Go-Reit Launches $325M Debenture Offering

Locales: Delaware, UNITED STATES

Toronto, ON - February 12th, 2026 - Go-Residential Real Estate Investment Trust (Go-Reit) today announced the launch of a significant debenture offering, aiming to raise $325 million through the issuance of 3.75% unsecured debentures due in 2031. Priced at 99.376% of their face value, the offering signals a strong vote of confidence in Go-Reit's future prospects and its established position within the Canadian residential real estate market.

This marks Go-Reit's first venture into unsecured debenture offerings, representing a crucial step in the company's financial evolution. Historically, REITs have relied heavily on equity financing and secured debt, but an unsecured offering allows for greater financial flexibility and potentially lower borrowing costs. The ability to successfully launch this offering indicates Go-Reit has demonstrated sufficient financial stability and a robust credit profile to attract investors without requiring specific asset backing.

Strategic Use of Proceeds Fuels Growth and Stability

According to the company's official statement, the net proceeds from this offering will be allocated towards several key strategic initiatives. These include funding potential acquisitions, reducing existing outstanding debt, and bolstering the company's overall working capital.

The intention to explore acquisitions suggests Go-Reit is actively seeking opportunities to expand its portfolio of residential properties. The Canadian rental market, particularly in major metropolitan areas, has experienced consistent demand, and Go-Reit is likely positioning itself to capitalize on this trend. Experts predict continued population growth and urbanization will further drive demand for rental accommodations, creating a favorable environment for strategic acquisitions.

Simultaneously, the planned reduction of outstanding debt highlights Go-Reit's commitment to financial prudence. Reducing leverage strengthens the company's balance sheet, lowers its interest expense, and provides greater capacity for future investment. This is particularly important in the current economic climate, where interest rate volatility remains a concern.

Finally, the allocation towards general working capital will provide Go-Reit with the liquidity needed to meet its day-to-day operational expenses and pursue unforeseen opportunities. This financial cushion allows for agility and responsiveness in a dynamic market.

Joint Book Managers Signal Market Confidence

The offering is being managed by a joint team of investment banking giants: J.P. Morgan Securities LLC and BofA Securities Inc. The involvement of these prestigious firms speaks volumes about the attractiveness of Go-Reit's offering and the expected investor demand. These institutions conduct rigorous due diligence before agreeing to manage an offering, ensuring a level of quality and credibility for potential investors.

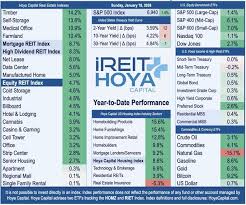

Market Context and REIT Performance

REITs, as a whole, have faced increasing scrutiny in recent years due to rising interest rates and concerns about affordability. However, Go-Reit has consistently outperformed its peers, demonstrating strong occupancy rates and effective property management. The company's focus on strategically located, high-quality residential properties has resonated with renters, contributing to its stable cash flow and consistent dividend payments.

Analysts note that Go-Reit's portfolio is well-diversified geographically and across different property types (apartments, townhouses, condominiums), which mitigates risk. This diversification, coupled with a proactive approach to property maintenance and tenant retention, has helped the company weather economic downturns more effectively than some of its competitors.

Offering Details and Timeline

The offering is scheduled to close on February 15, 2026, contingent on the fulfillment of customary closing conditions. Investors interested in participating should consult the official prospectus supplement for detailed information regarding the terms and conditions of the offering. This document provides a comprehensive overview of the risks and rewards associated with investing in Go-Reit's debentures.

Future Outlook

Go-Reit's debut unsecured debenture offering represents a pivotal moment for the company, signaling its maturity as a financial player and its ambition for continued growth. The funds raised will be instrumental in driving future acquisitions, strengthening its financial position, and ultimately delivering value to its unitholders. The successful execution of this offering positions Go-Reit for continued success in the competitive Canadian residential real estate landscape.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4550794-go-residential-real-estate-investment-trust-announces-c325m-inaugural-unsecured-debenture-offering ]