Highest Historical Investment Returns: Stocks vs. Bonds Explained

Investopedia

Investopedia

Historical Investment Returns: What the Numbers Tell Us About Stocks vs. Bonds

When you think of investing, the stock market usually comes to mind first. Yet, for more than a century, bonds have been a staple of many portfolios, offering a counterbalance to the volatility of equities. A recent piece from MSN Money, “Highest Historical Investment Returns: Stocks vs. Bonds Explained,” dives into the long‑term performance of these two asset classes, drawing on data that stretches back to the 1920s. The article charts how much more lucrative stocks have been over the decades, while also highlighting why bonds remain an essential component of a balanced portfolio.

1. The Big Picture: Stocks Have Historically Outperformed Bonds

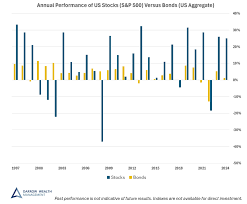

The cornerstone of the article is a side‑by‑side comparison of the cumulative growth of a $10,000 investment in the S&P 500 (a common proxy for the U.S. stock market) versus a $10,000 investment in the Bloomberg Barclays U.S. Aggregate Bond Index (a widely used bond benchmark). Starting in 1929, the S&P 500 returned an average annualized nominal yield of about 10.8 % over the past 94 years, translating into a cumulative growth of roughly $1.1 million from the initial $10,000. By contrast, the bond index delivered an average annualized nominal return of about 4.4 %, growing the same initial investment to just over $300,000.

When inflation is factored in, the gap narrows slightly but remains significant. Real returns (adjusted for a 3 % average inflation rate) sit at ≈7.5 % for stocks versus ≈1.2 % for bonds. Thus, while both asset classes have beaten inflation over the long haul, equities have done so by a wide margin.

2. Volatility and Risk: Bonds Provide a Buffer

The article emphasizes that raw returns are only part of the story. Equity markets are notoriously volatile, with annual standard deviations hovering around 15 % for the S&P 500. Bonds, on the other hand, exhibit a much lower volatility—about 5 % for the Aggregate Bond Index. Because of this stark contrast, bonds are prized for their ability to dampen portfolio swings during market turbulence.

A key illustration from the piece shows that during the 2008 financial crisis, the S&P 500 fell ~37 % in its worst month, whereas the bond index dipped just ~2 %. Over the entire 2008–2009 period, bonds added only 1.2 % to a portfolio that otherwise lost nearly 50 %. In return, the “risk premium” that stocks command is the additional return investors receive for accepting this higher volatility. Historically, that premium has been the difference between the roughly 10 % stock return and the 4 % bond return—a 6 % cushion that many investors find compelling.

3. Time Horizon and Asset Allocation

The article stresses that the appropriate mix of stocks and bonds hinges on your investment horizon and risk tolerance. For a young investor who can afford to ride out swings for 20–30 years, a heavier equity tilt (e.g., 80 % stocks / 20 % bonds) can maximize long‑term growth. A retiree or someone with a shorter horizon would likely benefit from a more defensive stance, such as 40 % stocks / 60 % bonds or even higher bond weightings if they prioritize preservation of capital.

To support these recommendations, the article links to the Bogleheads website, which outlines classic portfolio models (the “60‑40” rule, the “70‑30” rule, etc.) and explains how a gradual shift from stocks to bonds can smooth out retirement withdrawals. The linked page also offers calculators that show how different allocations would have performed over key historical periods.

4. The Bottom Line: Stocks Are Worth the Extra Risk

Despite the clear outperformance of stocks, the article cautions that past performance does not guarantee future results. A frequent counter‑argument cited in the piece is that bond yields have been falling for years, potentially eroding the “insurance” role bonds play. However, the long‑term trend remains favorable for equities. Even in low‑yield environments, the equity market’s resilience is evident: the S&P 500 has recovered from every major downturn in the past century, consistently delivering positive real returns over long horizons.

The article also references Macrotrends for up‑to‑date bond yield data, showing that while the 10‑year Treasury yield has hovered around 1–2 % in recent years, corporate bonds and municipal bonds still command higher yields (typically 2–3 % above Treasuries). These spreads are a tangible source of income for bond investors, especially for those in higher tax brackets.

5. Take‑away Takeaways

- Stocks have historically delivered roughly double the nominal and real returns of bonds over the last 90 + years.

- Bonds serve as a volatility buffer, reducing overall portfolio risk, especially during market downturns.

- The right allocation depends on your age, risk tolerance, and financial goals. A dynamic shift from stocks to bonds as you age is a common strategy.

- Keep in mind that future returns are uncertain. Even though equities have a proven track record, investors should maintain realistic expectations and diversify across asset classes.

For those interested in deeper numbers, the article links to the Bloomberg Barclays data for bond returns and to Investopedia’s explanations of equity risk and bond yield curves. Those resources provide a deeper dive into the mechanics behind the charts and help demystify the math that underpins the headlines.

In summary, the MSN Money piece reinforces a lesson that has long held in finance circles: equities, while riskier, have a higher reward, and bonds, though more modest, provide stability. The key for investors is to find a blend that balances ambition with prudence, tailored to their unique financial journey.

Read the Full Investopedia Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/highest-historical-investment-returns-stocks-vs-bonds-explained/ar-AA1rNh2W ]