UTA, SLM, AEO, CAEI, IMAX, CAR. Top Gainers With Lowest Price Friction In Morning Trade Today

June 25, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for June 25, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This fair market making requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest gains this morning and lowest price friction (bullish). This means that there was more buying than selling in the stocks and their stock prices rose faster with less Friction. Universal Travel Group (AMEX: UTA), SLM Corp (NYSE: SLM), American Eagle Outfitters (NYSE: AEO), China Architectural Engineering (NASDAQ: CAEI), IMAX Corp (NASDAQ: IMAX) and Avis Budget Group (NYSE: CAR). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

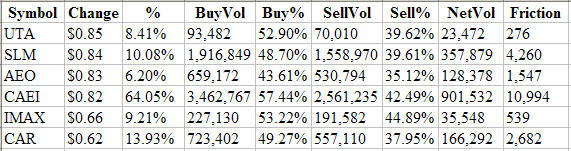

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

UTA $0.85 8.41% 93,482 52.90% 70,010 39.62% 23,472 276

SLM $0.84 10.08% 1,916,849 48.70% 1,558,970 39.61% 357,879 4,260

AEO $0.83 6.20% 659,172 43.61% 530,794 35.12% 128,378 1,547

CAEI $0.82 64.05% 3,462,767 57.44% 2,561,235 42.49% 901,532 10,994

IMAX $0.66 9.21% 227,130 53.22% 191,582 44.89% 35,548 539

CAR $0.62 13.93% 723,402 49.27% 557,110 37.95% 166,292 2,682

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar gains (Change) and very low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows UTA with a dollar gain this morning of +$0.85 and a Friction Factor of 276 shares. That means that it only takes 276 more shares of buying than selling to move UTA higher by one penny. The Market Makers are currently allowing the stock to rise quickly (low friction). The combination of low friction and positive market direction can drive prices higher much faster than normal.

Universal Travel Group (AMEX: UTA) engages in domestic and international airline ticketing services, and cargo transportation agency services primarily in the People's Republic of China. It also provides hotel reservations, tour planning and tour guiding, ground transportation, railway and express delivery, technological solutions to travel reservations, and air delivery services through online and customer representative services, as well as owns an aviation network that provides air ticket sales network. The company is based in Shenzhen, the People's Republic of China.

SLM Corporation (NYSE: SLM), through its subsidiaries, provides education finance in the United States. The company originates and holds student loans by providing funding, delivery, and servicing support for education loans through its participation in the federal family education loan program (FFELP) and through offering non-federally guaranteed private education loans. It primarily markets its FFELP Stafford and private education loans through on-campus financial aid offices. The company also engages in asset performance group business, which provides a range of accounts receivable and collections services, including student loan default aversion services, defaulted student loan portfolio management services, contingency collections services for student loans and other asset classes, and accounts receivable management and collection for purchased portfolios of receivables. In addition, it purchases and manages sub-performing and non-performing mortgage loans. Further, the company provides student loan and guarantees servicing, and loan default aversion and defaulted loan collections. Additionally, it provides processing capabilities and information technology to educational institutions, as well as, 529 college savings plan program management, transfer and servicing agent services, and administration services. The company was founded in 1972 and is headquartered in Reston, Virginia.

American Eagle Outfitters, Inc. (NYSE: AEO) operates as a retailer that engages in the design, marketing, and sale of clothing, accessories, and personal care products in the United States and Canada. The company offers jeans and graphic Ts, as well as essentials, such as accessories, outerwear, footwear, basics, and swimwear under American Eagle Outfitters, American Eagle, and AE brand names primarily targeting 15 to 25 year-olds. It also provides Dormwear and intimates collections for girls under the aerie by American Eagle� brand name. As of January 31, 2009, the company operated 1,098 stores in the United States and Canada under the American Eagle Outfitters, aerie, 77kidstm, and MARTIN + OSA brands. In addition, it offers its products through its Web sites, including ae.com, aerie.com, martinandosa.com, and 77kids.com. The company was founded in 1972 and is headquartered in Pittsburgh, Pennsylvania.

China Architectural Engineering, Inc. (NASDAQ: CAEI), through its subsidiaries, engages in the design, engineering, fabrication, and installation of curtain wall systems, roofing systems, steel construction systems, eco-energy saving building conservation systems, and related products for public works and commercial real estate projects. It offers support systems, such as glass fin support systems, metal structure support systems, and spidery tension rod/cable support systems; and glass panels, including insulating glass, laminated glass, energy coated glass, and spandrel glass products. The company�s exterior cladding system products are specialty wall systems consisting primarily of a series of glass panels set in metal frames, stone panels, or metal panels, as well as roofing systems and related products. It has operations in China, Australia, southeast Asia, the Middle East, and the United States. The company was incorporated in 1992 and is based in Zhuhai, the People�s Republic of China. China Architectural Engineering, Inc. is a subsidiary of KGE Group, Limited.

IMAX Corporation (NASDAQ: IMAX), together with its subsidiaries, operates as an entertainment technology company worldwide. The company specializes in motion picture technologies and large-format film presentations. It engages in the design, manufacture, sale, and lease of large-format digital and film-based theater systems; and the conversion of two-dimensional (2D) and three-dimensional (3D) Hollywood feature films for exhibition on such systems. The company�s theater systems are based on proprietary and patented technology for large-format digital projectors and large-format 15-perforation film frame, and 70mm format projectors. It serves theater exhibitors that operate commercial theaters, such as multiplexes; and museums, science centers, and destination entertainment sites. The company also engages in the production and distribution of original large-format films; provision of post-production services for large-format films; operation of a small number of IMAX theaters; and provision of services in support of IMAX theaters and the IMAX theater network, as well as rents 2D and 3D large-format analog cameras. As of December 31, 2008, it operated 351 theater systems comprising 231 commercial and 120 institutional operating in 42 countries. The company was founded in 1967 and is headquartered in Mississauga, Canada.

Avis Budget Group, Inc. (NYSE: CAR) provides car and truck rentals, and ancillary services to businesses and consumers in the United States and internationally. The company supplies rental cars to the premium commercial and leisure segments of the travel industry under the Avis brand name; and to the price-conscious segments of the industry under the Budget brand name. It also provides Avis Preferred, a counter bypass program; Where2, a GPS navigation system; Avis Cool Cars, a line of fun-to-drive vehicles; Roving Rapid Return, a wireless technology, which permits customers to obtain a printed charge record from service agents; Avis Access, a program for drivers and passengers with disabilities; Avis Interactive, a management tool for corporate clients to view and analyze their rental activity via Internet through account analysis and activity reports; Avis First Program, a customer loyalty program that rewards customers with additional benefits for frequent rentals; and Chauffeur Drive, a service, which allows customers to hire a professional driver to drive their Avis rental car. In addition, the company offers Fastbreak, an expedited rental service for frequent travelers; Budget Small Business Program, a program for small businesses that offers discounted rates and central billing options; and Unlimited Budget, a loyalty program for travel professionals. Further, it engages in the sale and/or rental of supplemental equipment, loss damage waivers, additional/supplemental liability insurance, personal accident/effects insurance, fuel service options, fuel service charges, and electronic toll collection. It was formerly known as Cendant Corporation and changed its name to Avis Budget Group, Inc. in August 2006. Avis Budget Group was founded in 1946 and is based in Parsippany, New Jersey.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each month�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State.

Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net