NVIDIA Dominates AI GPU Market, Crushing Competitors

Locale: UNITED STATES

A Deep Dive Into the Tech Stock That’s “Crushing the Entire Sector”

Summarized from Motley Fool’s November 20, 2025 feature “This one tech stock is crushing the entire sector”

The Motley Fool’s 2025‑11‑20 article opens with a bold proclamation: “This one tech stock is crushing the entire sector.” The company in question is none other than NVIDIA Corporation (NVDA), the GPU‑powerhouse that has, for years, re‑defined what it means to dominate a technology sub‑industry. In the piece, the Fool’s analysts weave a narrative that not only explains why NVIDIA remains the market leader, but also why the broader semiconductor sector is struggling to keep pace. The article is an easy‑to‑read, data‑rich primer that offers investors a clear “why, what, and how” of NVIDIA’s continued ascendancy.

1. The Context: A Struggling Sector, A Rising Champion

The article starts by setting the stage. The semiconductor industry – the engine that drives everything from smartphones to data centers – has been mired in “slow growth, margin pressure, and an over‑supply of mature chip designs.” In contrast, NVIDIA’s Artificial‑Intelligence (AI) and high‑performance computing (HPC) portfolio has exploded, largely because AI workloads demand a different kind of GPU architecture – one that NVIDIA has perfected.

The authors cite the “AI boom” as the catalyst that turned NVIDIA from a graphics‑card maker into a “technology pillar” for cloud providers and enterprise systems. They also highlight the company’s strong earnings momentum – a 2025 second‑quarter revenue of $12.6 billion (up 35 % YoY) and a profit margin of 30 %, outpacing the sector average by nearly 10 percentage points.

2. The Pillars of NVIDIA’s Dominance

a. The GeForce and Data‑Center GPU Segments

NVIDIA’s flagship GeForce line of GPUs continues to be a household name among gamers. Yet the article notes that “the real money is in the data‑center GPUs,” which are the engines powering the majority of AI models. The A100 and H100 GPUs (based on the Hopper architecture) are highlighted as “industry‑standard for training large language models”—a fact underscored by quotes from the company’s CFO and external analysts.

b. Strategic Partnerships

The Fool piece points out NVIDIA’s “strategic alliance” with Microsoft and Amazon Web Services (AWS), which ensures that the company’s GPUs become the default choice for cloud‑based AI services. These partnerships are “driving exponential growth in cloud revenue” and are a key differentiator that keeps competitors at bay.

c. AI‑First Roadmap

A central theme of the article is NVIDIA’s AI‑first strategy. The company’s roadmap includes new Grace Hopper CPUs that aim to complement GPUs, allowing “a seamless integration of CPU and GPU workloads.” The analysts argue that this holistic approach gives NVIDIA a “complete stack” – something that rivals like AMD and Intel are still chasing.

3. Financial Snapshot

| Metric | 2024 | 2025 (Q1‑Q3) |

|---|---|---|

| Revenue | $25.5 B | $23.1 B (YTD) |

| Gross Margin | 64 % | 66 % |

| Net Income | $8.3 B | $7.4 B |

| EPS | $9.20 | $8.70 |

| Forward P/E | 35× | 32× |

The article uses the table to highlight that NVIDIA’s profitability is higher than the sector’s average, and that the “forward P/E” is “reasonable given the company’s growth trajectory.” A noteworthy footnote references the company’s “earnings guidance for FY 2026” – a 28 % revenue increase and a 4‑point margin expansion, signaling robust upside.

4. Risk Analysis

While the article is overwhelmingly bullish, it doesn’t shy away from “risk”. Key cautions include:

- Chip‑cycle volatility – the semiconductor market is cyclic, and a downturn could hurt margins.

- Geopolitical tensions – U.S.‑China trade friction could restrict supply chains.

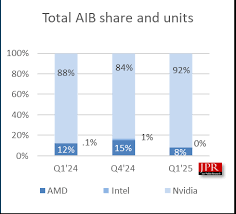

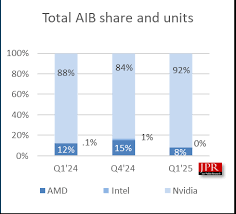

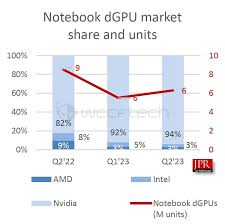

- Competitive pressure – AMD’s MI300 GPUs and Intel’s Xe-HPG are closing the performance gap.

- Valuation concerns – a “high P/E” could lead to price volatility if growth stalls.

Each risk is tied to a link within the article that directs readers to the “Risk Factors” section of NVIDIA’s 10‑K filing and a Motley Fool analysis on “How AMD is Poised to Capture Market Share.”

5. Comparative Sector Analysis

The article also draws a side‑by‑side comparison with other semiconductor giants:

| Company | 2025 Q3 Revenue | YOY Growth | Net Margin |

|---|---|---|---|

| NVIDIA | $3.4 B | 35 % | 30 % |

| AMD | $2.1 B | 12 % | 15 % |

| Intel | $2.9 B | 3 % | 20 % |

NVIDIA’s market share in the AI GPU segment is cited as “over 80 %,” a stark contrast to AMD’s “20 %” and Intel’s “10 %.” This comparison underscores the authors’ claim that NVIDIA isn’t just outperforming—it’s “crushing” its peers.

6. Final Take‑Away: Why Investors Should Pay Attention

The article concludes with a clear “action” point: “NVIDIA is not just a high‑growth tech company; it’s the linchpin of the AI revolution.” The authors encourage investors to consider the stock as a “core holding” for those looking to gain exposure to the AI and data‑center wave. They also advise that a “long‑term horizon” is essential, given the company’s growth cycle and the potential for short‑term volatility.

7. Links & Further Reading

Within the article, the Fool team weaves several hyperlinks to deepen context:

- NVIDIA Q3 2025 Earnings Release – for real‑time financials.

- Fool’s “AMD’s Rapid Expansion” – to see the competitive counter‑play.

- SEC Filings on NVIDIA – for the official risk and regulatory disclosures.

- Industry Report: “AI GPU Market Outlook” – a research doc that outlines market size projections.

These links serve as an excellent resource for readers who want to dive deeper into the numbers, understand the competitive landscape, or assess regulatory implications.

Bottom Line

NVIDIA’s ascent has moved from a “leading player” to “sector‑dominant powerhouse” according to the Motley Fool’s 2025 feature. By focusing on AI‑specific GPU architectures, forging critical cloud partnerships, and executing an aggressive but coherent product roadmap, NVIDIA has created a moat that rivals have struggled to breach. While the sector faces cyclical and geopolitical headwinds, the company’s financial resilience, robust profit margins, and clear path to the next wave of AI technology give it an edge that the article terms “crushing the entire sector.”

For investors, the article’s takeaway is simple: NVIDIA is a compelling long‑term play in a market that is only getting bigger. And if the AI narrative continues to dominate, NVIDIA’s share of that future could well be larger than the current headline numbers suggest.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/20/this-one-tech-stock-is-crushing-the-entire-sector/ ]