AI Valuations Stretched: A Growing Concern

Locales: Massachusetts, Virginia, New York, UNITED STATES

The AI Valuation Landscape: A Growing Concern

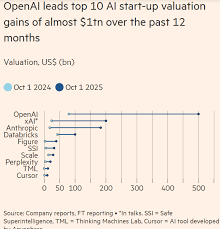

There's no denying the disruptive potential of AI. From healthcare to finance, AI is reshaping industries and offering the possibility of substantial returns. However, the widespread excitement has also pushed valuations to levels that many analysts consider stretched. The rapid rise in stock prices often outpaces underlying fundamentals, creating a risk of significant corrections.

Prologis: The Unsung Beneficiary of the AI Revolution

Prologis is a Real Estate Investment Trust (REIT) that operates on a massive scale, owning, developing, and managing a vast portfolio of warehouses, distribution centers, and last-mile facilities across the globe. While not a direct player in the AI space, Prologis is fundamentally interwoven with the technologies driving its growth. The remarkable expansion of e-commerce, the very backbone of many AI applications, is intrinsically linked to the need for efficient and sophisticated logistics infrastructure - and that's where Prologis thrives.

The rise of e-commerce wouldn't be feasible without automation. Today, warehouses are increasingly populated with robots performing tasks such as picking, packing, and sorting. Artificial intelligence algorithms are optimizing delivery routes, predicting demand, and streamlining supply chains. Prologis's properties are the physical foundation upon which these AI-powered operations are built.

Why Prologis Offers a Compelling Alternative

Prologis currently trades at a price-to-funds from operations (FFO) ratio of approximately 21. FFO is a key metric for evaluating REITs, representing the company's cash flow available for distribution. This valuation, while still respectable, appears significantly more grounded when compared to the soaring multiples seen in many AI-focused companies. This relative stability, coupled with Prologis's strong underlying business, makes it an attractive option for risk-averse investors wanting AI exposure.

Here's a breakdown of the key reasons why Prologis is garnering attention:

- Robust Fundamentals: Prologis boasts consistently high occupancy rates, a testament to the enduring demand for its facilities. Moreover, the REIT has demonstrated a proven track record of consistent rent growth, signifying the strength of its business model.

- E-commerce Momentum: The e-commerce sector's growth trajectory is projected to continue, ensuring a sustained demand for modern logistics infrastructure. As online shopping evolves, so too will the need for sophisticated distribution networks.

- Supply Chain Optimization - A Growing Trend: Businesses are actively investing in supply chain automation to enhance efficiency and reduce costs. These investments frequently involve upgrades and expansions within Prologis's facilities, further driving demand.

- Relative Value: Compared to the stratospheric valuations of some AI stocks, Prologis offers a comparatively reasonable entry point, potentially mitigating risk while still capitalizing on the broader technological advancements.

Looking Ahead: Prologis and the Future of Logistics

The symbiotic relationship between AI and logistics isn't likely to diminish anytime soon. As AI technologies become even more integrated into supply chains - think predictive maintenance of warehouse equipment, automated inventory management, and self-driving delivery vehicles - the demand for strategically located, technologically adaptable logistics facilities, like those owned and operated by Prologis, will likely only intensify. While investors grapple with the uncertainties of the AI market, Prologis presents a compelling opportunity to participate in the technological revolution without exposing themselves to the full brunt of market volatility. It's a strategic, indirect play on the future of AI.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/27/worried-about-ai-stock-valuations-this-reit-trades/ ]