Carnival Ditching London Stock Exchange for US Sole Listing

Locales: UNITED STATES, UNITED KINGDOM, BAHAMAS

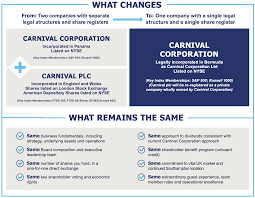

MIAMI, FL - February 21st, 2026 - Carnival Corporation & plc (CCL) today announced a significant shift in its corporate structure, officially signaling the end of its dual listing arrangement. The cruise giant will transition to a single, US-listed entity, abandoning its listing on the London Stock Exchange (LSE) in favor of a sole focus on the New York Stock Exchange (NYSE). The move, overwhelmingly approved by shareholders at a special meeting held earlier today, marks a pivotal moment for the company as it strives for greater operational efficiency and enhanced shareholder value.

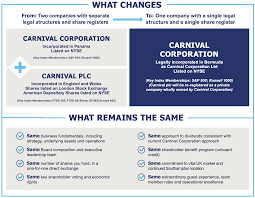

For years, Carnival operated under a complex dual listing structure, with a UK-listed parent company overseeing its US-listed subsidiary. While this structure served a purpose in the past, the company has determined it now presents unnecessary complexities and costs in the current business landscape. Tom Joyner, Carnival Corporation's chief financial officer, stated, "This is an important step for Carnival as we continue to simplify our corporate structure and improve operational efficiency. By eliminating our dual listing, we can reduce complexity, lower our costs and improve transparency for our shareholders."

The decision wasn't taken lightly. Carnival has been evaluating its corporate structure for some time, analyzing the advantages and disadvantages of maintaining a dual listing in a rapidly evolving global financial market. Factors considered included the cost of compliance with regulations in two jurisdictions, the logistical challenges of managing shareholder relations across different time zones and regulatory frameworks, and the potential for a streamlined capital structure to attract a wider range of investors.

Financial Implications & Shareholder Payout

As part of the de-listing process, Carnival Corporation & plc will provide cash consideration to shareholders holding ordinary shares listed on the LSE. The specific amount of this consideration is yet to be finalized and will be announced in due course, but the company has assured shareholders it will be a fair and equitable value. This payout is designed to compensate LSE shareholders for transitioning their holdings to the US market, providing them with liquidity and allowing them to participate in the future growth of the company.

Analysts predict this simplification will free up significant capital, allowing Carnival to reinvest in key areas like fleet modernization, onboard guest experiences, and sustainability initiatives. Reducing administrative burdens will also allow management to focus more intently on navigating the challenges and opportunities within the dynamic cruise industry.

Industry Context & Post-Pandemic Recovery

The cruise industry, which faced unprecedented challenges during the COVID-19 pandemic, is now firmly in recovery mode. Demand for cruises has rebounded strongly, fueled by pent-up travel demand and a desire for unique vacation experiences. Carnival, like its competitors, is focused on maximizing revenue and profitability in this renewed environment. Streamlining its corporate structure is viewed as a strategic move to enhance its competitive position.

Several other multinational companies have similarly rationalized their listing structures in recent years, opting for single-market listings to simplify operations and reduce costs. This trend reflects a broader shift towards greater corporate agility and efficiency in a globalized economy.

Regulatory Hurdles & Timeline

The de-listing process is subject to the necessary regulatory approvals from both US and UK authorities. Carnival anticipates the entire process will be completed within the coming months, though the exact timeline remains dependent on the speed of these approvals. The company is working closely with legal and financial advisors to ensure a smooth and compliant transition.

Looking Ahead: A US-Focused Future

By focusing solely on the NYSE, Carnival aims to increase its visibility among US investors, which represent a significant portion of its shareholder base. This move will also facilitate greater liquidity and potentially lead to a higher valuation for the company's shares. The company believes that a single listing will also simplify its investor relations efforts, allowing it to communicate more effectively with shareholders and analysts.

The consolidation is expected to signal a new era for Carnival, one characterized by streamlined operations, increased financial efficiency, and a unwavering focus on delivering exceptional experiences for its guests. Investors will be closely watching the company's performance in the coming quarters to assess the impact of this strategic restructuring.

Read the Full socastsrm.com Article at:

[ https://d2449.cms.socastsrm.com/2026/02/20/cruise-operator-carnival-to-unify-dual-listing/ ]