Clean Energy Growth Fueled by IRA and Innovation

Locales: Texas, California, Colorado, UNITED STATES

The Perfect Storm: Forces Fueling Clean Energy Growth

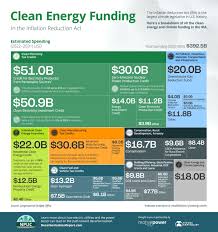

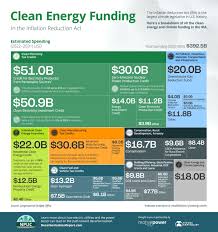

The current trajectory of the clean energy sector isn't accidental. It's the result of converging forces, creating a powerful momentum that's likely to accelerate in the coming years. At the heart of this movement lies substantial government support, primarily driven by the landmark Inflation Reduction Act (IRA). This legislation has committed over $369 billion to climate and energy initiatives, effectively lowering the barrier to entry for clean energy projects and making them significantly more attractive to both businesses and individual consumers. These financial incentives are designed to foster innovation and expedite the deployment of renewable technologies.

Beyond the IRA's direct impact, ongoing technological advancements are dramatically reshaping the landscape. The relentless pursuit of greater efficiency and lower production costs has yielded remarkable breakthroughs. Solar panel prices have experienced a steep decline, making solar power increasingly competitive. Wind turbine technology continues to evolve, maximizing energy capture and minimizing environmental impact. Perhaps most crucially, battery storage solutions are undergoing a rapid transformation, addressing the intermittent nature of renewable energy sources and enabling greater grid stability. These technological leaps are crucial for wider adoption.

Finally, global demand for clean energy is surging. Growing awareness of the urgent need to combat climate change, coupled with a desire for greater energy independence, are prompting nations worldwide to prioritize renewable energy investments. This isn't just a trend in developed nations; developing countries are also recognizing the economic and environmental benefits of clean energy, driving increased investment and creating new markets.

Key Companies to Watch as 2026 Approaches

While the entire clean energy sector holds promise, certain companies stand out as particularly well-positioned to capitalize on the opportunities ahead. Here are three examples, each representing a different facet of the renewable energy ecosystem:

- NextEra Energy (NEE): As the undisputed leader in utility-scale renewable energy generation, NextEra's sheer size and experience give it a significant advantage. They possess the resources and expertise to navigate regulatory complexities, secure large-scale projects, and benefit directly from the IRA's incentives. Their established infrastructure and track record of innovation make them a relatively stable, albeit still growth-oriented, investment.

- Enphase Energy (ENPH): Focusing on the residential and commercial solar markets, Enphase has carved out a niche as a leading provider of microinverter-based solar and storage systems. Their innovative technology, which optimizes energy production and reduces system costs, is driving impressive growth. Enphase's responsiveness to evolving consumer needs makes them a compelling pick for investors seeking exposure to the distributed generation market.

- First Solar (FSLR): First Solar distinguishes itself as a vertically integrated manufacturer of thin-film solar panels. This control over the entire production process allows for greater cost efficiency and quality control. Their focus on utility-scale projects, vital for large-scale energy generation, aligns perfectly with the demands of a rapidly expanding grid infrastructure. The company's resilience and commitment to sustainable practices further strengthen its long-term prospects.

Navigating the Risks and Maximizing Returns

Investing in clean energy stocks, like any investment, carries inherent risks. Market volatility is a constant factor, and regulatory changes could impact project viability. Increased competition within the sector may also put pressure on profit margins. However, the long-term growth trajectory of the clean energy sector, supported by strong government policies and technological innovation, remains extremely attractive. The IRA offers an unusual level of long-term certainty, diminishing some of the usual regulatory anxieties.

To mitigate risk and maximize potential returns, investors should prioritize thorough research and a diversified portfolio. Understanding a company's business model, competitive landscape, and financial health is crucial. Spreading investments across multiple companies and technologies can help cushion against potential setbacks within any single sector.

Disclaimer: The author does not own shares of any company mentioned.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/21/2026-could-be-a-banner-year-for-clean-energy-stock/ ]