Ready Capital Plummets as CMBS Exposure Fuels Concerns

Locales: Illinois, Texas, California, UNITED STATES

Wednesday, February 11th, 2026 - Ready Capital (RC) is facing increasingly turbulent times, with its stock price plummeting and the sustainability of its substantial dividend coming under intense scrutiny. Year-to-date, the stock has shed approximately 42% of its value, and it's down nearly 60% from its 52-week high. While the current dividend yield sits at a tempting 15.1%, a growing chorus of investors and analysts are questioning whether this payout can be maintained in the face of mounting pressures within the commercial real estate (CRE) sector.

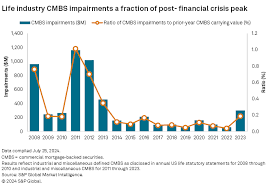

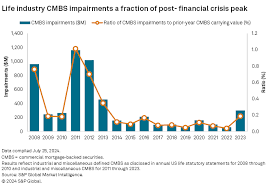

CMBS Exposure: The Core of the Concern

The primary driver of this downward spiral appears to be Ready Capital's significant exposure to commercial mortgage-backed securities (CMBS). As interest rates have continued to climb over the past year, the CMBS market has become increasingly vulnerable. Unlike traditional mortgages, CMBS are bundles of commercial and multi-family loans packaged and sold to investors. These securities are incredibly sensitive to fluctuations in interest rates, as rising rates directly impact the borrower's ability to service their debt, leading to potential defaults and ultimately, declines in the value of the CMBS.

Ready Capital's core business model is predicated on the origination, management, and servicing of these CMBS. The company profits from the spread between the interest earned on the loans underlying the CMBS and the cost of funding those loans. However, with interest rates aggressively hiked by the Federal Reserve in an attempt to combat persistent inflation, borrowing costs have surged, squeezing those spreads and diminishing profitability. The fear isn't just that existing CMBS will underperform, but that new origination volume will dramatically decrease as potential borrowers find financing unattainable.

Analyst Downgrades Signal Growing Pessimism

The growing concerns have prompted several analyst firms to reassess their outlook on Ready Capital. Last week, Raymond James lowered its price target to $14, a significant reduction from the prior $18. This downgrade, and similar moves by other firms, highlights a broad-based shift in sentiment towards the company. Analysts cite the rising interest rate environment, weakening CRE fundamentals, and the potential for increased defaults on underlying CMBS loans as key factors contributing to their bearish view.

Broader CRE Sector Woes Amplify Risk

Ready Capital's difficulties are not isolated. The entire commercial real estate sector is grappling with significant headwinds. The rise of remote and hybrid work models has led to decreased occupancy rates in office buildings, particularly in major metropolitan areas. Retail faces ongoing challenges from e-commerce, and even the traditionally resilient multifamily sector is showing signs of strain as new supply comes online and affordability issues limit demand.

The combination of higher interest rates and weakening fundamentals creates a dangerous feedback loop. As property values decline, lenders become more cautious, tightening credit standards and further exacerbating the situation. This environment significantly increases the risk of loan defaults within the CMBS that Ready Capital holds.

Dividend Sustainability: A Critical Question

Ready Capital's high dividend yield is undeniably attractive to income-seeking investors. However, the question remains: can the company afford to maintain it? The dividend payout ratio, which measures the percentage of earnings paid out as dividends, is a crucial metric to watch. If the company's earnings decline, the payout ratio will inevitably rise, making the dividend increasingly unsustainable.

While management has repeatedly expressed confidence in its ability to navigate the challenging environment and maintain the dividend, investors should remain cautious. The company's reliance on CMBS origination and a stable interest rate environment makes it particularly vulnerable to further economic shocks. Investors should closely monitor the company's earnings reports, cash flow statements, and any guidance provided by management regarding the dividend outlook.

Investment Considerations

Currently, justifying an investment in Ready Capital without a substantial discount is difficult. The risks are significant, and the potential for further downside remains considerable. While the high dividend yield may seem enticing, it's crucial to recognize that a dividend cut is a very real possibility. Potential investors should conduct thorough due diligence, assess their risk tolerance, and carefully consider the long-term prospects of the commercial real estate sector before making any investment decisions. A diversified portfolio approach is always recommended to mitigate risk.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4868785-news-impacting-ready-capital-continues-to-get-worse ]