AZZ, SHOO, FSYS, CHS, KBH, CWEI. Top Losing Stocks With Negative Price Friction In Morning Trade Today

June 26, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for June 26, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This fair market making requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest losses this morning and negative price friction (bearish). This means that there was more selling than buying in the stocks and their stock prices dropped faster with less Friction. AZZ Inc. (NYSE: AZZ), Steven Madden (NASDAQ: SHOO), Fuel Systems (NASDAQ: FSYS), Chicos (NYSE: CHS), KB Home (NYSE: KBH) and Clayton Williams Energy (NASDAQ: CWEI). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

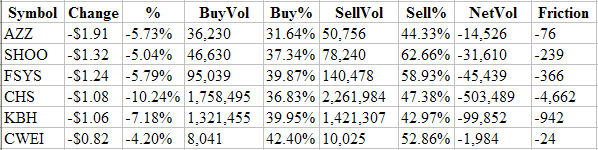

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

AZZ -$1.91 -5.73% 36,230 31.64% 50,756 44.33% -14,526 -76

SHOO -$1.32 -5.04% 46,630 37.34% 78,240 62.66% -31,610 -239

FSYS -$1.24 -5.79% 95,039 39.87% 140,478 58.93% -45,439 -366

CHS -$1.08 -10.24% 1,758,495 36.83% 2,261,984 47.38% -503,489 -4,662

KBH -$1.06 -7.18% 1,321,455 39.95% 1,421,307 42.97% -99,852 -942

CWEI -$0.82 -4.20% 8,041 42.40% 10,025 52.86% -1,984 -24

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar losses (Change) and extremely low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows AZZ with a dollar loss this morning of -$1.91 and a Friction Factor of -76 shares. That means that it only takes 76 more shares of selling than buying to move AZZ lower by one penny. This means the Market Makers are allowing the stock to drop quickly (low friction). The combination of low friction and negative market direction can drive prices lower faster than normal.

AZZ incorporated (NYSE: AZZ) manufactures electrical equipment and components for power generation, transmission and distribution, and industrial markets in the United States and Canada. It operates through two segments, Electrical and Industrial Products, and Galvanizing Services. The Electrical and Industrial Products segment produces specialty electrical products and industrial lighting and tubular products to distribute electrical power to and from generators, transformers, switching devices, and other electrical configurations. It also provides industrial lighting and tubular products for petro-chemical, industrial, petroleum, and food processing industries. This segment sells its products through manufacturers� representatives, distributors, agents, and internal sales force. The Galvanizing Services segment provides hot dip galvanizing to the steel fabrication industry. This segment serves fabricators or manufacturers that provide services to electrical and telecommunications, bridge and highway, petrochemical, and industrial markets, as well as original equipment manufacturers. As of February 28, 2009, this segment operated 20 galvanizing plants. AZZ incorporated was founded in 1956 and is based in Fort Worth, Texas.

Steven Madden, Ltd. (NASDAQ: SHOO), together with its subsidiaries, designs, sources, markets, and retails footwear for women, men, and children. The company also designs, sources, markets, and retails handbags and accessories. It sells its products under the Steve Madden, Steven, Steve Madden Mens, Stevies, Madden Girl, Candie�s, l.e.i., Fabulosity, and Elizabeth and James brand names. In addition, the company licenses its Steve Madden and Steven trademarks for use in manufacturing, marketing, and selling cold weather accessories, sunglasses, eyewear, outerwear, bedding, and hosiery. As of December 31, 2008, it owned and operated 92 retail stores under the Steve Madden name; and 4 retail stores under the Steven name, as well as operated 1 e-commerce Web site. The company distributes its products through its retail stores, e-commerce Web site, and department and specialty stores in the United States, as well as through special distribution arrangements in Canada, Europe, Central and South America, Australia, and Asia. Steven Madden, Ltd. was founded in 1990 and is headquartered in Long Island City, New York.

Fuel Systems Solutions, Inc. (NASDAQ: FSYS) engages in the design, manufacture, and supply of alternative fuel components and systems for use in the transportation, industrial, and power generation industries. Its components and systems control the pressure and flow of gaseous alternative fuels, such as propane and natural gas used in internal combustion engines. The company offers a range of gaseous fuel components, including fuel delivery"pressure regulators, fuel injectors, flow control valves, and other components to control the pressure, flow, and/or metering of gaseous fuels; electronic controls, such as solid-state components and proprietary software that monitor and optimize fuel pressure and flow for engine requirements; and gaseous fueled internal combustion engines. It also provides systems integration support to integrate the gaseous fuel storage, fuel delivery, and/or electronic control components and sub-systems; various ancillary components for systems operation on alternative fuels; and engineering and systems integration services. The company supplies its products and systems primarily to automobile manufacturers, taxi companies, transit and shuttle bus companies, and delivery fleets through a network of distributors and dealers, as well as through a sales force that develops sales with distributors, original equipment manufacturers, and end-users. Fuel Systems Solutions, Inc. was founded in 1958 and is headquartered in Santa Ana, California.

Chicos FAS, Inc. (NYSE: CHS), together with its subsidiaries, operates as a specialty retailer of casual-to-dressy clothing, intimates, complementary accessories, and other non-clothing gift items. The company offers its products under Chico�s, White House|Black Market (WH|BM), and Soma Intimates brand names. The Chico�s brand includes clothing focused on women, who are 35 years old and over. Its products include accessories, such as handbags, belts, scarves, and jewelry, including earrings, watches, necklaces, and bracelets. The WH|BM brand focuses on women, who are 25 years old and over. It offers accessories, such as handbags, shoes, belts, and jewelry, including earrings, necklaces, and bracelets. The Soma Intimates brand offers private branded intimate apparel, including bras, panties, and shape wear; active wear; sleepwear; robes; and loungewear. As of January 31, 2009, the company operated 1,076 retail stores in 49 states, the District of Columbia, the U.S. Virgin Islands, and Puerto Rico. It also had 41 Chico�s outlet locations, 17 WH|BM outlet locations, and 1 Soma outlet location that provide clearance activities for each of the brands. In addition, the company sells its products through catalog, and via the Internet at chicos.com, whitehouseblackmarket.com, and soma.com. Chico�s FAS, Inc. was founded in 1983 and is headquartered in Fort Myers, Florida.

KB Home (NYSE: KBH) constructs and sells homes in the United States. The company builds various types of homes, including attached and detached single-family homes, townhomes, and condominiums, designed primarily for first-time, first move-up, and adult buyers. It also offers mortgage services in a joint venture with Countrywide KB Home Loans. In addition, the company, through its subsidiary, KB Home Mortgage Company, provides title and insurance services to its homebuyers. KB Home sells homes under various purchase contracts in Arizona, California, Colorado, Florida, Georgia, Nevada, New Mexico, North Carolina, South Carolina, and Texas. The company was founded in 1957 and is headquartered in Los Angeles, California.

Clayton Williams Energy, Inc. (NASDAQ: CWEI), an independent oil and gas company, engages in the exploration for and production of oil and natural gas properties primarily in Texas, Louisiana, and New Mexico. As of December 31, 2008, it had 6,704 gross producing oil and gas wells; leasehold interests in approximately 1.2 million gross undeveloped acres; and proved reserves of 228.6 billion cubic feet of natural gas equivalents. The company also has equity interest in a joint venture with Lariat Services, Inc. to construct, own, and operate 12 drilling rigs. In addition, Clayton Williams Energy owns and operates natural gas service facilities consisting of 94 miles of pipeline, 3 treating plants, 1 dehydration facility, 3 compressor stations, and 4 wellhead type treating and compression facilities. The company was founded in 1991 and is headquartered in Midland, Texas.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each month�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State. Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net