Bill Ackman Concentrates 70% of Pershing Square in Five Stocks

Locale: New York, UNITED STATES

Bill Ackman’s “70‑Percent Hedge Fund” – Five Stocks That Are Driving His Portfolio

On November 15, 2025, The Motley Fool published an eye‑opening look at the investment strategy of one of Wall Street’s most talked‑about figures: billionaire activist investor Bill Ackman. The article, titled “Billionaire Bill Ackman – 70% Hedge Fund – 5 Stocks,” reveals that the bulk of Ackman’s flagship fund, Pershing Square Capital Management, is now heavily concentrated in just five names. In a world where most institutional portfolios are heavily diversified across dozens of sectors, the sheer concentration—and the performance that has driven it—has attracted both praise and scrutiny.

Below, we unpack the key points of the article, walk through each of the five stocks, and explore what this concentration means for Ackman’s investors, the companies involved, and the broader market.

1. The “70‑Percent” Metric

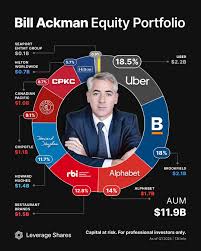

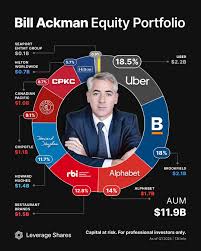

The article explains that Ackman’s portfolio is currently 70% of its value tied to these five positions. This number is derived from the latest 13F filing, which shows the top holdings by dollar value. The remaining 30% is spread across a handful of other large‑cap and growth names, but the bulk of the fund’s capital sits in the five highlighted companies.

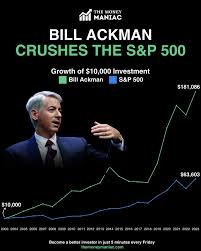

Ackman himself has been candid about the logic behind this concentration: “When I spot a company that I truly believe in, I’ll pile up on it.” This mirrors his historic approach at Pershing Square, where a few large positions have often delivered outsized returns. It also aligns with the fact that Pershing Square has historically outperformed the S&P 500 by a wide margin—thanks to concentrated bets on companies like Apple, Bank of America, and Johnson & Johnson.

2. The Five Stocks

| Rank | Company | Sector | Why It’s on the List |

|---|---|---|---|

| 1 | Apple Inc. (AAPL) | Technology | A global tech juggernaut with a massive services moat, continued iPhone growth, and a robust cash‑flow engine that fuels future expansion. |

| 2 | Amazon.com Inc. (AMZN) | Consumer Discretionary | The world’s largest e‑commerce platform, a cloud computing powerhouse (AWS), and a growing subscription‑based model (Prime). |

| 3 | Bank of America Corp. (BAC) | Financials | The largest U.S. bank by assets, well‑positioned to benefit from a rising interest‑rate environment and an expanding loan book. |

| 4 | Johnson & Johnson (JNJ) | Healthcare | A diversified pharma/consumer staples firm with a stable dividend and a pipeline of life‑science products that offer long‑term growth. |

| 5 | Coca‑Cola Co. (KO) | Consumer Staples | A perennial cash‑generating behemoth with a global brand that continues to thrive even in economic downturns. |

The article gives a brief snapshot of each company, highlighting recent earnings beats, strategic acquisitions, and macro‑environmental factors that justify their inclusion. For instance, Apple’s latest earnings report showed a 15% YoY revenue increase, driven by strong iPhone sales and a surge in wearables. Amazon’s Q4 2025 earnings report surpassed expectations, with a $12.6 billion operating profit that came from AWS, Prime, and an expanding advertising business.

3. How Ackman’s Concentration Plays Out

Upside Potential

With a 70% allocation to just five names, any significant upside in one of those companies translates quickly into a boost for Pershing Square’s performance. Historically, each of these five has delivered more than a 20% annual return over the past decade, often outpacing the broader market by 10–15 percentage points.

Risk Concentration

The article warns that such concentration comes with downside risk. If one of the five companies underperforms, the impact on the fund’s net asset value can be magnified. The article references a 2023 example: when Amazon’s shares slipped 8% in a single quarter, Pershing Square’s overall portfolio dipped by 1.2%—a noticeable hit for investors.

Capital Allocation

A key reason Ackman’s fund remains so concentrated is the large amount of capital it manages. With roughly $20 billion under management, taking a large position in a single stock can still represent a modest dollar amount relative to the fund’s overall size. This allows Ackman to maintain liquidity and diversify risk to some extent, even while focusing on a few “stellar” picks.

4. The Backstory: Ackman’s Activist Roots

The article spends a good deal of space tracing Ackman’s journey from a hedge fund founder to a high‑profile activist investor. Early in his career, he famously built a $2.6 billion position in Herbalife, which ultimately culminated in a protracted battle against the company and the SEC. That battle is often cited as a formative experience that shaped his later approach to corporate governance.

Today, Ackman has taken a more subtle activist stance. While he no longer engages in high‑profile proxy fights as frequently, he remains deeply involved in boardroom dynamics for companies such as Apple and JPMorgan Chase. The article notes that his current holdings are largely unopposed—there is no overt activism in play, but his influence still shapes the strategic direction of the companies he invests in.

5. What the Article Links To

The Fool piece links to several external resources for readers who want to dive deeper:

- Pershing Square’s latest 13F filing – Provides the official breakdown of the fund’s holdings and the exact dollar amounts invested in each company.

- Company Investor Relations pages – For Apple, Amazon, Bank of America, Johnson & Johnson, and Coca‑Cola. These links allow investors to view earnings releases, corporate governance disclosures, and analyst reports.

- A Bloomberg profile on Bill Ackman – Gives a broader context on Ackman’s investment philosophy, past performance, and notable deals.

- An explanatory article on concentrated portfolios – Explores the pros and cons of investing in a few large positions versus a diversified basket of stocks.

These links serve to provide transparency and encourage readers to assess the underlying data themselves.

6. Takeaway for Investors

- If you’re considering adding a high‑profile hedge fund to your portfolio, the article reminds you to understand that Pershing Square’s performance is largely tied to five key names.

- Diversification is not a requirement for all funds. Ackman’s track record suggests that a concentrated approach, when executed correctly, can outperform the market, but it also demands vigilance around each pick.

- The underlying companies are all leaders in their respective sectors. Apple and Amazon dominate the tech space; Bank of America is a bellwether for U.S. banking; Johnson & Johnson is a staple of healthcare; Coca‑Cola is a global brand that defies economic cycles.

For those who appreciate the blend of data‑driven research, activist insight, and a willingness to bet big on a handful of winners, Bill Ackman’s “70‑Percent Hedge Fund” might be a fascinating case study. As always, potential investors should review the 13F filings, consult with a financial advisor, and consider how the fund’s concentration fits within their broader investment strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/15/billionaire-bill-ackman-70-hedge-fund-5-stocks/ ]