Decoding Relative Strength for Smarter Stock Selection

Locales: Texas, California, UNITED STATES

Beyond the RS Line: Decoding Relative Strength for Smarter Stock Selection

(Friday, February 13th, 2026) - In the ever-volatile world of stock investing, identifying potential winners before they surge is the holy grail. Investors Business Daily (IBD)'s Stock Rating system, and particularly its focus on Relative Strength (RS), offers a compelling methodology for achieving just that. But understanding why rising relative strength signals potential breakouts, and how to integrate it into a broader investment strategy, is crucial for maximizing returns.

The Core Principle: Outperformance as a Predictor

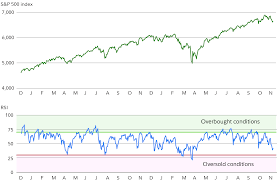

Relative Strength isn't simply about a stock's price going up. It's a comparative measure. As IBD defines it, RS quantifies a stock's performance over a defined period - typically the last 12 months - relative to a benchmark, most commonly the S&P 500. A stock with rising RS isn't necessarily the best performer overall; it's a stock that's consistently performing better than the broader market. This outperformance is the key signal.

Think of it like a race. A runner increasing their lead isn't just running faster; they're widening the gap between themselves and the competition. Similarly, a rising RS line indicates increasing demand for a stock, suggesting institutional and retail investors are accumulating shares at a higher rate than for other companies.

Why Does Rising RS Precede Breakouts?

The connection between rising RS and potential breakouts isn't coincidental. Institutional investors, who often drive significant price movements, are constantly scanning for leadership stocks - those poised to outperform in the next market advance. They prioritize companies demonstrating consistent strength before a major move occurs. This pre-emptive buying pressure fuels the RS line upwards and creates the conditions for a breakout from consolidation patterns.

These consolidation patterns - like cup bases, flat bases, or even more complex formations - represent periods where the stock is gathering energy. A rising RS line within this consolidation signals that the underlying fundamentals and investor sentiment are strong enough to overcome resistance and initiate an upward trajectory.

Recent Examples & Expanding the Universe

IBD's recent spotlight on stocks like Buckle (BKE), Dick's Sporting Goods (DKS), The Container Store (TCS), and Generac (GNRC) provides concrete examples. BKE's momentum out of a flat base, DKS's breakout attempt, and TCS holding near its buy point all showcase the principle in action. Generac, with its essential power solutions, has demonstrably shown consistent RS, likely benefiting from increased demand for backup power solutions.

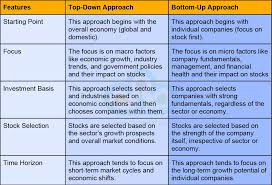

However, limiting the search to just these few examples is a mistake. A robust RS-based strategy requires a broader scan. Using stock screening tools, investors can identify hundreds of stocks with rising RS lines. Then, further filtering based on fundamental strength (earnings growth, revenue increases, return on equity) and technical indicators (volume, moving averages) will narrow the field to the most promising candidates.

Beyond Breakouts: RS as a Risk Management Tool

While identifying potential breakouts is the primary goal, rising RS also serves as a valuable risk management tool. Stocks with consistently declining RS lines suggest weakening fundamentals or diminishing investor interest. These stocks should be avoided or, if already held, considered for trimming or selling. A declining RS can act as an early warning signal, potentially preventing significant losses.

Integrating RS with a Comprehensive Strategy

It's critical to emphasize that rising RS shouldn't be used in isolation. It's a powerful indicator, but it's not a foolproof system. Successful investors integrate it into a broader strategy that includes:

- Fundamental Analysis: Understanding the company's business model, competitive landscape, and financial health is paramount.

- Technical Analysis: Confirming breakouts with volume and identifying support and resistance levels enhances the probability of success.

- Risk Management: Implementing stop-loss orders protects capital and limits potential downside.

- Position Sizing: Allocating capital prudently based on risk tolerance and conviction level.

The Future of Relative Strength Analysis

As data analytics and AI become more sophisticated, the application of Relative Strength is likely to evolve. Algorithms can now analyze vast amounts of data to identify subtle shifts in investor behavior and predict potential breakouts with greater accuracy. However, the underlying principle - that outperformance is a leading indicator - remains timeless.

Disclaimer: This is not financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Read the Full investors.com Article at:

[ https://www.investors.com/ibd-data-stories/stocks-with-rising-relative-strength-buckle/ ]