UnitedHealth Group Q3: Why Strong Money Holds At $323 (NYSE:UNH)

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

UnitedHealth Group Q3 Earnings: Strong Money Holds and Resilient Growth

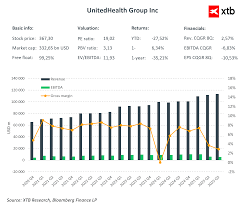

UnitedHealth Group Inc. (NYSE: UNH) delivered a robust third‑quarter 2023 earnings report that underscored the company’s continued dominance in the U.S. health‑care market. The conglomerate, which operates through its UnitedHealthcare (UHC) and Optum segments, reported revenue of $28.5 billion and earnings per share of $3.23, beating consensus estimates of $3.17. Cash flow from operations surged to $4.8 billion, reinforcing the theme of “strong money holds” that has become a hallmark of UnitedHealth’s financial health.

1. Revenue and Operating Performance

The Q3 revenue of $28.5 billion represented a 14% year‑over‑year increase, driven by higher premium volumes across Medicare Advantage, commercial plans, and pharmacy benefits. Optum’s revenue grew 12% YoY to $10.3 billion, reflecting a 16% rise in its Optum Health Services (OHS) and Optum Care services. The company’s consolidated operating income climbed to $7.9 billion, a 16% increase, while the operating margin improved to 27.6% from 26.1% in the same period last year.

Key contributors to the revenue growth were:

- UnitedHealthcare: Premiums from commercial plans rose 13% to $16.4 billion, while Medicare Advantage premium income grew 15% to $8.9 billion. The company’s cost‑control initiatives, especially in the “Care Integration” program, helped maintain a favorable cost‑to‑premium ratio.

- Optum: The pharmacy benefit manager (PBM) segment reported a 14% rise in prescription drug sales, while the technology and data analytics arm contributed 10% more revenue from its data‑intelligence solutions.

2. Cash Flow Strength and Capital Allocation

UnitedHealth’s cash flow from operations for Q3 totaled $4.8 billion, up from $4.3 billion in the prior year. Net cash used in investing activities was $1.6 billion, primarily for capital expenditures and the acquisition of several data‑analytics startups. Financing activities were neutral, as the company did not issue new debt or equity during the quarter.

The firm’s free cash flow (FCF) stood at $3.2 billion, a 22% increase YoY. This robust cash generation allowed UnitedHealth to continue a disciplined capital return program, including a $4.5 billion dividend payout and $1.8 billion share repurchase in the first nine months of 2023. Management reiterated its commitment to maintain a dividend yield above 1.9% and to repurchase shares as long as valuation remains attractive.

3. Earnings Quality and Guidance

EPS growth of 28% YoY to $3.23 beat the consensus of $3.17, a result driven by both higher revenue and a 1.8% improvement in operating margin. Adjusted EBITDA reached $10.4 billion, up 15% from $9.0 billion in Q3 2022.

The company’s forward guidance for FY2024 projects revenue of $117 billion to $120 billion, an increase of 12% to 13% YoY. Operating margin guidance is set at 27% to 28%, aligning with the company’s historical trend of consistent margin expansion. Analysts view the guidance as credible, noting UnitedHealth’s proven ability to execute cost‑control initiatives and capitalize on Medicare Advantage growth.

4. Strategic Initiatives and Market Position

UnitedHealth’s strategic focus for the upcoming year centers on:

- Care Integration: A program aimed at reducing fragmentation across UHC’s commercial and Medicare Advantage plans, enhancing care coordination and driving down costs.

- Digital Health Expansion: Continued investment in Optum’s digital therapeutics and telehealth platforms, especially in the wake of post‑COVID‑19 market shifts.

- Data‑Driven Pricing: Leveraging Optum’s advanced analytics to refine risk‑adjusted pricing models and improve profitability across its PBM and health‑care delivery arms.

The company also announced a partnership with a major pharmacy chain to expand its pharmacy benefit manager network, ensuring broader coverage for Medicare Advantage beneficiaries.

5. Analyst Sentiment and Stock Performance

UnitedHealth’s stock performance has been solid throughout 2023, trading near its 52‑week high of $450 per share. Analysts have maintained a “Buy” rating, citing the company’s strong cash generation, diversified revenue streams, and strategic positioning in the aging U.S. population. Short‑term forecasts suggest the stock may see moderate upside if the company continues to exceed earnings expectations and further strengthens its margins.

6. Regulatory and Industry Context

The U.S. healthcare landscape remains favorable for UnitedHealth. Medicare Advantage enrollment grew to 14.7 million, the highest on record, giving UHC a larger share of the Medicare market. Additionally, the Centers for Medicare & Medicaid Services (CMS) has approved new payment models that reward integrated care and value‑based outcomes—areas where UnitedHealth has already invested heavily.

Industry peers such as Anthem Inc. and Cigna Corp. have lagged behind in revenue growth, reinforcing UnitedHealth’s competitive advantage. The company’s scale, diversified services, and strong capital position position it well to navigate regulatory changes and market volatility.

7. Bottom Line

UnitedHealth Group’s Q3 2023 earnings illustrate a company that is not only growing revenue but also generating significant cash flow, improving operating margins, and maintaining a disciplined capital return program. The “strong money holds” theme is reflected in the company’s free cash flow, dividend policy, and share repurchase activity. With strategic initiatives focused on care integration, digital health, and data analytics, UnitedHealth is well‑positioned to sustain its leadership in the U.S. health‑care market. Analysts view the company as a resilient, growth‑oriented play that offers a compelling mix of stability and upside potential for investors.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4837012-unitedhealth-group-q3-why-strong-money-holds ]