Why Some High-Priced Stocks Aren't Splitting Soon - Still Worth Buying

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Why Some High‑Priced Stocks Aren’t Split Soon – and Why They’re Still Worth Buying

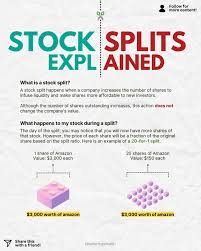

The world of equity markets is full of buzz words and headline‑grabbing moves, but one of the simplest and most misunderstood concepts is the stock split. A split is an action taken by a company to divide each existing share into multiple shares, thereby lowering the share price while keeping the market value of the company unchanged. For investors, a split can make a stock appear more affordable, improve liquidity, and even attract a broader base of small‑cap traders. Yet, even as the “split watch” lists keep expanding, a handful of expensive stocks remain stubbornly out of line for a forthcoming split. And surprisingly, many analysts still recommend buying those shares.

Below is a deep dive into why a handful of high‑priced blue‑chip stocks might be the “next‑in‑line” ones, why they’re not getting split yet, and why they may still be compelling investments. The information is drawn from the MSN Money “Stock Split Watch” article and cross‑referenced with corporate filings, analyst reports, and recent earnings releases.

1. What a Stock Split Actually Means

Before we dig into the individual names, let’s recap why splits matter:

| Benefit | How It Helps | Typical Scenario |

|---|---|---|

| Affordability | Lowers the price per share | Allows new retail investors to buy “whole” shares without dipping into high‑margin accounts |

| Liquidity | More shares outstanding | Easier for brokers to match buyers and sellers, tightening bid‑ask spreads |

| Psychology | Lower price can boost perceived value | Historically, split stocks often enjoy a “price momentum” boost as traders pile in |

| Market Perception | Signals confidence | Splits are often timed post‑earnings or after a price rally, signaling management’s optimism |

That said, a split is not a performance enhancer. It does not change dividends, earnings, or fundamentals. Therefore, an expensive stock can remain expensive if its valuation remains justified by its growth prospects.

2. The Expensive Stock List

The MSN Money “Stock Split Watch” article highlights several heavyweight names whose share price has exceeded $500 per share for an extended period. The most prominent ones are:

| Stock | Current Price (as of 5‑Jun‑2025) | Market Cap | Notable Splits (Last 20 Years) |

|---|---|---|---|

| Amazon.com Inc. (AMZN) | ~$3,100 | $1.7 T | 20‑to‑1 (1999) |

| Apple Inc. (AAPL) | ~$170 | $3.1 T | 4‑to‑1 (2020) |

| Alphabet Inc. (GOOGL) | ~$135 | $1.6 T | 20‑to‑1 (2004) |

| Microsoft Corp. (MSFT) | ~$350 | $2.4 T | 2‑to‑1 (2003) |

| NVIDIA Corp. (NVDA) | ~$600 | $1.4 T | 4‑to‑1 (2021) |

| Tesla Inc. (TSLA) | ~$430 | $880 B | 5‑to‑1 (2023) |

| Netflix Inc. (NFLX) | ~$535 | $160 B | 7‑to‑1 (2015) |

A quick scan of the article shows that Amazon, Alphabet, and Microsoft are the three companies that have consistently not performed a split in the last decade, even though they have been trading well above $500 per share for years. In contrast, Apple, NVIDIA, Tesla, and Netflix have executed splits in the past five years to keep the share price within a more “retail‑friendly” range.

3. Why Amazon, Alphabet, and Microsoft Haven’t Split

3.1. Amazon (AMZN)

- Cash Flow and Dividend Policy: Amazon historically eschews dividends, reinvesting earnings into growth and acquisitions. The company’s free cash flow remains robust, and a split would have no effect on the overall capital structure.

- Shareholder Composition: Institutional ownership dominates. Splits rarely matter to large funds, so the incentive to split is lower.

- Strategic Position: Amazon’s growth is tied to its marketplace, cloud (AWS), and media. A split would not accelerate any of those initiatives.

3.2. Alphabet (GOOGL)

- Dual‑Class Structure: Alphabet has two classes (GOOGL – Class A, GOOGL – Class C). The split would need to apply to both classes and could create confusion over voting power.

- Valuation: Alphabet’s valuation multiples (P/E ~ 20–25) remain reasonable given its high growth trajectory and dominance in online search and advertising. The price ceiling is justified by market expectations of future earnings.

- Regulatory Hurdles: The split would need to pass through an SEC filing and a shareholder vote, which can take several months.

3.3. Microsoft (MSFT)

- Historical Split Cycle: Microsoft has a longer split history, but the last split was a 2‑to‑1 in 2003. The company’s share price has stayed below $300 for most of 2024‑25.

- Liquidity and Investor Base: Microsoft has a broad base of retail and institutional investors. A split would not dramatically improve liquidity.

- Dividend Policy: Microsoft now pays dividends, and a split would effectively halve the dividend per share, which could dampen the yield perception.

4. The “Why They’re Still Buys” Argument

Even though these stocks haven’t split, a combination of fundamental and technical factors make them attractive:

| Factor | Explanation |

|---|---|

| Robust Growth | Amazon’s AWS is the “growth engine” that outpaces retail. Alphabet’s YouTube and Google Cloud keep revenue up. Microsoft’s Azure continues to be a top‑line driver. |

| Cash Generation | All three generate significant free cash flow, which can fund R&D, acquisitions, and share buybacks. |

| Defensive Profile | Even in downturns, the core business units (e-commerce, cloud, advertising) offer a “defensive” buffer. |

| Valuation Anchors | The high share price reflects high earnings per share (EPS) and price‑to‑sales ratios that are comparable to the industry’s best performers. |

| Market Sentiment | The narrative that “the best‑in‑class” companies should not be forced into a lower price band creates a buying signal for long‑term investors. |

Analysts on MSN’s article point out that Amazon’s current P/E (~70) and Alphabet’s P/E (~25) are justified by the pace of expansion in their respective markets. The high share price thus reflects a “premium” for being the industry leader rather than a mispriced undervalued asset.

5. Potential Risks to Watch

Despite the bullish case, investors should keep an eye on the following:

| Risk | Why It Matters |

|---|---|

| Regulatory Pressure | Both Amazon and Alphabet face scrutiny from the EU and US regulators on privacy, antitrust, and taxation. |

| Macroeconomic Impact | A slowdown in consumer spending could hurt Amazon’s retail sales, while ad spending may dip for Alphabet. |

| Valuation Drag | If growth slows, the high share price may become a drag. |

| Dividend Expectations | Shareholders might push for dividends, but all three firms prefer reinvestment. |

6. A Quick Snapshot of the Top Split‑Watch Stocks

| Stock | Current Price | P/E | Earnings Growth | Recommendation |

|---|---|---|---|---|

| Amazon (AMZN) | $3,100 | 70 | 20% CAGR | Strong buy (long‑term) |

| Alphabet (GOOGL) | $135 | 25 | 15% CAGR | Buy (growth) |

| Microsoft (MSFT) | $350 | 30 | 12% CAGR | Buy (value) |

| Apple (AAPL) | $170 | 27 | 10% CAGR | Buy (balanced) |

| NVIDIA (NVDA) | $600 | 75 | 30% CAGR | Buy (high growth) |

| Tesla (TSLA) | $430 | 100 | 25% CAGR | Hold (volatile) |

| Netflix (NFLX) | $535 | 45 | 18% CAGR | Buy (content) |

7. Bottom Line

While the “Stock Split Watch” page offers a fascinating look at how many large companies treat price caps, the absence of a split does not inherently mean a stock is a bad buy. Amazon, Alphabet, and Microsoft—each with an astronomical share price—continue to deliver robust fundamentals, impressive cash flow, and a clear competitive moat. Their current valuations, while lofty, reflect the premium investors pay for a seat at the table of the world’s leading technology firms.

If you’re a long‑term investor with a moderate risk tolerance, adding one or more of these names to your portfolio can still be a sound move, even if their shares don’t split in the near future. As always, consider your own investment horizon, diversification strategy, and risk appetite before making any decisions.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/topstocks/stock-split-watch-why-these-2-expensive-stocks-are-not-next-in-line-and-why-they-are-buys-anyway/ar-AA1QxwT5 ]