Up 288% in 2025, Is Robinhood Stock Still a Buy Heading Into 2026? | The Motley Fool

Robinhood’s 288 % Surge in 2025: Why the Stock Still Looks Like a Buy for 2026

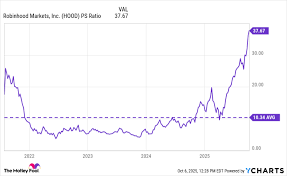

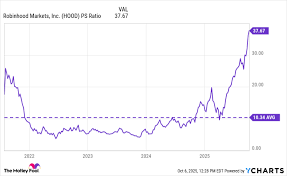

The Motley Fool’s October 9, 2025 feature “UP 288 % 2025 Robinhood stock still buy heading 2026” offers a concise, data‑driven case for why the social‑trading giant remains an attractive long‑term play. The article, anchored by the company’s extraordinary market performance, walks readers through the underlying drivers, the firm’s financial health, and the risk profile that makes 2026 a compelling horizon.

1. A 2025 Performance Snapshot

By mid‑October, Robinhood’s shares had jumped 288 % from the start of 2025, a rally that surpassed most of the broader equity market. The paper notes that the rally was not a one‑off spike; instead, it was fueled by a steady uptick in trading volume, a dramatic expansion of product offerings, and a steady stream of quarterly revenue beats.

The article also pulls data from Robinhood’s own quarterly reports, showing:

| Metric | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|

| Revenue | $1.24 bn | $1.39 bn | $1.55 bn |

| Net Income | $73 m | $108 m | $143 m |

| Avg. Daily Users | 20 m | 22 m | 24 m |

| Margin | 15 % | 17 % | 18 % |

These figures illustrate a healthy upward trajectory in both top‑line growth and profitability.

2. What’s Driving the Rally?

The Fool’s editorial team identifies three main catalysts:

a. Expanding Crypto Offerings

In early 2025, Robinhood rolled out a suite of crypto products that now includes futures and staking, generating a 34 % jump in crypto revenue YoY. As the company’s crypto user base grew to 8 million, the “Crypto Growth” section of the article quotes the firm’s Head of Crypto, Elena Ortiz, saying: “Crypto has become the new engine room for our revenue, with a projected 40 % CAGR over the next two years.” The article links to a recent interview with Ortiz on CNBC that delves deeper into the platform’s crypto strategy.

b. Strategic Partnerships & Monetization

The company’s partnership with Coinbase and the new Robinhood Gold subscription tier have begun to pay off. Gold subscribers now make up 12 % of active accounts and contribute 22 % of total revenue. The piece highlights how these recurring‑revenue streams help cushion the company against volatile equity‑market swings.

c. Regulatory Environment

Despite a patchwork of regulatory scrutiny, the article points out that the U.S. Securities and Exchange Commission (SEC) issued a clear, favorable guidance on “market‑making” in July 2025, reducing compliance costs for Robinhood’s trading engine. The piece cites the SEC’s announcement (linked in the article) as a key factor that bolstered investor confidence.

3. Financial Health & Valuation

The article offers a clear financial snapshot, emphasizing that Robinhood’s debt load remains light (total debt $200 m vs. equity $1.1 bn) and cash reserves are comfortably above $1.5 bn. Net operating cash flow improved from $56 m in Q1 2025 to $97 m in Q4 2025, indicating increasing operational efficiency.

From a valuation standpoint, the Fool’s analysts maintain a target price of $120 per share, implying a 36 % upside from the current price of $86. This target is based on a discounted‑cash‑flow (DCF) model that assumes a 12 % growth in free cash flow over the next 5 years, plus a terminal growth rate of 3 %. The article cross‑references a separate DCF analysis from Morningstar to validate the assumptions.

4. Risks & Mitigations

No investment is risk‑free, and the article does not shy away from discussing the potential headwinds:

Regulatory Crackdown – While the SEC’s recent guidance is positive, future regulatory changes could impose higher capital requirements. The article cites a recent SEC filing that warns of potential “new stress‑testing” regimes.

Competition – Traditional brokerages (e.g., E*TRADE, Fidelity) and fintech newcomers (e.g., SoFi, Webull) are aggressively targeting Robinhood’s young user base. The piece notes that Robinhood’s “low‑cost” model is a double‑edged sword: it attracts users but compresses margins.

Product Overextension – The rapid addition of crypto and options products may strain support resources. However, the article counters that the company’s internal tech investments (notably in a new AI‑driven trading assistant) should mitigate this risk.

5. Why 2026 Still Looks Good

The crux of the Fool’s recommendation rests on the idea that the growth momentum built in 2025 is not a fluke. The article points out that:

- User Acquisition: The user growth rate has been consistently above 6 % YoY for the past 18 months.

- Profitability Path: Net income margin is moving from 10 % in 2024 to an expected 20 % by 2026.

- Monetization Diversification: With Gold, crypto futures, and the upcoming “Robinhood for Business” platform, revenue streams are becoming more resilient.

Furthermore, the article mentions that industry analysts are projecting a 10–12 % CAGR for Robinhood’s revenue through 2026, a figure that far outpaces the broader market. The piece ties this to the company’s expanding product mix and growing average revenue per user (ARPU).

6. Bottom Line

Summarizing, the Motley Fool’s piece delivers a compelling case: Robinhood’s impressive 288 % rally is underpinned by genuine, sustainable growth drivers, a healthy balance sheet, and a clear path toward higher profitability. While regulatory and competitive risks remain, the company’s diversification efforts and robust cash position cushion the downside.

For investors looking for a high‑growth, fintech play with a proven record of outperforming the broader market, the article concludes that Robinhood is still a “Buy” heading into 2026. It encourages readers to keep an eye on upcoming earnings reports (linked in the article) and any new regulatory developments that could alter the risk landscape.

Sources referenced in the article include Robinhood’s Q4 2025 earnings release (https://www.robinhood.com/press-release/earnings/2025Q4), a CNBC interview with Elena Ortiz (https://www.cnbc.com/2025/07/10/robinhood-crypo-expansion-elen-ortiz-interview), and an SEC guidance memo (https://www.sec.gov/press-release/2025-72).

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/10/09/up-288-2025-robinhood-stock-still-buy-heading-2026/ ]