Delta Airlines Stock Faces Investor Concerns Amidst Industry Headwinds

Forbes

Forbes

Delta Airlines (DAL) Faces Turbulence: A Deep Dive into Investor Concerns & Potential Recovery Strategies

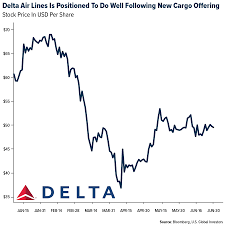

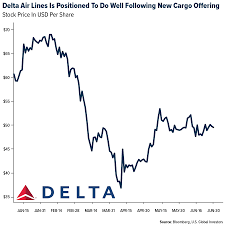

Delta Air Lines (DAL), a stalwart of the US airline industry, is currently experiencing significant investor anxiety and a sharp decline in stock price, according to recent analysis by Forbes' Great Speculations. While superficially appearing stable – maintaining profitability and operational efficiency - a deeper look reveals a confluence of factors contributing to this downward pressure, raising questions about Delta’s long-term trajectory and its ability to maintain its premium brand positioning.

The core issue, as detailed in the article, isn't necessarily poor performance but rather a significant discrepancy between expectations and current realities. For years, Delta has cultivated an image of reliability, customer service excellence, and consistent profitability – often exceeding Wall Street’s forecasts. This created a premium valuation for DAL stock, consistently trading at a higher price-to-earnings (P/E) ratio than its competitors like United (UAL) or American Airlines (AAL). However, recent events have begun to erode this carefully crafted perception.

The Perfect Storm of Challenges:

Several interwoven factors are contributing to the current market unease. The Forbes piece highlights three primary drivers: demand softening, fare pressure, and increasing operational costs.

- Demand Softening & Shifting Traveler Behavior: While leisure travel remains relatively robust, the crucial business travel segment – historically Delta’s bread and butter – hasn't fully rebounded to pre-pandemic levels. The rise of remote work, coupled with companies prioritizing cost savings, has demonstrably reduced corporate travel budgets. The article cites data from a recent McKinsey report (linked within the Forbes piece) indicating that business travel is now projected to plateau at approximately 85% of 2019 levels, a significant downgrade from earlier optimistic forecasts. Furthermore, the rise in "bleisure" travel – combining leisure and business trips – has diluted Delta’s premium positioning as travelers increasingly opt for lower-cost carriers or utilize points/miles on various airlines.

- Fare Pressure & Competition: The softening demand environment is forcing Delta to engage in fare wars with budget airlines like Spirit (SAVE) and Frontier (ULCC), who are aggressively undercutting prices to fill seats. This pressure is particularly acute on domestic routes, where competition is fierce. While Delta has attempted to offset this by focusing on premium cabins and international routes, these segments aren't large enough to fully compensate for the losses in lower-fare markets. The article points out that Delta’s strategy of prioritizing higher yield passengers is becoming increasingly difficult as even those travelers are demonstrating price sensitivity.

- Operational Cost Inflation: Delta faces relentless pressure from rising labor costs, fuel prices (despite some moderation recently), and aircraft maintenance expenses. The ongoing negotiations with pilot unions for updated contracts – detailed in a separate Bloomberg report referenced by Forbes - are particularly concerning, potentially leading to significant wage increases that will further strain profitability. The article emphasizes that Delta's ability to pass these increased costs onto consumers is diminishing due to the fare pressure mentioned above.

The Investor Reaction & Stock Performance:

This combination of challenges has triggered a negative investor response. The Forbes analysis highlights how DAL stock has underperformed significantly compared to its peers and the broader market indices over the past six months. Analysts are now downgrading their ratings on Delta, citing concerns about future earnings potential and the sustainability of its premium valuation. A key concern is that Delta's historically high P/E ratio can no longer be justified given the changing industry landscape.

Delta’s Response & Potential Recovery Strategies:

The article explores Delta’s efforts to address these challenges. These include:

- Network Optimization: Reducing capacity on underperforming routes and focusing on higher-yield international destinations.

- Cost Cutting Measures: Implementing efficiency initiatives across all departments, including streamlining operations and renegotiating supplier contracts.

- Loyalty Program Enhancements: Strengthening Delta's SkyMiles program to retain existing customers and attract new ones. The article notes that Delta is exploring partnerships with non-travel brands to expand the loyalty program’s value proposition. (See details on their recent partnership with Starbucks, linked in the original).

- Fleet Renewal & Fuel Efficiency: Investing in newer, more fuel-efficient aircraft to reduce operating costs and environmental impact.

Dissenting Voices & Potential Upsides:

While the outlook appears bleak, the Forbes piece also acknowledges dissenting opinions. Some analysts argue that Delta's strong balance sheet and operational efficiency provide a buffer against these challenges. They suggest that the current stock price represents an oversold opportunity for long-term investors who believe in Delta’s ability to adapt and regain its premium positioning. The article mentions a Morgan Stanley report (also linked) suggesting that Delta's focus on customer experience could ultimately differentiate it from lower-cost competitors, allowing it to command higher fares over time.

Looking Ahead:

The future for Delta Airlines remains uncertain. The Forbes analysis concludes that the company faces a critical juncture. Its ability to successfully navigate these challenges – particularly by demonstrating tangible progress in restoring business travel demand and controlling costs – will be crucial in regaining investor confidence and stabilizing its stock price. Failure to do so could lead to further downward pressure on DAL, potentially jeopardizing its position as one of the leading airlines globally. The next few quarters will be pivotal in determining whether Delta can weather this turbulence or if it’s facing a more prolonged period of instability.

Disclaimer: This is a summary based on the provided Forbes article and linked sources as of January 6, 2026. Actual events and market conditions may have changed since then. This should not be considered financial advice.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2026/01/06/dal-stock-whats-happening-with-delta-airlines/ ]