Bitcoin Plunge Rocks Corporate Crypto Holdings

Forbes

ForbesLocales: New York, Delaware, UNITED STATES

Bitcoin's Plunge Sends Shockwaves Through Corporate Crypto Holdings

Tuesday, February 17th, 2026 - The cryptocurrency market is once again experiencing significant turbulence, with Bitcoin leading the descent. Since peaking in December 2023, the flagship cryptocurrency has lost over half its value, triggering a ripple effect that's acutely felt by publicly-traded companies that dared to embrace Bitcoin as a core component of their financial strategy. These companies, dubbed 'crypto treasury stocks,' are now facing a crucial test of their foresight - or miscalculation - as the digital asset winter bites.

The Rise of Crypto Treasury Stocks: A Bold Bet on the Future

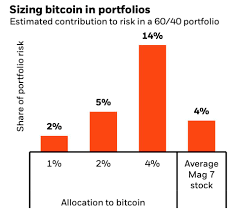

For several years leading up to 2024, a growing number of corporations began allocating capital to Bitcoin, effectively treating it as a reserve asset alongside traditional holdings like cash, bonds, and equities. This strategy, while relatively new, stemmed from a confluence of factors: a desire to hedge against increasing inflation, a diversification play to reduce reliance on fiat currencies, and a bold signal to the market demonstrating commitment to the burgeoning digital asset space. The thinking was that Bitcoin, with its limited supply, offered a potential store of value comparable to gold, but with the added benefits of digital portability and accessibility.

MicroStrategy (MSTR) emerged as the pioneer and most prominent proponent of this approach. Beginning in 2020, under the leadership of Michael Saylor, the company systematically converted its cash reserves into Bitcoin, accumulating a substantial holding that quickly became central to its identity and valuation. The company essentially became a Bitcoin play, rather than simply a software firm with a Bitcoin investment. This attracted a wave of investors eager to gain exposure to crypto through a publicly traded vehicle.

Following MicroStrategy's lead, other companies - particularly those directly involved in the Bitcoin ecosystem - also adopted the strategy. Riot Platforms (RIOT) and Marathon Digital Holdings (MARA), both prominent Bitcoin mining operations, added significant amounts of Bitcoin to their balance sheets, often representing a considerable portion of their total assets. These firms saw holding Bitcoin not only as a potential appreciation play but also as a way to offset the costs of mining and demonstrate confidence in the long-term viability of the network.

The Current Crisis: Paper Losses Mount

However, the recent dramatic downturn in Bitcoin's price is exposing the inherent risks of this strategy. As of today, MicroStrategy shares have plummeted over 50% from their December 2023 highs. Riot Platforms is down around 30%, and Marathon Digital Holdings has shed approximately 43%. These declines significantly outpace the broader market correction, highlighting the outsized impact of Bitcoin's performance on these companies' stock prices.

The core problem is simple: the paper losses on these Bitcoin holdings are substantial and directly impacting the reported financial health of these companies. While proponents of Bitcoin argue about its long-term potential, accounting rules require companies to mark their assets to market, meaning they must report the current value of their holdings - even if they intend to hold them for the long term. This creates a challenging narrative for investors, who are increasingly focused on short-term profitability.

Beyond the Numbers: Investor Sentiment and Future Strategy

The current situation is forcing a serious re-evaluation of the viability of holding digital assets on corporate balance sheets. The volatility of Bitcoin, once seen as a temporary hurdle, has proven to be a persistent and significant challenge. Questions are now being raised about whether the potential rewards of holding Bitcoin outweigh the risks, especially given the potential for significant shareholder value erosion during downturns.

Several scenarios are possible moving forward. Some companies may choose to "double down," continuing to accumulate Bitcoin during the dip, betting on a future price recovery. This would be a high-risk, high-reward strategy that could further alienate risk-averse investors. Others might be forced to liquidate portions of their Bitcoin holdings to shore up their balance sheets, demonstrating a lack of conviction in the asset class and potentially exacerbating the downward price pressure. A third option involves adopting hedging strategies, utilizing derivatives to mitigate potential losses, though this adds complexity and cost.

The long-term consequences of this crisis will likely reshape the landscape of corporate crypto adoption. While the initial enthusiasm for Bitcoin as a treasury asset was palpable, the current downturn serves as a stark reminder of the inherent volatility and risks associated with investing in digital currencies. The path forward for crypto treasury stocks will depend on a combination of Bitcoin's future performance, corporate resilience, and investor tolerance for risk. The coming months will be critical in determining whether this bold experiment will ultimately prove to be a visionary move or a costly misstep.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/ninabambysheva/2026/02/17/bitcoins-crash-is-putting-crypto-treasury-stocks-to-the-test/ ]