NeoGenomics Reports Q4 Loss, Initiates Strategic Realignment

Locales: Maryland, California, Florida, UNITED STATES

Fort Lauderdale, FL - February 22nd, 2026 - NeoGenomics (NEOG) today reported its fourth-quarter and full-year 2025 financial results, revealing a complex picture of contraction and strategic recalibration. While revenue for the quarter came in slightly below analyst expectations, the company is painting a picture of long-term health built on aggressive cost reduction and a sharpened focus on high-growth, high-margin areas within the oncology testing market. The results, released this Sunday, indicate a company in transition, acknowledging recent challenges while simultaneously outlining a path toward sustainable profitability.

Financial Performance - A Mixed Bag

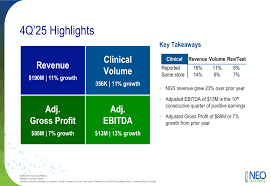

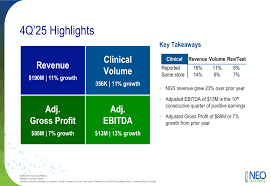

NeoGenomics reported Q4 revenue of $362.7 million, a decrease year-over-year compared to the $385 million reported in Q4 2024. This slight miss of consensus estimates triggered an initial negative reaction from investors, evidenced by a dip in the company's stock price. However, digging deeper reveals encouraging signs. The company posted a net loss of $28.7 million, but this represents a substantial improvement over the significantly larger loss recorded in the same period last year. This improvement is largely attributed to the rigorous implementation of cost-cutting initiatives.

Full-year revenue totaled $1.42 billion, reflecting a challenging year for the diagnostics sector as a whole, impacted by a post-pandemic slowdown in testing volumes and increasing competition. Despite the revenue decline, the significant reduction in operating expenses - details of which were not fully disclosed but alluded to involve streamlining operations and personnel adjustments - indicates a commitment to financial discipline. The company is betting that these efficiencies will translate to stronger bottom-line performance in the coming quarters.

Strategic Realignment: A Deep Dive

The core of NeoGenomics' current strategy revolves around a comprehensive realignment plan, initiated in late 2024 in response to market pressures. This plan isn't simply about cutting costs; it's a fundamental shift in focus. NeoGenomics is actively moving away from broader, lower-margin testing segments and concentrating resources on areas with demonstrably higher growth potential. Specifically, the company is doubling down on two key areas: companion diagnostics and liquid biopsy testing.

Companion Diagnostics - Riding the Precision Medicine Wave

Companion diagnostics, which identify patients most likely to benefit from specific targeted therapies, represent a rapidly expanding market fueled by the rise of precision medicine. NeoGenomics sees substantial opportunity in partnering with pharmaceutical companies to develop and commercialize these specialized tests. By providing critical diagnostic data that guides treatment decisions, the company aims to become an integral part of the drug development and patient care process. Expansion into this segment requires significant investment in research and development, but the potential returns are substantial.

Liquid Biopsy - The Future of Cancer Detection?

Liquid biopsy, a non-invasive technique that analyzes circulating tumor DNA (ctDNA) in a patient's blood, is gaining traction as a potentially transformative tool for early cancer detection, monitoring treatment response, and identifying minimal residual disease. NeoGenomics is actively investing in both the technology and the expertise necessary to become a leader in this rapidly evolving field. The company believes liquid biopsy holds the key to more personalized and proactive cancer care, offering the potential to improve patient outcomes and reduce healthcare costs. This segment is highly competitive, with multiple players vying for market share, but NeoGenomics' established infrastructure and expertise in genetic testing give it a competitive edge.

Looking Ahead: 2026 and Beyond

Management expressed optimism about the company's long-term prospects, emphasizing its strong market position in oncology testing and its commitment to innovation. "We are focused on executing our strategic realignment plan and delivering sustainable, profitable growth," a company spokesperson stated. "Our initiatives are designed to improve operational efficiency, reduce costs, and position us for success in the evolving diagnostics landscape."

While the immediate market reaction to the Q4 earnings was negative, the company's projections for 2026 suggest a potential turnaround. Analysts will be closely watching to see if NeoGenomics can successfully execute its strategic plan and deliver on its promise of improved financial performance. The success of this realignment will depend on the company's ability to navigate a competitive landscape, secure key partnerships, and continue to invest in cutting-edge technologies like liquid biopsy and companion diagnostics. The coming year will be crucial in determining whether NeoGenomics can solidify its position as a leading provider of cancer diagnostics.

Read the Full WTOP News Article at:

[ https://wtop.com/news/2026/02/neogenomics-q4-earnings-snapshot/ ]