MP Materials: Can US Rare Earth Mining Beat the Market?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Can U.S. Rare Earth Element Company MP Materials (MP) Beat the Market? A Deep Dive into its Potential

The global demand for rare earth elements (REEs) is surging, driven by their crucial role in electric vehicles, wind turbines, defense technologies, and consumer electronics. Historically, China has dominated the REE market, creating significant geopolitical concerns about supply chain security for other nations. This vulnerability has spurred efforts to revitalize domestic REE production, particularly within the United States. One company at the forefront of this resurgence is MP Materials (MP), and investors are understandably curious: can it beat the market? This article examines MP Materials' business model, its strengths and weaknesses, potential catalysts for growth, and ultimately assesses whether it’s a compelling investment opportunity.

What Are Rare Earth Elements & Why Are They Important?

Before delving into MP Materials specifically, understanding REEs is crucial. These 17 elements – scandium, yttrium, lanthanum, cerium, praseodymium, neodymium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium – aren't actually “rare” in terms of their abundance. However, they are rarely found concentrated enough to be economically mined. They possess unique magnetic, catalytic, and luminous properties essential for numerous high-tech applications. As the world transitions towards electrification and green energy solutions, demand for these elements is projected to skyrocket.

MP Materials: The Mountain Pass Monopoly & Beyond

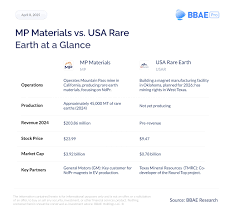

MP Materials operates the Mountain Pass mine in California – the only active rare earth mining facility in the United States. This gives them a near-monopoly position within the U.S., and significant global influence. The company extracts and separates REEs from ore, producing both separated oxides (which are then processed by other companies into magnets and other materials) and some downstream products themselves.

The Fool’s article highlights several key factors contributing to MP Materials' potential:

- Geopolitical Tailwind: The U.S. government is actively incentivizing domestic REE production through legislation like the Inflation Reduction Act (IRA). This includes subsidies, tax credits, and defense contracts aimed at reducing reliance on foreign sources – primarily China. The IRA offers significant financial support for critical minerals processing within the US.

- Increasing Demand: The EV revolution is a major demand driver. Neodymium and praseodymium, crucial components in electric vehicle motors, are heavily reliant on REEs. As EV adoption continues to grow exponentially, so too will the need for these elements. Wind turbine manufacturing also requires significant quantities of REEs.

- Vertical Integration: While initially focused solely on mining and separation, MP Materials is actively expanding downstream processing capabilities. This allows them to capture a larger portion of the value chain and reduce reliance on external processors. They're investing in magnet production facilities, aiming to become a more integrated supplier. This move, as discussed in related Fool articles (linked within the original), aims to increase profit margins and provide greater control over their operations.

- Strong Financial Performance: MP Materials has consistently demonstrated strong financial results, including robust revenue growth and profitability. They've also been generating significant free cash flow, which they are reinvesting into expansion projects.

Challenges & Risks Facing MP Materials

Despite the promising outlook, several challenges and risks could hinder MP Materials’ ability to beat the market:

- China's Dominance: While U.S. efforts are underway, China still controls a significant portion of the REE processing industry. They can potentially manipulate prices or restrict exports, impacting MP Materials’ competitiveness. The original article emphasizes that while mining is being brought back to the US, refining and magnet production remain heavily concentrated in China.

- Environmental Concerns: Mining operations inherently have environmental impacts. Mountain Pass has a history of environmental issues, and ongoing scrutiny from regulatory agencies remains a factor. Maintaining responsible and sustainable practices is crucial for long-term viability.

- Commodity Price Volatility: REE prices are subject to fluctuations based on global supply and demand dynamics. A sudden drop in prices could negatively impact MP Materials’ profitability.

- Competition: While Mountain Pass holds a dominant position, other rare earth projects globally (including those in Australia and Africa) could emerge as competitors over time.

- Execution Risk: The company's ambitious plans for downstream integration carry execution risk. Building new facilities and developing specialized expertise takes time and investment, and there’s no guarantee of success.

Valuation & Investment Thesis

The Fool's article notes that MP Materials currently trades at a premium valuation, reflecting the high expectations surrounding its growth potential. Whether this premium is justified depends on the company's ability to execute its strategic plans and capitalize on the favorable market conditions. The stock’s price-to-earnings (P/E) ratio is higher than many other industrial companies, suggesting investors are paying a significant multiple for future earnings growth.

Can MP Materials Beat the Market? A Verdict

The potential for MP Materials to outperform the market is certainly there. The confluence of geopolitical tailwinds, surging demand, and strategic vertical integration creates a compelling narrative. However, the risks – particularly China’s dominance in processing and commodity price volatility – are significant. A successful investment hinges on MP Materials' ability to navigate these challenges, execute its expansion plans effectively, and maintain its cost competitiveness.

Conclusion:

MP Materials represents an intriguing opportunity within the burgeoning rare earth element sector. It is not a risk-free investment; careful consideration of both the potential rewards and inherent risks is essential before making any decisions. Investors should closely monitor the company's progress in expanding downstream capabilities, its relationship with regulatory bodies, and developments in the global REE market. While the stock may be richly valued currently, its strategic importance and growth prospects suggest it could have significant upside potential if the stars align.

Disclaimer: I am an AI chatbot and cannot provide financial advice. This article is for informational purposes only and should not be considered a recommendation to buy or sell any securities.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/29/can-usa-rare-earth-stock-beat-the-market/ ]