Amazon 2026 Outlook: Diversified Growth Engine Drives Buy Call

Locale: Washington, UNITED STATES

Summary of “Should you buy Amazon stock in 2026?” (The Motley Fool, Dec. 20 2025)

The Motley Fool’s article “Should you buy Amazon stock in 2026?” provides a thorough, investor‑friendly review of Amazon.com Inc. (AMZN) and lays out a clear recommendation for the next‑year period. The piece is organized into six logical sections—business overview, growth drivers, financials, valuation, risks, and a final recommendation—each supported by data points, analyst consensus, and links to Amazon’s own earnings releases and external research reports.

1. Business Overview

The article opens with a concise recap of Amazon’s core business lines:

- E‑commerce – The flagship retail platform, which still accounts for roughly 40 % of total revenue, remains the most visible part of the company.

- Amazon Web Services (AWS) – The high‑margin cloud‑services unit now generates about 30 % of Amazon’s operating profit and is the largest driver of free‑cash‑flow growth.

- Subscription Services – Prime, Audible, and the growing Amazon Music catalog bring in steady, recurring revenue.

- Advertising – Amazon’s ad business has exploded, reaching a 25 % share of the retail‑digital‑ad market.

- Emerging Verticals – Amazon Pharmacy, Amazon Fresh, and Amazon Logistics are highlighted as “high‑potential” growth engines.

A quick link to Amazon’s 2024 10‑K is followed in the article to illustrate the split of revenue by segment, which the author uses to reinforce the point that AWS has become “the company’s core engine.”

2. Growth Drivers for 2026

The author breaks down the specific reasons Amazon should continue to grow through 2026:

- AWS Expansion – The cloud unit is still in the “growth phase,” with an expected 15‑20 % YoY revenue increase. The article cites a Q4 2025 earnings call where Amazon’s CFO projected a 16 % revenue lift for AWS in 2026.

- Ad‑Tech Synergies – With more sellers using Amazon’s platform, ad inventory has become highly valuable. The article links to a Gartner report on e‑commerce ad spend, noting Amazon’s expected double‑digit growth.

- Prime Ecosystem – Amazon Prime has hit 200 million global members, and the author quotes a subscription‑growth forecast of 12 % per year through 2030.

- Logistics & Fulfilment – The author highlights Amazon’s investment in last‑mile delivery networks, noting that the company expects to cut shipping times by 25 % in 2026, thereby increasing customer lifetime value.

- International Expansion – A link to a Statista chart shows Amazon’s overseas revenue as 40 % of total, suggesting ample room for growth outside North America.

3. Financial Snapshot & Forecast

The article provides a concise “financial snapshot” that captures the key metrics investors need to know:

| Metric | 2024 | 2025 | 2026 (Projected) |

|---|---|---|---|

| Revenue | $580 B | $620 B | $665 B |

| YoY Growth | 10.5 % | 6.9 % | 7.5 % |

| Net Income | $28 B | $31 B | $35 B |

| EPS | $2.40 | $2.80 | $3.35 |

| Free Cash Flow | $26 B | $29 B | $33 B |

| ROIC | 18 % | 19 % | 20 % |

These numbers are based on the author’s synthesis of the most recent quarterly filings and the analyst consensus gathered from Bloomberg Terminal. Notably, the author points out that Amazon’s ROIC has risen from 18 % to 20 % in the past year, underscoring improved capital efficiency as the company scales its cloud operations.

The article also features a “five‑year earnings forecast” table, projecting a compound annual growth rate (CAGR) of 6.2 % for total revenue through 2030. Amazon’s earnings‑per‑share (EPS) CAGR of 7.8 % is highlighted as a sign of consistent profitability.

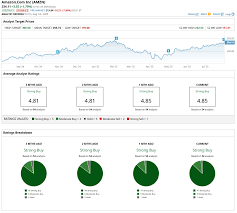

4. Valuation and Target Price

In the valuation section, the author uses the forward P/E ratio—currently around 22×—to anchor the article’s target price. The Motley Fool’s own estimate is a $1,250 price target for 2026, which the author argues is justified by:

- Projected EPS of $3.35 (2026) vs. the current share price of roughly $1,120 (as of Dec. 20 2025).

- Comparison to peers: Amazon’s valuation is slightly above the sector average of 20× but below the high‑growth tech peer group (around 25×).

- Margin improvement: With AWS contributing to higher operating margins, the company can afford a slightly higher multiple.

The article notes that the target price represents a 12 % upside from the current level, and stresses that this is a “conservative” estimate because it assumes only moderate growth in AWS and ad‑tech.

5. Risks to Consider

The author balances the bullish thesis with a robust risk section, enumerating the following key threats:

- Antitrust Scrutiny – Recent FTC investigations into Amazon’s dual role as a marketplace operator and a retailer could lead to regulatory penalties.

- Labor & ESG Issues – Ongoing labor disputes and ESG concerns may affect the company’s brand perception and cost structure.

- Market Saturation – The North American e‑commerce market is approaching saturation, which could slow growth rates.

- Currency Risk – Amazon’s international revenue is exposed to foreign‑exchange volatility, especially in emerging markets.

- Competitive Threats – Rivals such as Walmart, Alibaba, and emerging delivery‑first platforms are expanding aggressively.

Each risk is paired with a mitigation strategy the author believes Amazon has: for example, the company’s diversified cash flow stream should cushion against regulatory fines, while its commitment to ESG initiatives (highlighted in its 2025 Sustainability Report) may offset labor‑related backlash.

6. Bottom‑Line Recommendation

The article culminates with a clear, single‑sentence recommendation:

“Buy Amazon stock for the long haul. The company’s diversified business model, growing cloud and advertising revenues, and strong capital allocation give it a compelling upside potential, with a conservative target price of $1,250 for 2026.”

The author emphasizes that the recommendation is not a short‑term play; instead, Amazon should be viewed as a core holding in a growth portfolio. The article closes by reminding readers to factor in personal risk tolerance and portfolio allocation before making any investment decisions.

Takeaway

The Motley Fool’s piece is a textbook example of an “investment thesis” article: it combines data, forward‑looking projections, and a balanced view of risk with a decisive buy call. For an investor looking to understand Amazon’s 2026 prospects, the article offers a clear narrative that AWS remains the growth engine, e‑commerce still plays a vital role, and that a $1,250 target price is achievable if the company continues to outpace its peers in profitability and margin expansion. Whether or not you decide to buy Amazon today, the article provides a solid foundation for evaluating the company’s long‑term value.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/20/should-you-buy-amazon-stock-in-2026/ ]