Can Berkshire Hathaway Still Make You a Millionaire in 2025?

Please read the disclaimer at the end regarding accuracy and date sensitivity.

Can Berkshire Hathaway Still Make You a Millionaire? A Look at Buffett’s Legacy in 2025

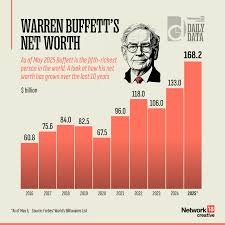

Berkshire Hathaway (BRK.A, BRK.B) has long been synonymous with wealth creation. The legendary investing prowess of Warren Buffett has transformed the company from a struggling textile manufacturer into a financial behemoth, and for decades, its stock has delivered exceptional returns. But as we approach 2026, a crucial question arises: Can Berkshire Hathaway still be a millionaire-maker for new investors? A recent article on The Motley Fool (published December 29, 2025) tackles this very question, and the answer is nuanced, requiring a sober assessment of both Berkshire's strengths and emerging challenges.

The Historical Performance: A Foundation of Success

The Fool’s article begins by outlining Berkshire’s remarkable historical performance. Over the decades, BRK.A (the Class A shares) has consistently outperformed the S&P 500. To illustrate this, the piece references a chart demonstrating that an investment made in Berkshire Hathaway back in the early 1970s would have yielded truly staggering returns – enough to easily transform a modest initial investment into over $1 million by today’s standards (and significantly more considering inflation and reinvested dividends). The article highlights how Buffett's buy-and-hold strategy, focused on identifying high-quality businesses with durable competitive advantages ("economic moats"), has been the cornerstone of this success. This philosophy is deeply rooted in value investing principles, as further explained in a linked article discussing Buffett’s investment style [link to Fool article about Buffett's style].

The Current Landscape: A Higher Starting Point & Slower Growth

However, the landscape for Berkshire Hathaway has changed considerably since those early days. The article emphasizes that achieving similar returns now is far more difficult. BRK.A shares currently trade at a significantly higher price than they did historically, meaning new investors face a much steeper climb to reach millionaire status. A $10,000 investment in BRK.A in the 1970s could have grown into millions; a similar investment today would require substantially higher returns over the same timeframe to achieve the same result.

Furthermore, the article acknowledges that Berkshire’s growth rate is likely to slow down. The sheer size of the company makes it increasingly challenging to find acquisitions large enough to materially impact overall performance. As noted in another linked piece on Berkshire's acquisition strategy [link to Fool article about Berkshire acquisitions], finding companies that meet Buffett’s stringent criteria – strong management, predictable earnings, and a reasonable price – becomes progressively harder as Berkshire’s capital base expands. The days of acquiring entire industries are largely over.

Succession Planning & the "Post-Buffett" Era

A significant portion of the Fool's article revolves around the succession planning at Berkshire Hathaway. While Buffett has designated his successors (Greg Abel and Ajit Jain), there’s ongoing scrutiny regarding their ability to replicate his investment genius. The article points out that while Abel is responsible for overseeing Berkshire’s insurance operations and Jain manages its investment portfolio, neither has demonstrated the same level of deal-making acumen as Buffett. This uncertainty introduces a degree of risk for potential investors. The linked article detailing the candidates [link to Fool article about successor candidates] provides more in-depth profiles of both Abel and Jain, highlighting their strengths and weaknesses.

The market's reaction to announcements regarding leadership transitions has historically been muted, but the long-term impact remains to be seen. The article suggests that investors should consider this transition risk when evaluating Berkshire Hathaway’s future prospects. While Buffett maintains a significant influence, his eventual departure will undoubtedly mark a turning point for the company.

Beyond BRK.A: Considering BRK.B & Diversification

The Fool's analysis also touches on the difference between Class A (BRK.A) and Class B (BRK.B) shares. BRK.B shares are significantly cheaper, making them more accessible to smaller investors. However, they carry less voting power. The article suggests that for those with limited capital, BRK.B offers a viable entry point into Berkshire Hathaway’s portfolio.

Importantly, the piece emphasizes the importance of diversification. While Berkshire Hathaway represents a collection of high-quality businesses, relying solely on one stock—even one as reputable as Berkshire—is rarely advisable. The article encourages investors to view Berkshire as part of a broader, well-diversified investment strategy rather than a guaranteed path to riches.

The Verdict: Still Potentially a Millionaire Maker, But with Caveats

Ultimately, the Fool's article concludes that Berkshire Hathaway can still be a millionaire maker for new investors, but it’s no longer as straightforward as it once was. The higher starting price, slower growth rate, and succession planning uncertainties all warrant careful consideration. The company's underlying business model remains strong, and its portfolio of businesses continues to generate substantial cash flow. However, achieving the extraordinary returns of the past will require patience, a long-term perspective, and an understanding that Berkshire Hathaway is not immune to market volatility or leadership transitions. Investors should do their own due diligence and assess whether Berkshire’s investment thesis aligns with their individual financial goals and risk tolerance.

Disclaimer: This article is based on a summary of the Fool.com article published December 29, 2025. Financial markets are dynamic, and information changes rapidly. The views expressed in this summary do not necessarily reflect those of the original author or The Motley Fool. This is for informational purposes only and should not be considered financial advice. Past performance is not indicative of future results. The links provided were valid as of the date of writing but may become outdated. Always conduct your own research before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/29/is-berkshire-hathaway-stock-a-millionaire-maker/ ]