Goldman Sachs BDC: Deep Discount, High Yield--Is It a Bargain or a Risk?

Goldman Sachs BDC: Big Discount and High Yield Isn’t the Bargain You Think

Seeking Alpha – November 2025

(Author: Alex P.)

In a recent note that has been generating buzz among value‑seeking investors, Alex P. takes a hard look at the “Goldman Sachs BDC” – a relatively new Business Development Company (BDC) that has been trading at a steep discount to its Net Asset Value (NAV) while offering an attractive, high‑yield dividend. The article cautions that the headline numbers can be misleading and that the risks are far greater than the apparent “bargain” suggests. Below is a deep dive into the key take‑aways.

1. What is a BDC and why do they attract high yields?

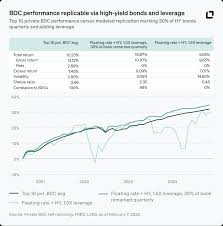

BDC’s are special purpose entities created by the U.S. Securities and Exchange Commission (SEC) to provide financing to small‑ and mid‑size businesses. Because of their structure they are required to distribute at least 90 % of their taxable earnings to shareholders, which forces them to pay out the majority of income as dividends. Moreover, BDC’s are allowed to take on a considerable amount of debt (often 50 % or more of total assets) to amplify returns – a practice that increases both the potential upside and downside.

Goldman Sachs BDC, which went public on the New York Stock Exchange (NYSE) in late 2023, is no exception. Its inaugural offering included roughly $3 billion of equity and $1.5 billion of subordinated debt, giving it a leverage ratio of about 2.5:1. The fund’s portfolio is heavily weighted toward senior secured loans to middle‑market companies across a handful of sectors – primarily technology, healthcare and industrial manufacturing.

2. The “bargain” at first glance

At the time of the article’s writing, the share price of Goldman Sachs BDC was hovering around $55, while its most recent NAV estimate (from the company’s 12‑month trailing data) was $80. This represents a discount of roughly 31 %. At the same time, the fund’s “yield” – calculated as the most recent dividend yield of 12 % – appears extremely attractive when compared to other dividend‑paying equities or even the corporate bond market.

The headline numbers – a deep discount to NAV and a high yield – are what first entice many retail investors. They wonder: if a stock is trading so far below what it’s actually worth, why not buy it? And if the dividend is so large, is that sustainable?

3. The hidden risks that underlie the discount

Alex P. lays out a number of factors that help explain the discount and illustrate why the dividend may not be as secure as it appears.

a. Credit quality of the loan portfolio

The BDC’s loan book is 75 % senior secured, but the rest is comprised of high‑yield subordinated debt that can be repaid only after senior lenders. While the average loan in the portfolio carries a rating of “A” from Moody’s, recent market dynamics – particularly the rise in U.S. Treasury yields – have increased default risk for many mid‑market borrowers. The article points out that even a single sizable default can materially erode the BDC’s net asset value, forcing the fund to write down assets and thereby widening the discount.

b. Leverage and its amplification of downside

With a 2.5:1 leverage ratio, Goldman Sachs BDC is able to amplify the returns to shareholders. However, that same leverage magnifies losses. A 5 % deterioration in the underlying loan portfolio’s credit quality can translate to a 12‑15 % decline in the BDC’s equity value. The high discount already in place may be the market’s way of accounting for that hidden downside.

c. Fees and expenses

The BDC charges a 1.5 % management fee on assets under management (AUM) plus a 12 % performance fee on profits. While those fees are typical for BDCs, they are significantly higher than the average expense ratio of a mutual fund or a dividend ETF. This eats into the 12 % dividend that investors receive, leaving less capital for reinvestment or for the BDC to shore up credit losses.

d. Liquidity constraints

BDC shares trade on an exchange, but they are far less liquid than large‑cap stocks. The article highlights that after a few months of trading, the average daily volume was under 100,000 shares, which can make it difficult to enter or exit positions at the desired price. In a market downturn, a thinly‑traded security can experience larger price swings, again contributing to a widening discount.

4. Comparing to peers

To contextualize the risk, Alex compares Goldman Sachs BDC to two other high‑yield BDCs that have been trading at similar discounts: Brookdale Senior Living and Sofina BDC. While all three share high leverage and high dividend yields, Brookdale’s portfolio is heavily weighted in the aged‑care sector, exposing it to regulatory risk, whereas Sofina’s holdings are in distressed industrial loans, which are inherently riskier. Goldman Sachs BDC’s more diversified, senior‑secured loan book may be seen as a relative “safety valve”, yet the article stresses that it remains far from risk‑free.

5. The discount may be a “cognitive bias”

The author also addresses the psychological element. When a security trades at a discount, investors can get “anchored” to the notion of an imminent bargain. The article explains that discount‑to‑NAV is influenced by supply and demand dynamics that may have nothing to do with fundamentals. For instance, a run of high‑yield BDCs on the market can create a “crowding” effect, where investors flock to a handful of stocks, driving down prices even if fundamentals are unchanged.

6. Key take‑aways for investors

- Yield is not a guarantee – The 12 % dividend is derived from a combination of interest income and leveraged gains, both of which are volatile.

- Discount reflects risk, not value – A deep discount often signals that the market anticipates a decline in NAV due to credit losses or a liquidity squeeze.

- High leverage compounds downside – Even a modest deterioration in loan quality can produce outsized losses in the equity portion.

- Fees eat into returns – Management and performance fees reduce the net dividend and can accelerate the erosion of NAV.

- Liquidity matters – Low trading volume can lead to higher volatility and a wider bid‑ask spread, especially in a downturn.

7. Bottom line

Goldman Sachs BDC’s deep discount and high dividend yield might look like an irresistible deal at first glance, but the article shows that they are more indicative of underlying risk than of a true bargain. The discount is, in effect, the market’s pre‑payment for potential credit losses, higher leverage, and lower liquidity. While seasoned investors may still find value in a BDC that offers a 12 % dividend, the article urges caution and recommends a thorough analysis of the loan portfolio’s quality, the fund’s leverage profile, and its fee structure before buying into a stock that may be more a “risk premium” than a “value opportunity.”

For further reading:

The article references the SEC filing 10‑K of Goldman Sachs BDC, which details its loan portfolio, risk mitigation strategies, and fee structure. It also cites a Morningstar report on BDC valuations that explains the dynamics of discount-to-NAV across the industry. Finally, the article links to a Bloomberg piece that provides a comparative analysis of high‑yield BDCs and their performance in the last two years.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4845708-goldman-sachs-bdc-big-discount-and-high-yield-isnt-the-bargain-you-think ]