Bond Market Signals Potential Economic Slowdown: The '3% World'

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Please read the disclaimer at the end of this response regarding AI-generated content.

The Bond Market's Silent Warning: A "3% World" and Why Markets Are Ignoring It

The current economic narrative is one of persistent inflation, aggressive Federal Reserve rate hikes, and a resilient market seemingly unfazed by these headwinds. However, as highlighted in a recent Seeking Alpha article ("The 3% World: The Bond Market Tells What the Fed Won’t Say – But Markets Don't Care"), this picture might be dangerously incomplete. The bond market, often considered a more sober indicator than equities, is flashing a warning sign: we are heading towards a world of significantly lower growth and potentially recessionary pressures, a scenario the article labels "the 3% World."

What Does “The 3% World” Mean?

The term refers to a future where global GDP growth consistently averages around 3% or less. This is a stark contrast to the post-pandemic rebound and even the pre-pandemic average of roughly 3.5%. The article's author, Kevin Muir, argues that this slowdown isn’t merely a cyclical blip but represents a structural shift driven by several converging factors. He posits that the era of easy money and ultra-low interest rates – which fueled decades of growth – is definitively over.

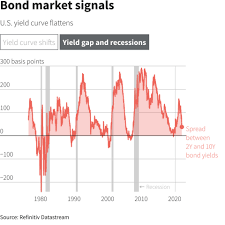

The Bond Market's Perspective: Yield Curve Inversion as a Key Signal

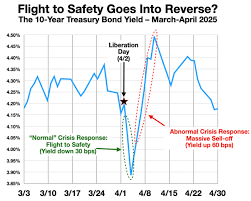

Muir’s central argument revolves around the behavior of bond yields, specifically the inverted yield curve. An inverted yield curve occurs when short-term Treasury yields are higher than long-term yields. Historically, this has been a remarkably reliable predictor of recessions, typically preceding them by 6 to 24 months. The current inversion is significant and persistent, suggesting that investors anticipate slower growth and lower inflation in the future.

The article emphasizes that the bond market isn't just reacting to immediate Fed policy; it’s pricing in future expectations about economic conditions. While the Federal Reserve publicly maintains a hawkish stance – signaling continued rate hikes to combat inflation – the bond market is essentially saying, "You're going too far." The inversion reflects a belief that the Fed's actions will ultimately choke off growth and force them to reverse course, leading to lower rates down the line.

The Drivers of Slowing Growth: Beyond Monetary Policy

Muir doesn’t attribute the potential slowdown solely to the Federal Reserve’s actions. He identifies several underlying structural factors contributing to a "3% World":

- Demographic Shifts: Aging populations in developed economies are reducing labor force participation and dampening consumption. Japan, for example, has been grappling with this demographic reality for decades, significantly impacting its economic growth.

- Debt Overhang: Global debt levels have soared over the past few decades, making economies more vulnerable to shocks and limiting their ability to stimulate growth through fiscal policy. The article references data showing staggering levels of both public and private debt globally.

- Geopolitical Fragmentation: Increased trade barriers, geopolitical tensions (like the war in Ukraine), and a general move towards deglobalization are disrupting supply chains and hindering international commerce. This is creating uncertainty and discouraging investment.

- Declining Productivity Growth: Technological advancements haven't translated into significant productivity gains as they did in previous eras. This limits the potential for sustained economic expansion.

- The End of Globalization: The article references a paper by Michael Pettis, which argues that China’s growth model, heavily reliant on export-led growth and cheap labor, is unsustainable and contributing to global imbalances.

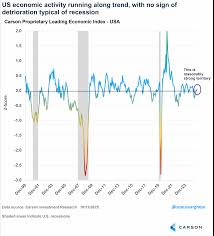

Why Markets Aren't Paying Attention (Yet)

Despite the bond market's clear signal, equity markets have largely shrugged off these concerns. Muir attributes this disconnect to several factors:

- Algorithmic Trading & Momentum: A significant portion of trading volume is driven by algorithms that react to short-term price movements rather than fundamental economic data. This creates a self-reinforcing cycle where rising prices attract more buying, regardless of underlying conditions.

- "Hope" Over Reality: Investors are clinging to the hope that the Fed will be able to engineer a "soft landing"—bringing inflation under control without triggering a recession. This optimism is overriding the warnings from the bond market.

- Corporate Profit Resilience (So Far): Corporate earnings have remained relatively strong, providing a veneer of economic health that masks underlying vulnerabilities. However, Muir cautions that this resilience may not last as the lagged effects of higher interest rates and slowing demand begin to bite.

Implications & Potential Outcomes

The article concludes by warning that ignoring the bond market's signal is dangerous. If the "3% World" scenario unfolds, it will have significant implications for investors: lower returns, increased volatility, and a potential re-evaluation of asset valuations. Muir suggests that investors should consider reducing their exposure to risk assets and preparing for a period of slower growth and potentially higher unemployment. He advocates for a more cautious approach, focusing on companies with strong balance sheets and pricing power – those best positioned to weather an economic downturn.

Disclaimer: This article is a summary based solely on the content found at the provided URL (https://seekingalpha.com/article/4843782-the-3-percent-world-the-bond-market-tells-what-the-fed-wont-say-but-markets-dont-care). As an AI, I am not a financial advisor and this summary should not be taken as investment advice. The original article contains specific opinions and analysis that are the author's own. Readers should conduct their own research and consult with qualified professionals before making any investment decisions. AI-generated content can contain inaccuracies or biases; always verify information from multiple sources.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4843782-the-3-percent-world-the-bond-market-tells-what-the-fed-wont-say-but-markets-dont-care ]