CHUX, MNTA, HTZ, FRPT, BSX, KIRK. Top Gainers With Lowest Price Friction In Morning Trade Today

June 25, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for June 25, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This fair market making requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest gains this morning and lowest price friction (bullish). This means that there was more buying than selling in the stocks and their stock prices rose faster with less Friction. O Charleys (NASDAQ: CHUX), Momenta Pharmaceuticals (NASDAQ: MNTA), Hertz Global (NYSE: HTZ), Force Protection (NASDAQ: FRPT), Boston Scientific (NYSE: BSX) and Kirklands (NASDAQ: KIRK). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

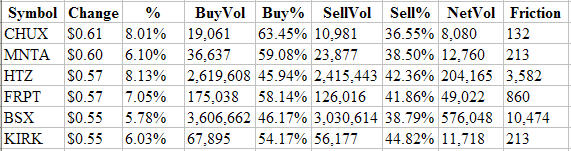

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

CHUX $0.61 8.01% 19,061 63.45% 10,981 36.55% 8,080 132

MNTA $0.60 6.10% 36,637 59.08% 23,877 38.50% 12,760 213

HTZ $0.57 8.13% 2,619,608 45.94% 2,415,443 42.36% 204,165 3,582

FRPT $0.57 7.05% 175,038 58.14% 126,016 41.86% 49,022 860

BSX $0.55 5.78% 3,606,662 46.17% 3,030,614 38.79% 576,048 10,474

KIRK $0.55 6.03% 67,895 54.17% 56,177 44.82% 11,718 213

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar gains (Change) and very low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows CHUX with a dollar gain this morning of +$0.61 and a Friction Factor of 132 shares. That means that it only takes 132 more shares of buying than selling to move CHUX higher by one penny. The Market Makers are currently allowing the stock to rise quickly (low friction). The combination of low friction and positive market direction can drive prices higher much faster than normal.

OCharleys Inc. (NASDAQ: CHUX) engages in the ownership and operation of casual dining restaurants in the United States. It operates restaurants under the O�Charley�s, Ninety Nine, and Stoney River Legendary Steaks names. As of December 28, 2008, the company operated 232 O�Charley�s restaurants in 16 states in the east, southeast, and the Midwest regions; 116 Ninety Nine restaurants in 9 states throughout New England and the Mid-Atlantic states; and 11 Stoney River restaurants in 7 states in the east, southeast, and the Midwest regions. It also franchised nine O�Charley�s restaurants, including four restaurants in Michigan, two in Ohio, and one each in Iowa, Pennsylvania, and Tennessee, as well as had three joint venture O�Charley�s restaurants in Louisiana and Wisconsin. The company was founded in 1983 and is headquartered in Nashville, Tennessee.

Momenta Pharmaceuticals, Inc. (NASDAQ: MNTA), a biotechnology company, specializes in the structural analysis of complex mixture drugs. The company applies its technology for the development of generic versions of complex drug products, as well as for the discovery and development of novel drugs. Its product candidates include M-Enoxaparin, a generic version of Lovenox that is used to prevent and treat deep vein thrombosis, and to support the treatment of acute coronary syndromes; M356, a technology-enabled generic version of Copaxone, which is used for the reduction of the frequency of relapses in patients with relapse-remitting multiple sclerosis; and M118, an anticoagulant. The company also involves in developing generic or biosimilar glycoprotein products. Momenta Pharmaceuticals has collaborations with Sandoz AG and Sandoz Inc. to develop and commercialize injectable enoxaparin. The company was formerly known as Mimeon, Inc. and changed its name to Momenta Pharmaceuticals, Inc. in September 2002. Momenta Pharmaceuticals was founded in 2001 and is based in Cambridge, Massachusetts.

Hertz Global Holdings, Inc. (NYSE: HTZ), through its subsidiaries, engages in the car and equipment rental businesses worldwide. It operates in two segments, Car Rental and Equipment Rental. The Car Rental segment engages in the ownership and lease of cars. This segment operates car rental locations at or near airports, as well as in central business districts and suburban areas of cities in North America, Europe, Brazil, and the Pacific. In addition, it operates retail used car sales locations in the United States and France. The Equipment Rental segment rents earthmoving equipment, material handling equipment, aerial and electrical equipment, air compressors, generators, pumps, small tools, compaction equipment, and construction-related trucks. In addition, this segment sells new equipment and consumables. The company also offers claim administration services, such as investigating, evaluating, negotiating, and disposing of various claims, including third-party, first-party, bodily injury, property damage, general liability, and product liability. Hertz Global serves various industries, such as construction, petrochemical, automobile manufacturing, railroad, power generation, and shipbuilding. The company was founded in 1918 and is headquartered in Park Ridge, New Jersey.

Force Protection, Inc. (NASDAQ: FRPT), together with its subsidiaries, engages in the design, manufacture, testing, and delivery of blast and ballistic protected vehicles that support armed forces and security personnel in harm's way. The company�s products include mine protected clearance vehicles, which are used for route clearing operations; medium-sized blast and ballistic protected vehicles, which facilitate troop transport, command and control, route reconnaissance, convoy escort, and casualty evacuation operations; and 4-wheeled vehicles for reconnaissance, forward command and control, and urban operations. It also offers Armor Kit/ForceArmor, an external ballistic protection module that protects from explosively formed projectiles. In addition, the company provides ongoing life cycle support in the areas of logistics engineering, acquisition logistics, and operational logistics. Force Protection, Inc. offers its products under the Buffalo, Cougar, and Cheetah platforms. It principally serves the U.S. Army, the U.S. Marine Corps, and the U.S. Department of Defense. The company has a joint venture agreement with NP Aerospace Ltd. Force Protection, Inc. was founded in 1996 and is headquartered in Ladson, South Carolina.

Boston Scientific Corporation (NYSE: BSX) operates as a developer, manufacturer, and marketer of medical devices used in various interventional medical specialties worldwide. Its products help physicians and other medical professionals improve the patients� quality of life by providing alternatives to surgery. The company�s cardiovascular group consists of drug-eluting and bare-metal stents, coronary revascularization products, Intraluminal ultrasound imaging catheters and systems, Embolic protection system, peripheral and neurovascular interventions, electrophysiology devices, and cardiac rhythm management devices. This group�s products are used to treat cardiovascular, peripheral vascular and neurovascular diseases, cardiac arrhythmias, and neuro and aortic aneurysms. Its endosurgery group includes esophageal, gastric, and duodenal intervention products; colorectal, pancreatico-biliary, and pulmonary intervention devices; and products for urinary tract intervention and bladder disease, prostate intervention, pelvic floor reconstruction and urinary incontinence, and gynecology. This group�s products are used for the treatment of gastrointestinal diseases, esophagitis, portal hypertension, peptic ulcers, esophageal cancer, polyps, inflammatory bowel disease, diverticulitis, colon cancer, and benign prostatic hyperplasia. The company�s neuromodulation group comprises Precision Spinal Cord Stimulation system for the treatment of chronic pain of the lower back and legs. Its cardiac rhythm management group offers implantable devices used to treat cardiac arrhythmias and heart failure. Boston Scientific Corporation markets its products through direct sales force, and a network of distributors and dealers. The company was founded in 1979 and is headquartered in Natick, Massachusetts with additional offices in Tokyo, Japan and Paris, France.

Kirklands, Inc. (NASDAQ: KIRK) operates as a specialty retailer of home decor in the United States. Its stores offer a range of merchandise, including framed art, mirrors, wall decor, candles, lamps, decorative accessories, accent furniture, textiles, garden accessories, and artificial floral products. The company also provides an assortment of holiday merchandise, as well as gift items. It operates stores under the Kirkland�s, Kirkland�s Home, Kirkland�s Home Outlet, and Kirkland�s Outlet trademarks. The company operates stores in enclosed malls, as well as in various off-mall venues, including strip centers, outlet centers, and freestanding locations. As of January 31, 2009, it operated 299 stores in 34 states. The company was founded in 1966 and is based in Jackson, Tennessee.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each month�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State.

Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net