[ Tue, Dec 17th 2024 ]: Seeking Alpha

[ Tue, Dec 17th 2024 ]: MSN

[ Tue, Dec 17th 2024 ]: MSN

[ Tue, Dec 17th 2024 ]: THE WEEK

[ Tue, Dec 17th 2024 ]: Yahoo

[ Mon, Dec 16th 2024 ]: Business Insider

[ Mon, Dec 16th 2024 ]: Gulf News

[ Mon, Dec 16th 2024 ]: India Infoline

[ Mon, Dec 16th 2024 ]: EconoTimes

[ Mon, Dec 16th 2024 ]: U.S. News & World Report

[ Mon, Dec 16th 2024 ]: Motley Fool Australia

[ Mon, Dec 16th 2024 ]: SlashGear

[ Mon, Dec 16th 2024 ]: Yahoo Finance

[ Mon, Dec 16th 2024 ]: Yahoo Finance

[ Mon, Dec 16th 2024 ]: The Globe and Mail

[ Mon, Dec 16th 2024 ]: Motley Fool Australia

[ Mon, Dec 16th 2024 ]: The Globe and Mail

[ Mon, Dec 16th 2024 ]: The Motley Fool Canada

[ Mon, Dec 16th 2024 ]: Business Insider

[ Mon, Dec 16th 2024 ]: Investing

[ Mon, Dec 16th 2024 ]: Kiplinger

[ Mon, Dec 16th 2024 ]: Yahoo

[ Mon, Dec 16th 2024 ]: The Motley Fool Canada

[ Mon, Dec 16th 2024 ]: Seeking Alpha

[ Mon, Dec 16th 2024 ]: moneycontrol.com

[ Mon, Dec 16th 2024 ]: moneycontrol.com

[ Mon, Dec 16th 2024 ]: Kiplinger

[ Mon, Dec 16th 2024 ]: The Motley Fool UK

[ Mon, Dec 16th 2024 ]: The Motley Fool

[ Mon, Dec 16th 2024 ]: The Motley Fool UK

[ Mon, Dec 16th 2024 ]: The Motley Fool

[ Mon, Dec 16th 2024 ]: Forbes

[ Mon, Dec 16th 2024 ]: Forbes

[ Mon, Dec 16th 2024 ]: Seeking Alpha

[ Mon, Dec 16th 2024 ]: MSN

[ Mon, Dec 16th 2024 ]: MSN

[ Mon, Dec 16th 2024 ]: The Daily Telegraph

[ Sun, Dec 15th 2024 ]: Indiatimes

[ Sun, Dec 15th 2024 ]: AOL

[ Sun, Dec 15th 2024 ]: Yahoo Finance

[ Sun, Dec 15th 2024 ]: The Globe and Mail

[ Sun, Dec 15th 2024 ]: MSN

[ Sun, Dec 15th 2024 ]: Wall Street Journal

[ Sun, Dec 15th 2024 ]: The Daily Telegraph

[ Sun, Dec 15th 2024 ]: 24/7 Wall St

[ Sun, Dec 15th 2024 ]: Kiplinger

[ Sun, Dec 15th 2024 ]: The Motley Fool

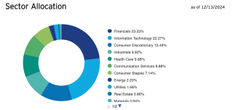

SPMO: 5 Reasons Why This ETF Is A Buy

The Invesco S&P 500 Momentum ETF offers investors a way to gain exposure to a momentum factor-based stock selection approach. Explore more details here.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4744496-spmo-5-reasons-why-this-etf-is-a-buy ]