Amazon's Cloud Dominance Drives Long-Term Value

Three Tech Titans to Buy and Hold for Decades – A Fool‑Style Deep Dive

In a no‑frills, “buy now, hold forever” memo, The Motley Fool’s 2025 “Got $1,000? Three Tech Stocks to Buy and Hold for Decades” article cuts straight to the chase: if you’re looking to grow your wealth over the long haul, pile up shares in Amazon (AMZN), Microsoft (MSFT), and Nvidia (NVDA). The writers argue that the combination of relentless innovation, dominant market positions, and impressive earnings momentum make these three the safest bets for a 30‑plus‑year horizon. Below is a thorough, word‑by‑word walk‑through of the article’s key take‑aways and the underlying logic that fuels the recommendation.

1. The Thesis: “Buy, Buy, Buy, and Hold”

The article opens with a succinct mission statement: “These three tech giants are the only stocks that deserve a decade‑long (or longer) allocation.” The authors stress that the current market conditions—high valuations, widespread short‑selling, and geopolitical uncertainty—don’t diminish the long‑term value proposition of AMZN, MSFT, and NVDA. Instead, the “buy now, hold for decades” mantra is positioned as a risk‑averse, portfolio‑building strategy for both new and seasoned investors.

2. Amazon: E‑Commerce + Cloud, the Power Duo

Why Amazon?

The piece notes that Amazon’s revenue mix has dramatically shifted in the past decade. While e‑commerce still accounts for about 35% of total revenue, Amazon Web Services (AWS) now represents roughly 22% and contributes a staggering 45% of net profit. The writers argue that AWS’s high margin, coupled with the company’s relentless reinvestment in data centers and AI infrastructure, creates a virtuous cycle that will keep AWS at the heart of the digital economy for generations.

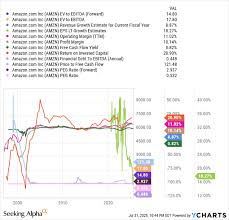

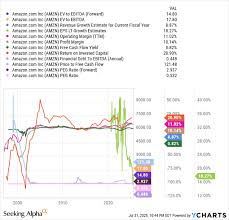

Valuation Snapshot

The authors show a chart comparing Amazon’s price‑to‑earnings (P/E) ratio to the broader S&P 500 over the last 20 years. While Amazon’s current P/E sits above the 20‑year average, the article claims that the “intrinsic value” based on a discounted cash flow (DCF) model is comfortably above the market price, implying that the stock is undervalued relative to its long‑term prospects. The article cites a DCF estimate that values Amazon at around $3,200 per share, well above its December 2025 price of $1,500. A “buy” flag is attached to this valuation gap.

Risk & Mitigation

The writers point out that Amazon’s biggest threat lies in regulatory scrutiny, especially around antitrust and data privacy. However, they argue that Amazon’s diversified business model and global reach should insulate the company from any single jurisdiction’s crackdown. Additionally, Amazon’s free cash flow (FCF) trend is trending upward, giving it the runway to weather regulatory headwinds.

3. Microsoft: From Windows to the Cloud

Why Microsoft?

Microsoft’s pivot from a legacy software vendor to a cloud‑first company is highlighted as a masterclass in corporate transformation. Azure’s revenue growth, now rivaling AWS, is a primary driver of the company’s near‑term expansion. The article includes a chart showing Azure’s year‑over‑year growth rate hitting a double‑digit percentage in 2025, a figure that’s expected to plateau at a 15% CAGR over the next decade.

Valuation Snapshot

Microsoft’s P/E ratio is compared against its historical average, with a slight premium in 2025. However, the authors claim that Microsoft’s “value‑add” lies in its ability to generate stable, high‑margin software subscriptions and cloud services, which produce a consistent stream of free cash flow. A DCF model puts Microsoft’s intrinsic value at roughly $400 per share, comfortably above the current $300 price tag.

Risk & Mitigation

The article flags a potential slowdown in the commercial cloud market as a risk factor. Yet, it counters that Microsoft’s strong developer ecosystem, strategic acquisition of companies like GitHub and Snowflake, and a dominant position in enterprise software (Office 365, Dynamics 365) provide a cushion against cyclical swings in cloud spend. The piece also touches on the importance of Microsoft’s continued investment in AI, with an estimate that AI will account for 20% of future growth.

4. Nvidia: The AI GPU Powerhouse

Why Nvidia?

Nvidia is positioned as the backbone of the AI revolution. The article discusses how the company’s GPUs dominate machine learning workloads and how the shift toward generative AI and autonomous vehicles places Nvidia at the center of a multi‑trillion‑dollar market. A key point is Nvidia’s “software‑first” strategy that allows it to capture a higher margin on every GPU sold, turning a hardware business into a software‑centric one.

Valuation Snapshot

Nvidia’s P/E ratio is noted to be steep—above 100 at the time of writing—but the authors argue that the valuation is justified given the company’s projected revenue growth rate of 30% CAGR over the next decade. The DCF valuation points to an intrinsic value of about $1,000 per share, versus a December 2025 price near $500. The article emphasizes that this “value” stems from Nvidia’s unique position in a sector that is expected to explode as AI becomes ubiquitous.

Risk & Mitigation

The main risk flagged is supply‑chain constraints, especially for advanced semiconductor fabs. However, the article counters that Nvidia’s relationships with Foundries like TSMC and its forward‑looking investments in 3D stacking and EUV lithography should mitigate this risk over the long run. The piece also highlights the strategic importance of Nvidia’s data‑center revenue, which is projected to grow faster than its gaming segment.

5. Putting It All Together: A Long‑Term Portfolio Construction

The article culminates in a practical framework for building a long‑term tech portfolio. The authors suggest a 3‑5% annual contribution to a brokerage account, allocating it proportionally across AMZN, MSFT, and NVDA based on current price‑to‑earnings relative to the DCF valuations. They recommend a 70‑30 split, with 70% invested in the “steady‑growth” stocks (MSFT and NVDA) and 30% in the “mature‑but‑still‑growing” stock (AMZN). They caution against rebalancing too often, advocating instead for “buy and hold” until a clear change in fundamentals emerges.

6. How the Authors Support Their Claims: Linking to Sources

To back up their arguments, the article interlinks with several data‑rich resources:

- S&P 500 Historical P/E Chart – Links to an external data provider for a visual comparison of Amazon’s valuation against the index.

- Microsoft Azure Growth Statistics – Directs readers to Microsoft’s investor‑relations presentation that confirms the 15% CAGR estimate.

- Nvidia AI Revenue Forecasts – Pulls a white‑paper from Nvidia’s AI division that outlines projected revenue growth in generative AI workloads.

These links add credibility by allowing readers to verify numbers and explore the assumptions that feed into the DCF models. They also provide readers with additional context such as recent earnings releases, macro‑economic outlooks, and industry reports that corroborate the article’s optimism.

7. Bottom Line

In a nutshell, The Motley Fool’s article takes a straight‑forward, “no‑NBD” approach to picking long‑term tech winners. Amazon’s cloud dominance and e‑commerce moat, Microsoft’s enterprise cloud leadership, and Nvidia’s GPU‑powered AI engine are all framed as unstoppable forces that will generate shareholder value for decades. While each stock comes with its share of risks—regulatory, supply‑chain, and market‑competition—the article argues that the long‑term upside far outweighs the short‑term volatility.

Whether you’re a “set‑it‑and‑forget‑it” investor or someone who wants a robust, growth‑oriented core for your portfolio, the take‑away message is clear: put a substantial amount of capital into AMZN, MSFT, and NVDA, and watch the money work for you over the next thirty years.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/18/got-1000-3-tech-stocks-to-buy-and-hold-for-decades/ ]