Investor Pessimism Surges to Highest Level Since 2023

Locales: N/A, Illinois, UNITED STATES

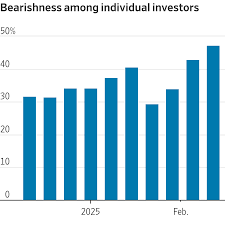

Ann Arbor, MI - February 12th, 2026 - A wave of pessimism has washed over individual investors, according to the latest American Association of Individual Investors (AAII) Sentiment Survey released today. The survey, a closely watched barometer of retail investor mood, reveals a dramatic surge in bearish sentiment and a corresponding decline in optimism, raising concerns about a potential market correction.

This week's results paint a stark picture. Bearish sentiment - the percentage of investors expecting the market to decline over the next six months - has jumped to 37.3%. This represents the highest level of investor dread since October 2023, a significant escalation from last week's 25.3%. The increase is particularly noteworthy given the relatively stable overall market performance in recent weeks. It suggests underlying anxieties are brewing beneath the surface.

Simultaneously, bullish sentiment has taken a hit, falling to 22.1% from 29.7% the previous week. This isn't merely a slight cooling of optimism; it's a substantial decrease indicating a loss of conviction in continued market gains. For context, a reading below 30% for bullish sentiment is generally considered quite low, indicating widespread skepticism.

Neutral sentiment, representing those with no strong directional bias, remains at a moderate 40.6%. While not dramatically shifting, the balance tipping towards bearishness leaves fewer investors positioned to absorb potential downside risk. The fact that neutral investors haven't shifted significantly towards bullishness despite relatively calm market conditions is also telling.

Decoding the Shift: What's Driving the Fear?

Analysts point to a confluence of factors fueling this increased pessimism. While headline economic figures remain relatively positive, a closer examination reveals subtle but concerning trends. Inflation, though cooling from its peak, remains stubbornly above the Federal Reserve's 2% target. Recent labor market data, while still strong, has shown signs of easing, sparking worries about a potential slowdown in economic growth.

Geopolitical uncertainty continues to loom large. The ongoing conflicts in Eastern Europe and the Middle East, along with rising tensions in the South China Sea, are creating a volatile global landscape, impacting investor confidence. The recent escalation of trade disputes between major economic powers is also contributing to the uneasy mood.

Furthermore, corporate earnings reports, while generally positive, have been accompanied by increasingly cautious guidance for the future. Many companies are citing higher input costs, supply chain disruptions, and weakening consumer demand as factors impacting their outlook.

Historical Significance: A Contrarian Indicator?

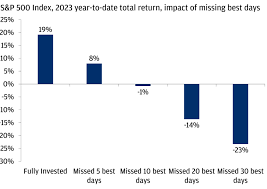

The AAII Sentiment Survey has a long history of serving as a contrarian indicator. This means that extreme levels of pessimism often precede market rallies, and conversely, excessive optimism can signal an impending downturn. The logic is that when everyone is bearish, there's less room for further negative sentiment, and a positive catalyst can trigger a significant bounce. However, it's crucial to note that the survey is not foolproof and should not be used in isolation.

Currently, the combination of rising bearishness and falling bullishness is particularly noteworthy. Historically, such divergences have often foreshadowed market corrections, particularly when coupled with other warning signs like slowing economic growth or rising interest rates. While the VIX (volatility index) remains relatively subdued, suggesting a lack of immediate panic, the underlying sentiment shift warrants careful attention.

The survey polls over 500 individual investors each week, providing a valuable glimpse into the collective mindset of retail investors - a demographic often considered less sophisticated than institutional investors. Their emotional responses can sometimes amplify market movements, making their sentiment a useful, albeit imperfect, tool for market analysis.

Looking Ahead: What to Expect?

While it's impossible to predict the future with certainty, the current AAII Sentiment Survey suggests a period of heightened volatility may be ahead. Investors should consider reviewing their portfolios, ensuring they are adequately diversified, and remaining cautious in the near term. Ignoring the rising level of investor fear could prove costly. The coming weeks will be crucial in determining whether this pessimism is a temporary blip or a harbinger of a more significant market correction.

Disclaimer: This is not financial advice. The AAII Sentiment Survey is one data point among many to consider when making investment decisions. Consult with a qualified financial advisor before making any investment choices.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4869635-aaii-sentiment-survey-pessimism-rebounds ]