Berkshire Hathaway Profits Plummet, Signaling Economic Concerns

Locales: Nebraska, New York, Texas, California, UNITED STATES

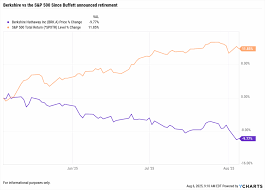

OMAHA, Neb. - February 18th, 2026 - Berkshire Hathaway, the conglomerate led by legendary investor Warren Buffett, reported a significant downturn in fourth-quarter profits, signaling broader concerns about the current economic climate. Net income for the quarter totaled $10.57 billion, or $8.41 per Class B share, a sharp decrease from the $22.75 billion, or $18.37 per share, reported during the same period last year. While operating profits remained relatively stable, the dramatic dip in overall earnings was largely attributed to unrealized losses within Berkshire's massive investment portfolio.

This downturn comes as investors grapple with a complex interplay of factors: persistent inflation, aggressive interest rate hikes by the Federal Reserve, and escalating geopolitical tensions - most notably the ongoing conflict in Ukraine. The results underscore the challenges even seasoned investors like Buffett face navigating these turbulent waters.

Investment Portfolio Takes a Hit

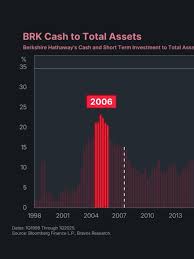

The primary driver of the decline was the diminishing value of key holdings in companies like Apple, Bank of America, and Chevron. While Berkshire's investment strategy is renowned for its long-term focus, the recent market volatility, influenced by macroeconomic pressures, has undeniably impacted its bottom line. The company's book value, a crucial metric for gauging overall worth, experienced a 7.7% decrease during the quarter.

Despite these losses, experts emphasize that unrealized losses don't necessarily reflect a fundamental issue with the underlying businesses. They represent a temporary markdown in value based on current market conditions. However, sustained downturns could lead to realized losses if Berkshire were to sell those holdings at lower prices.

Operating Businesses Demonstrate Resilience

Not all of Berkshire's performance was negative. The company's insurance businesses, including the familiar GEICO brand, demonstrated robust performance, contributing $1.37 billion in underwriting profit. Similarly, BNSF, Berkshire's railroad subsidiary, enjoyed a strong quarter, posting $1.37 billion in operating income. These solid results from the core operating businesses highlight Berkshire's diversified structure, providing a buffer against the volatility of the investment markets.

Buffett's Perspective and Future Outlook The annual report accompanying the earnings release, penned by Buffett and his team, largely stuck to familiar themes. Buffett reaffirmed his confidence in the long-term competitive strength of American businesses and the enduring value of Berkshire's holdings. He explicitly acknowledged the risks posed by rising interest rates, warning they could potentially dampen economic growth, and the continued uncertainty stemming from global geopolitical conflicts.

Analysts like Cathy Seifert from CFRA Research interpret the report as a cautious acknowledgement of the current economic landscape. "The economic landscape is more uncertain than it has been in recent years," Seifert stated, "and Berkshire's results reflect that." Buffett's long-held philosophy of avoiding short-term market speculation remains central to Berkshire's strategy, but even his approach isn't immune to the prevailing economic headwinds.

Broader Market Implications

Berkshire Hathaway is often viewed as a bellwether for the broader market, due to its diverse portfolio and significant influence. The company's Q4 performance provides a window into the pressures facing investors generally. The combination of high inflation, restrictive monetary policy, and geopolitical instability has created a challenging environment for asset appreciation.

The Federal Reserve's continued commitment to curbing inflation through interest rate hikes, while necessary, presents a risk of triggering a recession. The ongoing war in Ukraine further complicates matters, disrupting supply chains and adding to inflationary pressures. These factors collectively contribute to a climate of increased risk aversion among investors.

Looking ahead, Berkshire Hathaway's future performance will likely depend on a combination of factors, including the trajectory of inflation and interest rates, the resolution of geopolitical conflicts, and the overall health of the American economy. While Buffett remains optimistic about the long-term prospects of American business, the current environment demands a cautious and strategic approach to investment.

Read the Full Associated Press Article at:

[ https://apnews.com/article/berkshire-hathaway-warren-buffett-ny-times-chevron-0538fa0915e5039fae4885b5fe0c571f ]