Hermes: Luxury, Scarcity, and a Questionable Valuation

Locales: FRANCE, UNITED KINGDOM, JAPAN

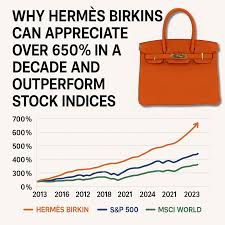

The Allure of Hermes: A Brand Built on Scarcity and Craftsmanship

Before delving into the financial concerns, it's crucial to understand why Hermes commands such a premium. The brand doesn't just sell products; it sells a lifestyle, an aspiration, and a history of unparalleled craftsmanship. The deliberate scarcity of flagship items, like the Birkin and Kelly bags, fuels demand and reinforces the perception of exclusivity. This carefully curated image, combined with high-quality materials and meticulous production, justifies a price point far above competitors. The company's vertically integrated supply chain - controlling everything from leather sourcing to final retail - also ensures quality and contributes to strong margins. This dedication to quality and craftsmanship resonates deeply with a global clientele willing to pay a premium for enduring luxury.

The Valuation Question: Riding a High Price-to-Earnings Ratio

The core issue isn't Hermes' performance, but its valuation. Currently, Hermes trades at a price-to-earnings (P/E) ratio that significantly surpasses not only its historical average but also that of its peers - LVMH, Richemont, and Kering. While luxury brands often command higher multiples due to their brand power and potential for sustained profitability, Hermes' current P/E ratio stretches into territory that feels unsustainable. This implies investors are expecting extraordinary future growth that, realistically, may not materialize. The market is essentially paying a substantial premium for the expectation of continued exceptional performance, and any deviation from that expectation could trigger a significant correction.

Growth Deceleration: Navigating a Changing Luxury Landscape

Hermes has enjoyed a period of robust growth driven by increasing demand from emerging markets, particularly Asia. However, several factors suggest that this growth trajectory is slowing. The luxury market, while still substantial, is becoming increasingly saturated. Competition is fierce, with established brands vying for market share and new entrants constantly emerging. More importantly, macroeconomic headwinds are growing. Global economic uncertainties, including inflation, geopolitical instability (the ongoing situation in Eastern Europe and increasing tensions in the South China Sea continue to create anxieties), and potential recessions in key markets, are likely to dampen consumer spending, even among high-net-worth individuals.

While Hermes has proven remarkably resilient, it's not immune to these pressures. Slowing economic growth in China, a key market for luxury goods, is already impacting sales. Increased currency fluctuations also affect profitability. The company's reliance on discretionary spending makes it particularly vulnerable to economic downturns. Although the company continues to expand its retail footprint globally, the law of large numbers will inevitably apply; achieving the same growth rates as in the past will become increasingly difficult.

Limited Upside Potential: A Risky Proposition for New Investors

Given the exceptionally high valuation and the decelerating growth prospects, the potential for significant upside in Hermes stock appears limited. The stock has already factored in a considerable degree of optimism regarding the company's future performance. A positive earnings surprise might provide a short-term bump, but it's unlikely to be substantial enough to justify the current price. Conversely, any negative news - weaker-than-expected earnings, a slowdown in key markets, or a shift in consumer preferences - could trigger a sharp decline. Investors who purchase the stock at these levels are taking on considerable risk with a limited potential reward.

Beyond Hermes: Exploring Alternative Investment Opportunities

While Hermes remains a fundamentally strong company, its current stock price doesn't reflect a compelling investment opportunity. Investors seeking exposure to the luxury market may find more attractive options among its peers, which trade at more reasonable valuations. Furthermore, exploring growth opportunities in other sectors - technology, healthcare, or renewable energy - could offer superior returns with less risk. Diversification is key to a healthy portfolio, and concentrating heavily on a single, overvalued stock is rarely a prudent strategy. Investors would be better served by considering assets offering a more balanced risk-reward profile.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4869943-hermes-stock-priced-perfection-remains-overvalued ]