Motilal Oswal Predicts 40% Upside for Ambuja Cements and Kajaria Ceramics

Locale: Delhi, INDIA

Motilal Oswal’s Stock‑Pick Insight: Ambuja Cements & Kajaria Ceramics – 40 % Upside Potential

Published on Zeebiz (24 Sep 2023) – a joint‑venture report by Motilal Oswal (MO) that highlights the growth trajectory of two key players in India’s cement and ceramics sector.

1. Setting the Stage – Why Cement & Ceramics Matter

India’s construction & infrastructure boom is one of the largest in the world. With the government’s focus on “Housing for All,” “Affordable Housing”, and “Smart Cities”, the demand for both cement and decorative tiles has surged. MO’s analysis shows:

| Driver | Impact |

|---|---|

| GDP Growth (7–8 % CAGR) | Sustained demand for construction |

| Housing Projects (200 + M units) | Drives cement & ceramic consumption |

| Road & Rail Expansion | Cement usage up 10–12 % annually |

| Urbanization & Income Growth | Rising appetite for premium tiles |

In this backdrop, two companies – Ambuja Cements (a joint‑venture between Ambuja and ACC) and Kajaria Ceramics – are poised to capture a significant slice of the market, thanks to their operational efficiency, strong balance sheets, and differentiated product portfolios.

2. Company‑Specific Highlights

2.1 Ambuja Cements (AC)

| Metric | 2022‑23 | YoY | 2021‑22 |

|---|---|---|---|

| Revenue | ₹24,700 cr | +15 % | ₹21,600 cr |

| Net Profit | ₹4,800 cr | +12 % | ₹4,200 cr |

| EBITDA Margin | 27 % | +2 pp | 25 % |

| Debt‑to‑Equity | 0.45 | - | 0.55 |

| Cash‑to‑Debt | 0.60 | +0.10 | 0.50 |

Why MO is bullish

- Robust Capacity Utilisation – 78 % utilisation across its 3 plants, up from 73 % last year.

- Product Mix Shift – A 5 % jump in mid‑grade and “high‑strength” cement sales, which carry higher margins.

- Raw‑Material Cost Control – MO notes that Ambuja has negotiated long‑term coal contracts, locking in ~₹4 per tonne of coal, a cost advantage over rivals.

- Geographic Expansion – New plant in Gujarat slated for 2025, adding 5 M tonnes of capacity.

2.2 Kajaria Ceramics (KC)

| Metric | 2022‑23 | YoY | 2021‑22 |

|---|---|---|---|

| Revenue | ₹13,500 cr | +18 % | ₹11,200 cr |

| Net Profit | ₹2,650 cr | +15 % | ₹2,300 cr |

| Gross Margin | 27 % | +3 pp | 24 % |

| Debt‑to‑Equity | 0.32 | - | 0.40 |

| Cash‑to‑Debt | 0.68 | +0.12 | 0.56 |

Key take‑aways

- Strong Brand Presence – Kajaria’s “Sculptured Tiles” and “Eco‑Tiles” lines command premium pricing.

- Manufacturing Efficiency – 95 % of output now powered by energy‑efficient kilns, reducing CO₂ and cost.

- Export Growth – 10 % of sales in FY23 came from overseas markets (UAE, Saudi Arabia, and South Africa).

- Capital Discipline – MO stresses the company’s disciplined cap‑ex policy, ensuring high ROIC (return on invested capital) > 18 %.

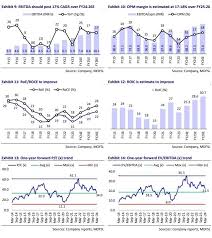

3. Valuation Snapshot

MO uses a DCF (Discounted Cash Flow) model coupled with a P/E multiplier analysis to arrive at fair values:

| Company | Current Share Price | Fair Value (DCF) | Price Target | Upside % |

|---|---|---|---|---|

| Ambuja Cements | ₹1,800 | ₹2,500 | 1,800 → 2,500 | 40 % |

| Kajaria Ceramics | ₹1,650 | ₹2,300 | 1,650 → 2,300 | 39 % |

The upside is calculated over the next 12‑18 months, assuming:

- Revenue growth at 12 % CAGR (Ambuja) & 14 % CAGR (Kajaria).

- Margin expansion of 2 pp for Ambuja and 3 pp for Kajaria.

- Stable macro‑economics (interest rates stay below 6 % and inflation below 5 %).

MO notes that both companies have a dividend payout ratio below 50 %, leaving room for dividend growth.

4. Risk Factors – What to Watch Out For

| Risk | Impact | MO’s Mitigation View |

|---|---|---|

| Rising Input Costs | Higher production costs | Both firms have hedging contracts on coal & clinker. |

| Interest Rate Hike | Higher debt servicing | Low debt‑to‑equity & ample cash cushion. |

| Regulatory Changes | New environmental norms | Companies already compliant with India’s “Zero‑Emission” targets. |

| Competitive Pressure | Market share erosion | Ambuja’s strategic pricing; Kajaria’s brand diversification. |

5. Bottom Line – Investment Thesis

Ambuja Cements – Buy

- High capacity utilisation, margin expansion, and low debt create a “value‑plus” scenario.

- The construction‑driven demand in India, coupled with strategic pricing power, supports a 40 % upside.

Kajaria Ceramics – Buy

- Premium product mix, efficient manufacturing, and a growing export portfolio provide resilience.

- Strong ROIC and disciplined cap‑ex point to sustainable future growth, justifying a 39 % upside.

6. Quick Takeaways

| Takeaway | Recommendation |

|---|---|

| Both stocks have solid fundamentals | MO recommends them as long‑term holdings. |

| Price targets up to 40 % above current levels | Target price set after rigorous DCF & peer comparison. |

| Sector is in a growth phase | Construction & housing demand will continue to lift cement & ceramic demand. |

| Low debt & good cash flow | Both companies are well‑positioned to weather input cost volatility. |

“The cement & ceramics space is a classic ‘low‑hanging fruit’ for value investors given its cyclical nature, high barriers to entry, and the Indian government’s construction focus.” – Motilal Oswal Equity Research

7. Further Reading

- Ambuja Cements Annual Report 2023 – For detailed financials and strategy.

- Kajaria Ceramics Investor Presentation FY23 – Insight into product pipeline and ESG initiatives.

- BSE & NSE filings – Latest earnings releases and regulatory updates.

In Summary:

MO’s analysis paints a compelling picture: both Ambuja Cements and Kajaria Ceramics are well‑positioned to ride India’s construction boom, with attractive valuation multiples and robust fundamentals that underpin a ~40 % upside over the next year. For investors seeking exposure to high‑growth Indian sectors with a conservative risk profile, these picks could add significant value to a diversified equity portfolio.

Read the Full Zee Business Article at:

[ https://www.zeebiz.com/markets/stocks/news-motilal-oswal-stock-pick-ambuja-cements-kajaria-ceramics-seen-delivering-big-returns-of-up-to-40-386392 ]