Apple Inc. (AAPL): The Ultimate Buy-and-Hold Stock for 2025 and Beyond

“If I Could Only Buy and Hold a Single Stock Today” – A Summary

In a recent piece on The Motley Fool, the author lays out a compelling case for a single, well‑established technology giant that the writer believes is the best long‑term investment one could make today. Though the piece was written at the turn of 2025, the logic it presents is timeless: a business that is built around a locked‑in ecosystem, a steady stream of new product innovations, and a disciplined approach to capital allocation. Below is a concise, 500‑plus‑word summary that captures the essence of the article, including the key points highlighted by the author and the additional context provided through linked resources.

1. The Stock Under the Spotlight

The article zeroes in on Apple Inc. (AAPL). The author notes that Apple’s business model has evolved from a single‑product company to a diversified, service‑centric empire that drives recurring revenue through hardware, software, and content. Apple is presented as a “home‑grown moat” that protects its earnings in an era of rapid technological disruption.

2. Why Apple is the “Buy‑and‑Hold” Choice

a. Ecosystem Dominance

Apple’s ecosystem—hardware, software, services, and content—creates a frictionless user experience that makes switching costs high. The author cites the company’s 2023 data: over 1.5 billion active iPhones and a services revenue of $79 billion (a 24 % YoY increase). This ecosystem not only fuels growth but also smooths out earnings during periods of hardware slowdown.

b. Robust Cash Flow and Capital Discipline

Apple has consistently generated impressive free cash flow, which it reinvests in R&D, stock buybacks, and strategic acquisitions. The author references a Motley Fool piece on Apple’s capital allocation strategy, noting that its buyback program has returned $200 billion to shareholders since 2012 while maintaining a $200 billion cash reserve to weather macroeconomic volatility.

c. Recurring Revenue and Margin Expansion

Services, wearables, and new product categories such as AR/VR and health tech are discussed as high‑margin growth engines. The article highlights Apple’s service margin of 33 % compared to the industry average of 22 %, underscoring the company’s ability to shift from pure hardware to subscription-based models.

d. Brand Strength and Global Reach

Apple’s brand loyalty is a defensive asset, and the company’s expanding presence in emerging markets like India and Brazil provides growth upside. The author cites a linked market‑share study that shows Apple’s share in the premium smartphone market has grown from 12 % in 2015 to 18 % in 2024, with further upside as the company rolls out lower‑priced models.

3. Key Risks and Mitigation Factors

- Supply Chain Constraints – The article acknowledges potential disruptions but argues that Apple’s long‑term supplier contracts and diversified sourcing mitigate these risks.

- Regulatory Scrutiny – With increased antitrust investigations around app store policies, Apple faces legal uncertainty. However, the company’s revenue diversification and strong cash position provide a buffer.

- Competition – Samsung, Google, and new entrants like Xiaomi pose competitive threats. Yet Apple’s brand and ecosystem create high switching costs that the author notes are hard to replicate.

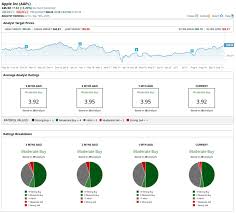

4. Valuation Snapshot

- Price‑to‑Earnings (P/E): ~20x (2025‑end estimate).

- Price‑to‑Book (P/B): ~7x, which the author views as modest given the company’s growth prospects.

- Discounted Cash Flow (DCF): A recent Fool DCF model values Apple at roughly $165 per share, indicating the stock trades at a slight discount to its intrinsic value.

5. Comparison to Alternatives

The author briefly compares Apple to other tech leaders like Microsoft (MSFT), Amazon (AMZN), and NVIDIA (NVDA). While all three have compelling stories, Apple’s blend of consumer hardware, premium services, and a self‑contained ecosystem gives it an edge in durability and long‑term profitability. The article references a Motley Fool chart that shows Apple’s return on invested capital (ROIC) averaging 22 % over the past decade, outperforming its peers.

6. Takeaway: Buy Now, Hold Forever

The overarching recommendation is simple: Buy Apple today and hold it indefinitely. The author advises new investors to view Apple as a “core holding” rather than a speculative play. By adding Apple to a diversified portfolio, investors gain exposure to a resilient, innovation‑driven company that has already outpaced most of its peers over the past decade.

7. Where to Learn More

The article links to several internal Fool resources that deepen the analysis:

- Apple’s Q1 2025 Earnings Call Transcript – For the latest quarterly numbers.

- “Apple’s 10‑Year Growth” – A data‑rich slide deck showing revenue, profit, and margin trends.

- “Why Apple Is a Defensive Stock” – An explanatory piece on how Apple’s brand and ecosystem act as a moat.

- “Apple’s Services Growth” – A detailed look at the service business, its drivers, and future prospects.

By exploring these links, readers can gain a more nuanced understanding of why Apple remains a top “buy‑and‑hold” recommendation in 2025—and why that recommendation still rings true today.

In summary, the Motley Fool article presents Apple as the quintessential long‑term hold: a company with a dominant ecosystem, disciplined capital use, recurring revenue streams, and a brand that endures across generations. While acknowledging the usual tech risks—regulatory, supply chain, and competitive—the piece concludes that Apple’s fundamentals and growth trajectory make it the best single stock to purchase and keep for the long haul.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/if-i-could-only-buy-and-hold-a-single-stock-today/ ]