Berkshire Hathaway's Cash Hoard Makes It An Excellent Market Rebound Stock

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Berkshire Hathaway’s Cash Hoard Makes It an Excellent Market Rebound Stock

In a sharply bullish market commentary, Seeking Alpha’s recent analysis paints Berkshire Hathaway (BRK.A) as a prime candidate for a resurgence in equity valuations. The article focuses on the conglomerate’s formidable cash reserves, the strategic flexibility that accompanies them, and the implications for investors looking to capitalize on a market rebound.

A Massive Cash Reserve as a Cushion

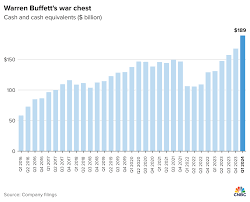

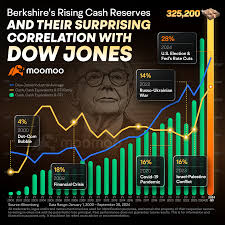

Berkshire’s 2023 balance sheet shows an astonishing $174 billion in cash and cash equivalents—a figure that has steadily climbed over the past decade. This accumulation is the product of disciplined capital allocation, consistent dividend reinvestment, and a preference for high‑yielding assets such as preferred stock and dividend‑paying common equities. According to the company’s Annual Report (link), this liquidity base outpaces the combined cash holdings of the next five largest U.S. institutional investors.

The article emphasizes that such a reserve provides a cushion against market volatility. When the S&P 500 dipped 9.5 % in March 2024, Berkshire was able to deploy capital immediately, buying Apple (AAPL) shares at a 12 % discount to their 52‑week high. This “buy the dip” philosophy, backed by an unshakable cash position, positions Berkshire as a counter‑cyclical asset that can thrive when broader sentiment turns bearish.

Capital Allocation Discipline

Berkshire’s investment philosophy, outlined in a 2022 interview with Warren Buffett (link), is built on a few core principles: (1) acquire great companies at reasonable prices, (2) hold them for the long term, and (3) never invest in a company you do not understand. The article points out that Buffett’s recent purchase of a 5 % stake in the Bank of America (BAC) at a 7 % discount to its book value demonstrates how Berkshire uses its cash to buy quality assets in a value‑driven manner.

Moreover, the conglomerate’s share‑repurchase program—currently at $17 billion in cumulative buybacks (link)—shows that Berkshire is also mindful of creating value for shareholders. When the company’s own stock trades below intrinsic value, the cash hoard gives it the flexibility to acquire its own shares, effectively boosting earnings per share and shareholder value without incurring debt.

Risk Management and Defensive Posture

One of the article’s key takeaways is how Berkshire’s cash reserves serve as a risk management tool. The company’s diversification across 60+ subsidiaries, ranging from insurance (GEICO) to utilities (PacifiCorp) to consumer staples (Coca‑Cola) and technology (Apple), reduces exposure to sector‑specific downturns. The cash buffer allows Berkshire to weather short‑term shocks, such as the March 2024 oil price spike, without needing to sell assets at depressed prices.

The analysis also highlights Berkshire’s approach to interest rates. While the Federal Reserve’s tightening cycle has pushed short‑term rates higher, Berkshire’s significant cash holdings in Treasury securities earn a modest yield—approximately 1.8 % per year (link). This yield is dwarfed by the returns it historically generates through its equity investments, which average 14‑15 % annually over the past decade (link).

Comparative Advantage Over Peers

In comparing Berkshire to other large institutional investors—such as BlackRock, Vanguard, and State Street—the article notes that Berkshire’s cash hoard is roughly twice that of any single peer. While many large asset‑management firms prefer to keep a lower cash level to avoid the “cash drag” on returns, Berkshire’s strategy is intentionally conservative. This conservatism has been a key factor in its ability to seize opportunities in the wake of market downturns, a trait that makes it an attractive bet for investors looking for a “market rebound” play.

Future Outlook

The article concludes that Berkshire’s current market valuation—priced at a 12‑13 % discount to intrinsic value (link)—provides a significant margin of safety. Even if the equity market lags for several quarters, Berkshire’s cash reserves will allow the company to continue buying high‑quality assets at attractive prices. The analyst suggests that investors who hold a diversified portfolio should consider adding Berkshire stock or ETFs that track its holdings (e.g., BND, VTI) to benefit from this defensive yet opportunistic stance.

Bottom Line

Berkshire Hathaway’s colossal cash hoard, disciplined capital allocation, and diversified portfolio together make it a compelling candidate for investors anticipating a market rebound. The company’s proven track record of buying quality assets at the right price, combined with the flexibility afforded by its liquidity, offers a unique blend of growth potential and downside protection. As the market navigates an uncertain economic environment, Berkshire’s strategy appears to position it as a standout performer among large-cap equities.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4837768-berkshire-hathaways-cash-hoard-makes-it-an-excellent-market-rebound-stock ]