International Inflation-Linked Bonds Gain Traction

Locales: UNITED STATES, UNITED KINGDOM, GERMANY, FRANCE, AUSTRALIA, CANADA, JAPAN

**Seeking Alpha - February 13, 2026

By: Evelyn Reed, Senior Investment Correspondent**

The Global Inflation Puzzle and Portfolio Resilience

Inflationary pressures, stubbornly persistent across the globe, continue to dominate the investment landscape. While US Treasury Inflation-Protected Securities (TIPS) have long been a go-to for investors seeking to shield their portfolios from eroding purchasing power, a potentially more rewarding, though historically overlooked, asset class is gaining traction: international inflation-linked securities. This analysis delves into the resurgence of these bonds, outlining the factors driving their renewed appeal and the considerations for incorporating them into a diversified portfolio.

A Past Marked by Headwinds, A Future Fueled by Change

For years, international inflation-linked bonds have trailed their US counterparts in performance. This underperformance wasn't due to inherent flaws in the asset class itself, but rather a confluence of external factors. Currency fluctuations posed a significant hurdle, as the strengthening US dollar often negated gains made on the bond itself. Higher issuance costs, stemming from differing regulatory environments and market complexities abroad, also chipped away at returns. Furthermore, lower liquidity in many international markets resulted in wider bid-ask spreads, increasing transaction costs for investors.

However, the landscape is shifting. The macroeconomic environment is creating a more favorable backdrop for international inflation-linked bonds, and several compelling forces are aligning to drive their potential re-emergence.

Inflationary Dynamics Beyond US Borders

While the US has experienced significant inflation, many other major economies are facing comparable, or even more acute, inflationary pressures. The drivers vary - supply chain disruptions, geopolitical instability (as demonstrated by ongoing conflicts and trade tensions), and post-pandemic demand surges all contribute. Crucially, inflation expectations are rising in key international markets. This rise in expectations is the very mechanism that benefits inflation-linked bonds, as the principal value adjusts upwards to reflect anticipated price increases. Bonds issued by countries like the UK, Canada, Australia, and select emerging markets are now benefiting from these expectations.

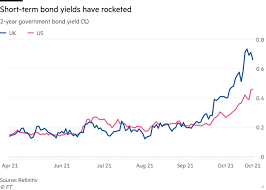

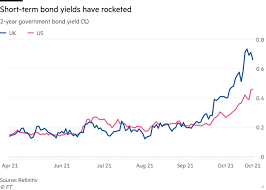

Central Bank Responses and Currency Considerations

Global central banks are increasingly adopting hawkish stances to combat inflation, mirroring the Federal Reserve's actions. While tightening monetary policy can initially dampen bond returns, it also signals a commitment to price stability, ultimately supporting the real (inflation-adjusted) value of inflation-linked securities. Moreover, several currencies are currently undervalued relative to the US dollar. A potential reversal of this trend, driven by improved economic conditions or policy shifts, could provide a significant boost to returns for international bondholders.

Navigating the Investment Options

Accessing international inflation-linked bonds is becoming increasingly streamlined. Investors have several options:

- ETFs: A growing number of Exchange Traded Funds (ETFs) offer diversified exposure to the asset class. These ETFs typically invest in a basket of bonds from various countries, providing instant diversification and liquidity. Due diligence is essential, focusing on expense ratios and tracking error.

- Mutual Funds: Actively managed mutual funds specializing in international inflation-linked bonds provide a more hands-on approach. Skilled fund managers can potentially identify undervalued bonds and navigate currency risks effectively, but often come with higher fees.

- Direct Investment: For sophisticated investors, directly purchasing individual bonds is an option. This requires significant research and expertise in foreign bond markets, as well as access to brokerage platforms that facilitate international transactions.

Strategic Portfolio Allocation

For long-term investors, a strategic allocation of 5-10% to international inflation-linked securities can serve as a valuable complement to core US inflation-linked holdings. This allocation isn't about replacing TIPS entirely, but rather about enhancing diversification and potentially capturing higher returns. The correlation between US TIPS and international inflation-linked bonds is not perfect, meaning they can perform differently in varying economic scenarios. A blended approach can reduce overall portfolio risk and improve inflation protection.

The Road Ahead: Risks and Rewards

While the outlook for international inflation-linked bonds is encouraging, investors should be aware of the inherent risks. Currency volatility remains a concern, and geopolitical events can quickly impact market sentiment. Due diligence, diversification, and a long-term investment horizon are crucial. However, with current valuations appearing attractive and global inflationary pressures persisting, international inflation-linked bonds are increasingly deserving of a place in well-diversified portfolios seeking resilience in an uncertain economic climate.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4868132-a-re-emerging-portfolio-building-block-the-case-for-international-inflation-linked-securities ]