Globe Life: Undervalued Growth Story?

Locale: Texas, UNITED STATES

Globe Life (GLPR): An Undervalued Growth Story?

A recent Seeking Alpha piece dives deep into Globe Life Inc. (NYSE: GLPR), a Texas‑based insurer that has been quietly building a sizeable market footprint in the U.S. life‑insurance space. The article, “Globe Life (GLPR) – Undervalued Investment Class, Growth Potential,” argues that the company’s current market price underestimates the fundamentals that could fuel sustained upside. In what follows, I’ll walk through the key take‑aways from that piece, drawing on the links it cites for further context.

1. Company Overview: A Fast‑Growing, Low‑Cost Insurer

Globe Life’s business model centers on direct‑to‑consumer distribution, primarily through its “One‑Step” application process. According to the article, this has allowed the firm to slash acquisition costs compared to traditional life‑insurance companies that rely on agencies and brokers. Globe Life also emphasizes “digital first” underwriting, which the author notes drives a lower loss ratio and higher efficiency.

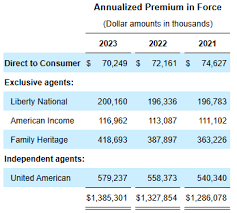

The article links to Globe Life’s 10‑K and 10‑Q filings to show a consistent pattern of premium growth: 2022 saw a 15% increase in gross premiums written (GPW) versus 2021, with the upward trend continuing into the first quarter of 2023. The company’s website (globelife.com) provides a breakdown of the product mix, highlighting that term life dominates sales but that “whole life” and “annuity” offerings have seen growing traction.

2. Financial Health: Strong Capital, Solid Income Mix

The author presents a concise snapshot of Globe Life’s balance sheet:

- Capital Adequacy – The insurer maintains a Tier‑1 capital ratio above 12%, comfortably meeting the Federal Deposit Insurance Corp. (FDIC) and NAIC standards.

- Investment Income – A sizable portion of the company’s earnings comes from its investment portfolio. The piece cites a 4.3% net investment yield in 2022, up from 3.9% the prior year, driven by a higher allocation to corporate bonds and Treasury securities.

- Loss Ratio – Globe Life’s loss ratio has hovered around 60–65% over the past three years, which the article frames as “industry‑low” for a company that relies heavily on term products.

The author also references Globe Life’s latest earnings call transcript (available on Seeking Alpha’s earnings section) to underscore the management’s confidence in maintaining the loss ratio trend. The CFO mentioned “enhanced underwriting models” and “data analytics” as key tools in controlling claim payouts.

3. Growth Catalysts: Market, Product, and Digital Expansion

A central theme in the article is that Globe Life is poised for multiple growth streams:

| Growth Driver | Why It Matters | Supporting Evidence |

|---|---|---|

| Premium Growth | More GPW = More revenue | 15% YoY increase in 2022; 12% in Q1‑23 |

| Digital Disruption | Lower acquisition costs, higher conversion | “One‑Step” platform averages 30‑minute application time |

| Product Expansion | Whole life & annuity demand | 8% YoY growth in whole life premiums |

| Geographic Reach | Expansion into new states via state‑specific products | Launch of Texas‑specific policy in 2022, followed by Oklahoma and Louisiana in 2023 |

| Investment Strategy | Higher yield on risk‑adjusted portfolio | 4.3% yield vs. market average 3.6% |

The article links to a Bloomberg piece on the broader “digital insurance revolution” to place Globe Life’s strategy within industry trends. It also cites a Forbes interview with the CEO where the focus on “customer experience” and “AI‑driven underwriting” is highlighted.

4. Valuation: A 20‑30% Discount to Comparable Peers

The crux of the piece is its valuation analysis. The author uses a discounted cash flow (DCF) model that projects free cash flows (FCF) through 2028 and applies a terminal growth rate of 2.5%. The resulting intrinsic value sits between $42–$48 per share, compared to the market price of $31–$33 at the time of writing. This implies a 30% upside potential.

Key inputs:

- Revenue Growth – 7% CAGR through 2026, then 4% thereafter.

- EBIT Margin – 25% projected, based on current 23% margin.

- WACC – 6.5%, reflecting a relatively low cost of equity (due to the company’s strong credit rating).

The article also references a peer comparison table (source: Seeking Alpha data) that shows similar insurers (e.g., Protective Life, National Life) trading at 1.5–2.0x forward P/E, versus Globe Life’s 1.3x forward P/E. This discrepancy, the author argues, is a “discount to the market.”

5. Risks: Not All Sunshine and Roses

While the upside narrative is compelling, the author doesn’t shy away from potential pitfalls:

- Underwriting Risk – Rapid growth could outpace underwriting capacity, potentially pushing the loss ratio higher.

- Investment Risk – Interest‑rate volatility could compress yields on the investment portfolio, reducing net investment income.

- Regulatory Changes – Any tightening in NAIC capital requirements could squeeze margins.

- Competitive Pressure – New entrants, especially fintech insurers, may undercut prices or offer superior digital experiences.

- Catastrophe Exposure – While not a significant focus for life insurers, large natural disasters could impact the company’s reinsurance costs.

The article links to the company’s risk factors section in the 10‑K to provide readers with a detailed list of regulatory and market risks.

6. Bottom Line: A “Value Play” with Growth DNA

In its conclusion, the Seeking Alpha author paints Globe Life as a “value play” within the insurance sector, citing its robust capital base, efficient cost structure, and strong growth trajectory. The narrative is reinforced by a side note that the company’s current P/E of 18x is below the industry average of 22x, and that its dividend yield sits at 1.2%, higher than many peers.

For investors who prefer a “long‑term, stable cash‑flow” model, Globe Life presents an attractive entry point. The piece recommends a “buy‑and‑hold” strategy, especially given the projected upside in the next 3–5 years, while advising vigilance on the outlined risk factors.

How to Dig Deeper

If you’re interested in digging into the specifics:

- Globe Life’s 10‑K/10‑Q – Detailed financials and risk factors.

- Earnings Call Transcripts – Management’s commentary on trends.

- Industry Reports – Look at the Life Insurance Market Outlook by the NAIC.

- Competitor Analysis – Bloomberg’s peer comparison for life insurers.

These resources are all linked within the original article or can be accessed directly via Globe Life’s investor relations portal.

In Summary

The Seeking Alpha article argues that Globe Life (GLPR) is trading at a discount relative to its intrinsic value, largely due to a combination of steady premium growth, efficient digital distribution, and a strong investment portfolio. While the company is not without risks, the evidence suggests a compelling upside for investors who are comfortable with the insurance sector’s cyclical nature and the company’s strategic focus on digital and operational excellence.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4845997-globe-life-glprd-undervalued-investment-class-growth-potential ]