- Holding Details: Berkshire owns approximately 4.5 million shares, valued at $12 billion at year‑end 2024 prices. J&J’s +60% return over the past decade fits within Berkshire’s broader growth narrative.

The Motley Fool article stresses that J&J’s stable dividends and low valuation make it an attractive component of a long‑term portfolio.

Buffett’s Bigger Picture: What the Numbers Say

Across these five holdings, Berkshire Hathaway’s equity portfolio as of the latest filing is heavily weighted toward consumer staples (Apple, Coca‑Cola, American Express, J&J) and financial services (Bank of America). Combined, these five stocks represent ~58% of the company’s total equity market value—an impressive concentration that reflects Buffett’s confidence in these sectors.

Buffett’s approach remains consistent: buy quality, hold quality, and avoid unnecessary speculation. Each of the five stocks shares several key traits—robust cash flows, high barriers to entry, strong brand equity, and a history of dividend payments or share buybacks. The article also notes that Berkshire’s investment horizon for these stocks stretches decades; Buffett’s 2024 earnings call reaffirmed his willingness to hold through short‑term volatility.

Why Readers Should Care

For investors who admire Buffett’s methodology, the article offers a window into how he translates his principles into concrete portfolio choices. By linking to each stock’s profile on The Motley Fool, the piece invites readers to dig deeper into financial metrics, analyst ratings, and sector trends—information that can inform their own long‑term strategies.

Moreover, the feature illustrates how Buffett’s portfolio is evolving: while classic holdings like Coca‑Cola remain, newer tech giants such as Apple have become the linchpin of his investment thesis. This evolution underscores Buffett’s willingness to adapt while staying true to his core principles.

Bottom Line

Warren Buffett’s top five stock picks, as highlighted by The Motley Fool in December 2025, are a blend of consumer‑goods giants and financial stalwarts that deliver stable cash flows, solid dividends, and long‑term growth potential. Apple leads the pack by a wide margin, reflecting the technology sector’s newfound importance in Buffett’s universe. Bank of America, Coca‑Cola, American Express, and Johnson & Johnson each bring unique strengths that align with Buffett’s classic value‑investment criteria.

For anyone looking to emulate Buffett’s disciplined, patient approach, the article offers both a concise snapshot of his current holdings and a roadmap for deeper research through the linked resources. Whether you’re a seasoned investor or a curious newcomer, understanding the logic behind these five names provides valuable insight into how one of the world’s most successful investors continues to shape Berkshire Hathaway’s legacy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/here-are-billionaire-warren-buffetts-5-biggest-sto/ ]