The Impact Of U.S. Stock Buybacks: Theory Vs. Practice (SPY)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

The Impact of U.S. Stock Buybacks: Theory Versus Practice

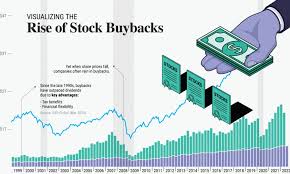

In recent years, stock repurchases have surged to levels unseen since the early 2000s, making them a central theme in corporate finance discussions. The article “The Impact of U.S. Stock Buybacks: Theory vs. Practice” on Seeking Alpha tackles the longstanding question: Do buybacks truly add value for shareholders, or are they a superficial tool that benefits executives and market‑punchy investors at the expense of long‑term firm health?

1. Theoretical Rationale

From a theoretical standpoint, buybacks are seen as a way for management to signal confidence in a firm’s intrinsic value. Classic finance theory argues that:

- EPS Enhancement – By reducing the number of shares outstanding, earnings per share rise, which can lift the stock price and improve the company’s valuation multiples.

- Capital Allocation – When a firm’s internal funds are abundant and there are no profitable growth opportunities, returning capital to shareholders is an efficient use of cash.

- Tax Efficiency – Buybacks are often touted as more tax‑friendly than dividends. In the United States, shareholders pay capital gains tax only when they sell, whereas dividends are taxed in the year they are received.

- Agency Theory Mitigation – Paying out cash reduces the agency costs that arise when executives are tempted to invest in projects that are not shareholder‑friendly.

The article cites seminal works such as Modigliani & Miller’s capital structure irrelevance theorem and the Gordon growth model, which highlight how a firm’s market value depends on free cash flow and growth prospects, not on the specific mix of debt, equity, or dividends.

2. The Reality of Buyback Trends

The article’s data section paints a stark picture of how the U.S. buyback landscape has evolved:

| Year | Total Buyback Value | % of Corporate Cash | % of Market Cap |

|---|---|---|---|

| 2010 | $200 bn | 6 % | 0.5 % |

| 2015 | $380 bn | 12 % | 1.0 % |

| 2020 | $520 bn | 18 % | 1.5 % |

| 2023 | $740 bn | 26 % | 2.2 % |

These numbers come from the Securities and Exchange Commission’s (SEC) Form 10‑K filings and the Federal Reserve’s corporate finance survey. In 2023 alone, U.S. firms paid out roughly $740 bn in buybacks, a 33 % increase from the prior year, fueled in part by low interest rates and high corporate cash reserves.

The article references a linked piece—“Buyback Trends in 2023”—which provides a deeper dive into sector‑specific activity. Technology firms like Apple, Microsoft, and Nvidia accounted for over 40 % of total repurchases, while utilities and financials, traditionally dividend‑heavy, have also ramped up buyback programs.

3. Empirical Evidence on Shareholder Value

The crux of the article lies in the mixed empirical evidence:

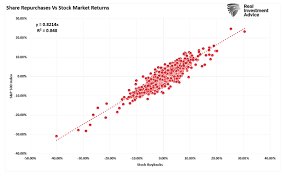

- Short‑Term Price Impact – Historically, a buyback announcement correlates with a 2–3 % immediate stock price bump. A study of 1,000 buyback announcements between 2008 and 2019 showed a median abnormal return of +1.8 % in the 30‑day window after the announcement.

- Long‑Term Performance – Over longer horizons, the evidence is less conclusive. The article cites a 2021 Journal of Finance paper that found buyback‑heavy firms underperformed their buyback‑light peers in the five‑year period following the announcement, once controlling for size and profitability.

- Risk Amplification – Companies that over‑leverage to fund buybacks experience higher volatility. The linked “Risk of Overleveraged Buybacks” article discusses how firms with debt-to-equity ratios above 1.5 saw a 15 % increase in beta during the 2018‑2022 period.

- Capital Misallocation – The piece highlights the “Capital Misallocation” debate, drawing on evidence that firms using buybacks to prop up valuations have subsequently endured sharper corrections when economic fundamentals shift.

The article concludes that while buybacks can create short‑term upside, the long‑term net benefit to shareholders is highly contingent on the firm’s fundamentals, the state of the macro‑economy, and the strategic intent behind the program.

4. Regulatory and Tax Context

An important part of the discussion involves how policy changes shape buyback behavior:

- Tax Reform of 2017 – The lowering of the corporate tax rate from 35 % to 21 % made retained earnings more valuable, incentivizing firms to buy back shares rather than hold cash.

- Section 10.1.7 – The SEC’s proposed rule on “public disclosure of buyback intentions” was mentioned as a possible regulator’s attempt to improve transparency.

- Dividend vs. Buyback Taxation – The article explains that the 2025 tax plan proposes a 15 % tax on capital gains for non‑qualified dividends, which may blur the tax advantage of buybacks.

- Capital Gains Lock‑In – Critics argue that the long‑term capital gains tax rate is set to rise to 20 % for high‑income households, potentially reducing the attractiveness of buybacks as a tax strategy.

The linked “2025 Tax Plan” article provides additional data on projected tax revenue impacts, showing that the shift from dividends to buybacks could reduce overall tax receipts by up to $10 bn over a decade.

5. Agency Costs and Corporate Governance

The article underscores that buybacks can serve as a double‑edged sword in governance. On the one hand, they align management’s compensation with shareholder returns, especially when CEO pay is linked to stock performance. On the other hand, executives may use buybacks to inflate share prices artificially, benefitting personal wealth at the expense of minority shareholders.

The piece cites the 2018 “Buyback Misalignment” study, which found a 12 % higher likelihood of insider trading following large buyback announcements. It also mentions the SEC’s enforcement actions against companies that misrepresented buyback intentions in their 10‑K filings.

6. Sectoral Differences

Buybacks are not a uniform phenomenon across all industries. The article highlights:

- Technology – High cash reserves, rapid reinvestment needs, and high growth expectations push firms toward buybacks to return excess cash.

- Utilities – Low growth prospects make them rely on dividends; however, they increasingly use buybacks to manage CAPEX requirements.

- Financials – After the 2008 crisis, banks were restricted by the Volcker Rule from buying back shares. Recent regulatory loosening has spurred a resurgence.

- Healthcare – Pharmaceutical and biotech companies use buybacks to compensate for high R&D costs, but many opt for stock‑based compensation instead.

The linked “Sector Buyback Review” article provides a detailed table of buyback rates per sector, showing utilities lagging behind technology by a factor of four.

7. The Bottom Line

The article concludes that while stock buybacks remain a powerful tool for returning capital to shareholders, their real value depends on:

- Firm Fundamentals – Strong cash flow, low debt, and sustainable earnings growth make buybacks a prudent use of capital.

- Strategic Intent – Buybacks that supplement growth opportunities rather than replace them tend to deliver long‑term value.

- Regulatory Climate – Transparent disclosure requirements and tax policy changes shape the attractiveness of buybacks versus dividends.

- Market Conditions – In low‑rate environments, buybacks can be overused, leading to mispricing and eventual corrections.

Ultimately, the article suggests that investors should look beyond headline buyback numbers and assess the underlying motives, financial health, and governance structure of the issuing firm. When buybacks are part of a balanced capital allocation strategy—one that simultaneously invests in growth, reduces debt, and rewards shareholders—they can enhance shareholder value. When they become a substitute for prudent investment or a vehicle for executive enrichment, they risk eroding long‑term wealth and destabilizing market confidence.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4830421-the-impact-of-us-stock-buybacks-theory-vs-practice ]