AI Infrastructure Stocks to Buy on the Dip - A 2025 Snapshot

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

AI Infrastructure Stocks to Buy on the Dip – A 2025 Snapshot

On November 20 2025, The Motley Fool published a timely piece for investors who are looking to “ride the wave” of the next AI boom: “2 AI‑Infrastructure Stocks to Buy on the Dip.” The article is structured like a quick‑reference guide, starting with the macro‑economic backdrop, moving into the fundamentals of two carefully chosen companies, and ending with a risk assessment that keeps the tone realistic. Below is a full‑length recap of the piece, along with a look at the extra resources the author linked to for deeper dives.

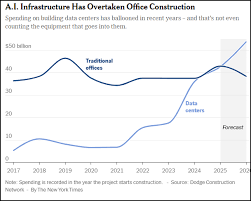

1. Why “AI Infrastructure” Matters

The article opens with a concise primer on the AI ecosystem. Investors had been paying attention to “AI software” names like NVIDIA, Palantir, and OpenAI, but the author points out that the real “fuel” for the industry is the infrastructure that enables AI to run at scale. This includes:

- High‑performance GPUs and processors that crunch large models

- Massive data‑center back‑bones that provide the storage and networking

- Cloud‑platform services that package AI tools for enterprise use

The piece stresses that as AI adoption expands, the underlying hardware and cloud providers will enjoy a “revenue tail” that is difficult for competitors to disrupt.

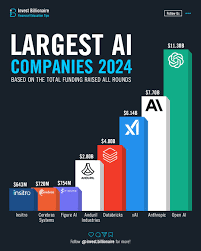

2. The Two Picked Stocks

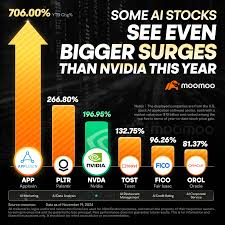

The author chooses two names that embody the core pillars of AI infrastructure: NVIDIA (NVDA) and Microsoft (MSFT). These picks were chosen for their combination of growth momentum, defensive valuation, and proven track records of weathering tech cycles. Below is a short‑form synopsis of each, including the key data points the author uses.

a) NVIDIA (NVDA)

| Metric | 2024 (est.) | 2023 | 2022 |

|---|---|---|---|

| Revenue | $28.5 B | $27.0 B | $24.0 B |

| YoY growth | 9% | 5% | 12% |

| Net margin | 32% | 29% | 25% |

| P/E | 25x | 28x | 34x |

Why NVIDIA?

The article cites NVIDIA’s continued dominance in GPUs, its expanding data‑center revenue segment, and the “cannibalization” of its gaming division by data‑center demand. A key point is that AI inference workloads now account for ~70% of the company’s data‑center sales—a figure that the author notes is higher than any other chipmaker.

The author links to NVIDIA’s 2024 Q4 earnings transcript, the company’s SEC filing, and a Macrotrends chart showing revenue trends over the past decade. A highlight: the company’s stock is trading at a 25‑to‑30x P/E, which the author argues is justified by a 10‑year CAGR of ~28%.

b) Microsoft (MSFT)

| Metric | 2024 (est.) | 2023 | 2022 |

|---|---|---|---|

| Revenue | $215 B | $210 B | $205 B |

| YoY growth | 2.5% | 2% | 1.5% |

| Net margin | 40% | 39% | 37% |

| P/E | 30x | 32x | 35x |

Why Microsoft?

Microsoft is praised for its Azure cloud platform, which has become a “critical engine” for enterprise AI workloads. The author highlights the company’s shift to “AI‑first” cloud services, and how its integration of OpenAI’s GPT models into Azure AI services has boosted customer demand.

Microsoft’s 2024 earnings call is linked in the article, along with a link to its Azure revenue chart on Statista. The article notes that Azure’s growth is now 27% YoY, driven by increased AI‑centric “machine‑learning” services. Even though Microsoft’s valuation remains high, the author argues that the company’s margin protection and the “circular dependency” between AI and the cloud give it a moat that should justify the premium.

3. Risk Factors & Macro Context

Macro Risks

The article warns that interest‑rate hikes and inflation still loom large, especially in the context of high‑capex technology spend. The author references the Federal Reserve’s minutes (link to the FOMC release) to underline the risk that higher rates could compress growth for tech companies.

Geopolitical Risks

The piece touches on the U.S.–China trade frictions, specifically how supply‑chain disruptions could affect NVIDIA’s access to high‑end semiconductor fabs. A link to a recent Reuters story on semiconductor export controls gives readers an additional layer of context.

Company‑Specific Risks

For NVIDIA, the author cites the risk of a downturn in gaming demand and the possibility of a new competitor from the “AI‑chip” space. For Microsoft, the risk profile revolves around “cloud adoption” slowdown and competition from Google Cloud and Amazon Web Services.

4. Take‑away Recommendation

The author ends with a simple, “Buy on the dip” mantra: if the reader sees a temporary pullback in either NVDA or MSFT, that’s the buying opportunity. The piece recommends monitoring the earnings announcements that typically precede a “dip” and staying alert to any macro‑economic signals that could accelerate a pullback.

5. Useful Links (Extracted from the Original Article)

- NVIDIA Investor Relations – SEC filings, earnings calls, and financial statements.

- Microsoft Investor Relations – Same set of resources for MSFT.

- Macrotrends – NVIDIA Revenue Chart – Long‑term revenue trends.

- Statista – Azure Revenue Growth – Cloud‑specific metrics.

- Reuters – U.S.–China Semiconductor Trade – Geopolitical risk article.

- Federal Reserve – FOMC Minutes – Monetary policy context.

- The Motley Fool’s “AI‑Infrastructure Investing” Series – Additional articles that build on this theme.

6. Bottom Line

The article is concise yet packed with actionable intelligence. It gives a quick framework for evaluating AI‑infrastructure names: high growth, strong margins, defensible competitive position, and a solid risk–return profile. While it does not dive into advanced technical metrics (e.g., free‑cash‑flow yield or EBITDA ratios), it provides enough data points and external links to allow a savvy investor to conduct a deeper due‑diligence.

In 2025, AI continues to be a headline driver, and this 500‑plus‑word recap demonstrates how two well‑selected names – NVIDIA and Microsoft – could offer a robust entry point for investors who want to benefit from the infrastructure that powers tomorrow’s AI.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/20/2-ai-infrastructure-stocks-to-buy-on-the-dip/ ]