GameStop: A Meme Stock Revival?

Investopedia

InvestopediaLocales: California, New York, UNITED STATES

A Return to the Meme Stock Arena?

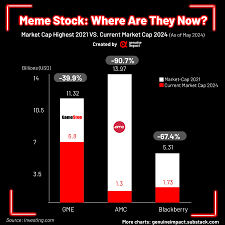

GameStop's story is inextricably linked to the "meme stock" phenomenon that exploded in early 2021. A coordinated effort by retail investors, largely organized through platforms like Reddit's r/wallstreetbets, led to a dramatic and unprecedented surge in the stock's price. This surge inflicted substantial losses on hedge funds that had heavily shorted the stock, illustrating the power of collective retail investing and the vulnerabilities within traditional financial markets. Since that volatile period, GameStop's stock has experienced considerable ups and downs, oscillating wildly between periods of exuberance and periods of sharp decline. The company's financial performance hasn't always matched the stock's market behavior, highlighting the disconnect between fundamental value and speculative trading.

Burry's Contrarian Play: Value Beyond the Hype

What makes Burry's investment particularly intriguing is his established investment philosophy. Burry is renowned as a rigorous value investor, meticulously scrutinizing a company's fundamentals - revenue, debt, management, and competitive landscape - before committing capital. Meme stocks, by their very nature, thrive on sentiment, social media trends, and short squeezes, often exhibiting a disconnect from underlying business performance. This makes them typically unsuitable for a value-based approach.

Therefore, Burry's foray into GameStop suggests a potential re-evaluation of the company. It's possible he sees something beyond the meme stock label - a glimmer of long-term potential that others have overlooked amidst the noise and volatility. Perhaps Burry believes the current price undervalues GameStop's assets, future earnings potential, or its ability to adapt to the evolving landscape of the gaming and retail industries. Analysts are scrambling to decipher his intentions, with some suggesting he might be betting on a turnaround strategy within GameStop, or perhaps that the stock is simply significantly undervalued by the broader market.

Market Reactions and Future Outlook

The immediate market reaction to the news has been predictably bullish. GameStop shares jumped in premarket trading, reflecting the widespread excitement and speculation surrounding Burry's involvement. The news has reinvigorated the narrative surrounding GameStop, attracting renewed interest from retail investors and prompting further analysis from institutional investors.

However, the long-term implications remain to be seen. GameStop's underlying business faces ongoing challenges, including the shift towards digital game distribution and competition from online retailers. The company's management has been working to adapt, exploring new revenue streams and streamlining operations, but success is far from guaranteed. Burry's investment could provide a much-needed boost in confidence and capital, but it also places increased scrutiny on GameStop's future performance.

It's important to note that Burry's track record is exceptional, but even the most astute investors can be wrong. His investment is likely to be closely watched by the market, and its success will depend heavily on GameStop's ability to execute its strategic plans and demonstrate tangible improvements in its business. Ultimately, whether Burry's bet on GameStop proves to be a shrewd investment or a costly miscalculation remains to be seen, but it has undoubtedly reignited the conversation around this controversial and captivating stock.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/big-short-investor-michael-burry-says-he-s-betting-on-this-og-meme-stock-gme-gamestop-11892959 ]